This is my complete guide to accounting automation.

So if you want to:

- Learn the 8 benefits of automated accounting

- Save time by automating your accounting processes

- Automate all 15 areas of your accounting

- Find out the latest tools to help you streamline and automate your work

Then you’ll love this new guide.

Let’s get started.

Table of Contents

- What is Accounting Automation?

- Will Automated Accounting Replace You?

- 8 Benefits of Automated Accounting

- How to Automate your Accounting in 15 Key Areas

What is Accounting Automation?

I once worked for a partner at a firm that required files to be handwritten on a paper ledger like this:

Performing this work consisted of manual, time-consuming tasks which were inefficient, prone to error, and quite painful.

Today, accounting automation uses technology to, in many instances, completely remove the manual parts of an accountant’s work.

This means no more:

- Manual data entry into a computer

- Manually reconciling bank statements

- Paying suppliers one-by-one

- Producing financial reports in a spreadsheet

- Chasing after documents from your client

- And so many more repetitive tasks…

In short, there are numerous benefits associated with finance process automation, and accounting automation allows you to get most accounting tasks completed and this can free up resources that can be used for other purposes, such as accounting marketing strategies or practice management.

Will Accounting Automation be Enough to Replace You?

The answer depends on your ability to adapt to the changing world of accounting.

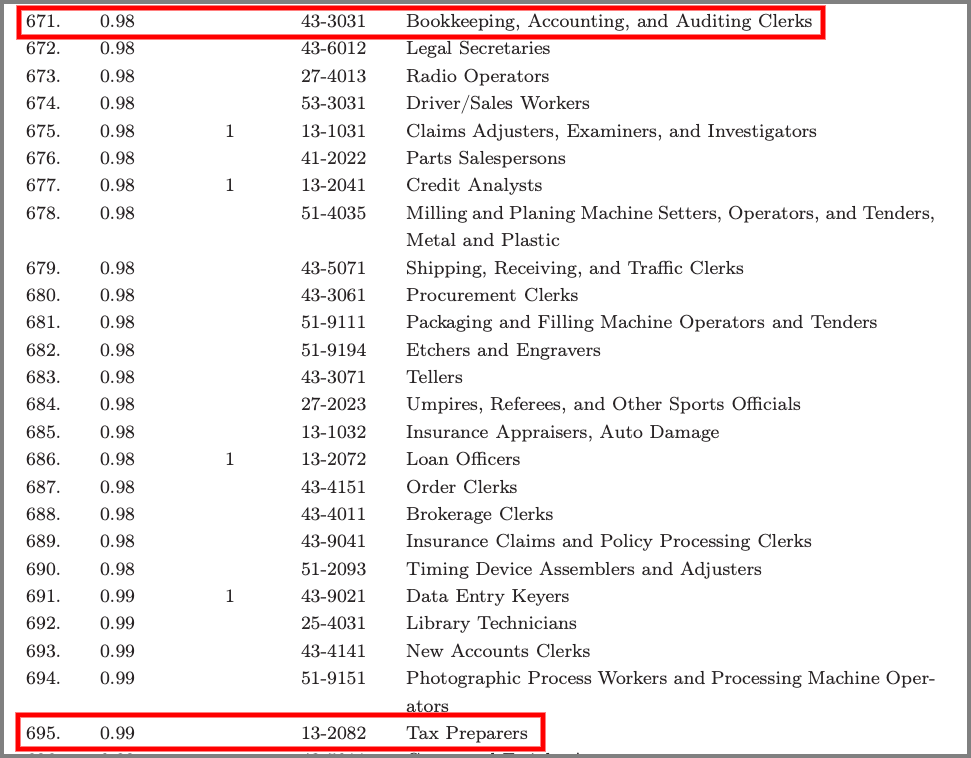

A report by Oxford University concluded that there was a 99% chance that tax preparers’ jobs would be automated and a 98% chance that it will happen to bookkeepers and accountants. Those numbers for finance professionals or accounting professionals are some of the highest scores among the 702 occupations listed!

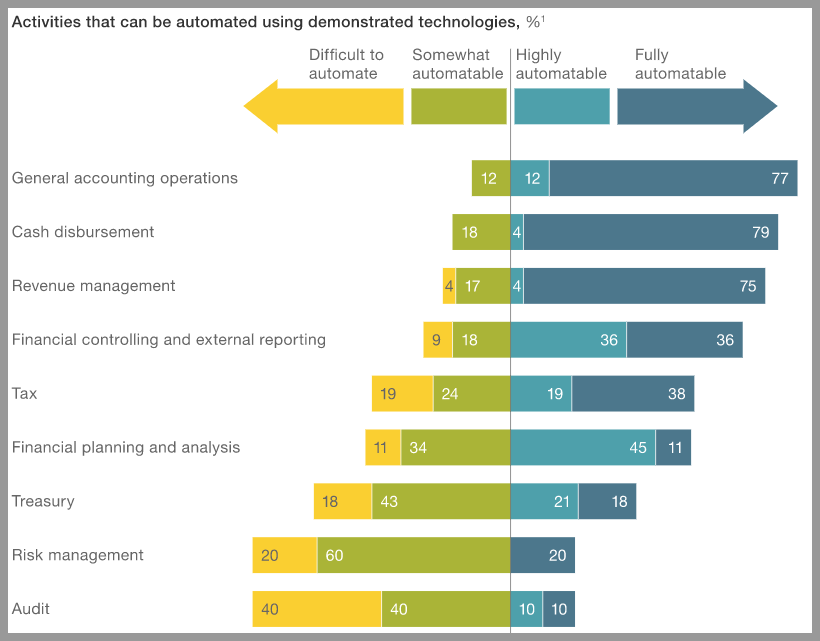

And another report from McKinsey found that most of what accountants do are either highly or fully automatable:

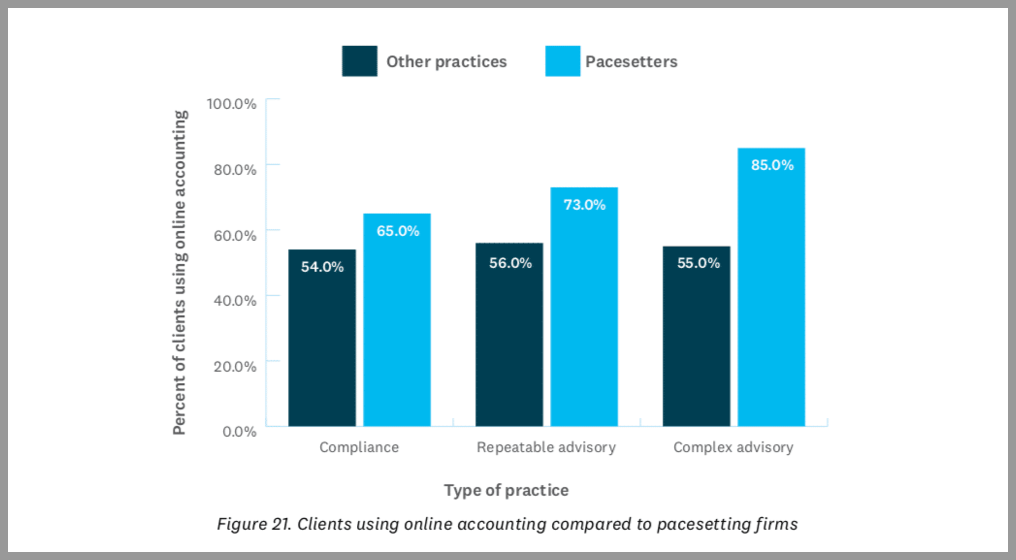

That said, pacesetting accounting firms, the ones growing the fastest according to a recent Xero study, are also the ones adopting the most technology:

The above proves that while there’s a shift taking place, there are still plenty of opportunities for accountants who choose to adopt. Some parts might need automation, but overall accounting jobs will still require a human being in order to properly do the task.

It’s no longer a question of “will accounting be automated”, but more a question of “how much”.

8 Benefits of Accounting Automation

Let’s now briefly outline the main benefits of automated accounting:

1) Time Savings

This is an obvious benefit of accounting process automation. The more manual accounting data input tasks that you can automate through the accounting software, the more time you can save to focus your efforts elsewhere.

2) It Improves Margins

If automated accounting cuts down the time you spend to perform certain accounting tasks, then it’s only natural to expect that you’ll be incurring cost savings on the work of those automated accounts.

3) Greater Accuracy

If you set up your automation properly, you can effectively eliminate human error arriving from manual accounting data input transcription. This is incredibly important in an industry like the accounting industry that relies on accurate, real-time financial data.

4) Faster Turnaround Time

Because automation runs with the click of a button compared to someone having to key in financial information entry manually, you can speed up the turnaround time of your deliverables and financial reporting.

5) Superior Customer Experience

With quicker results and improved accuracy, it’s natural that a superior customer experience results from the benefits of automated accounts.

6) Lends Itself Well to Upskilling

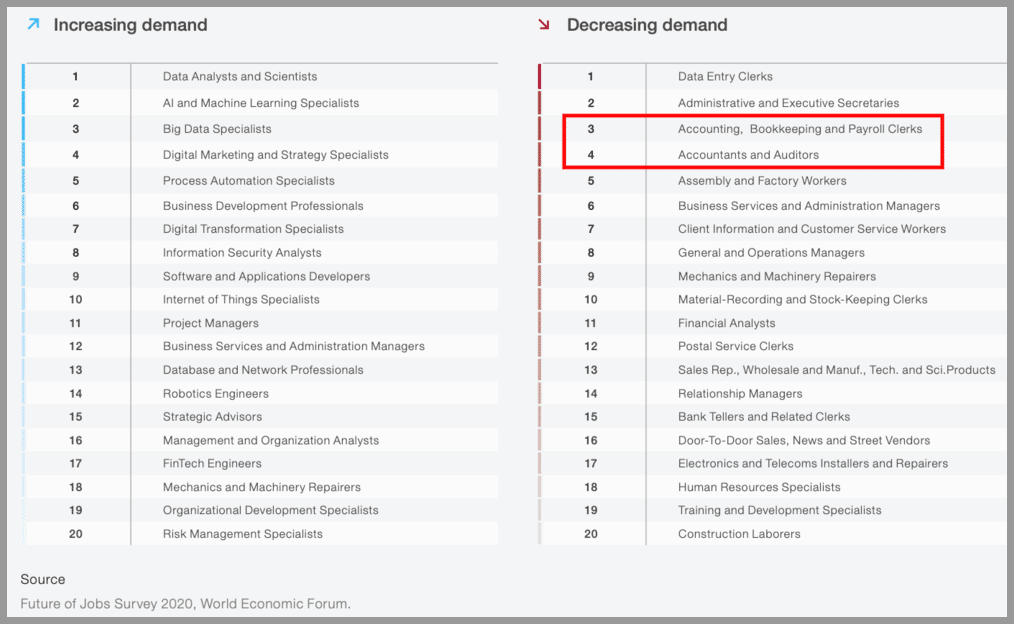

This study by the World Economic Forum gives insights into the skills increasing and decreasing in-demand:

Learning how to use accounting systems to automate accounting processes helps you improve professional development and be prepared for the future of accounting.

7) Real-Time Decision-Making

When there’s accounting process automation, you can get faster insights into the numbers, which can then be leveraged by financial analysts and accounting teams for improved business operations decision-making.

8) Improved Accessibility

Because accounting automation now takes place online, you can access your data and perform your work on the go rather than being tied down to a physical location.

6 Steps to Automate Your Accounting Processes

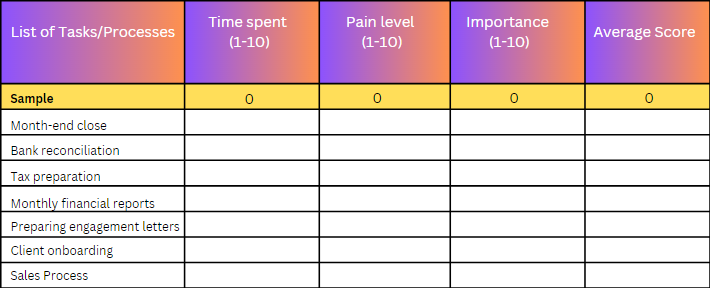

Step #1 List & Prioritize All Your Accounting Processes

Before you start your automation journey, it’s crucial to identify every financial task.

Use the Process Improvement Ranker template to identify which of your current accounting processes are most important to improve.

List your tasks, put the most important ones on top, and start with the repetitive, error-prone, and resource-heavy ones.

This way, you’ll start getting the good stuff from automation quickly and slowly make your whole accounting work easier.

Step #2 Choose 1-3 Processes to Implement and/or Update per Month

Choose 1-3 of your highest priority processes to implement/update each month.

Estimate the time you need to implement/update these processes. Trying to automate everything at once can be overwhelming and counterproductive.

Be realistic with how much you’re able to accomplish to smoothen the transition before moving on to the next set of processes.

Step #3 Document Your Processes

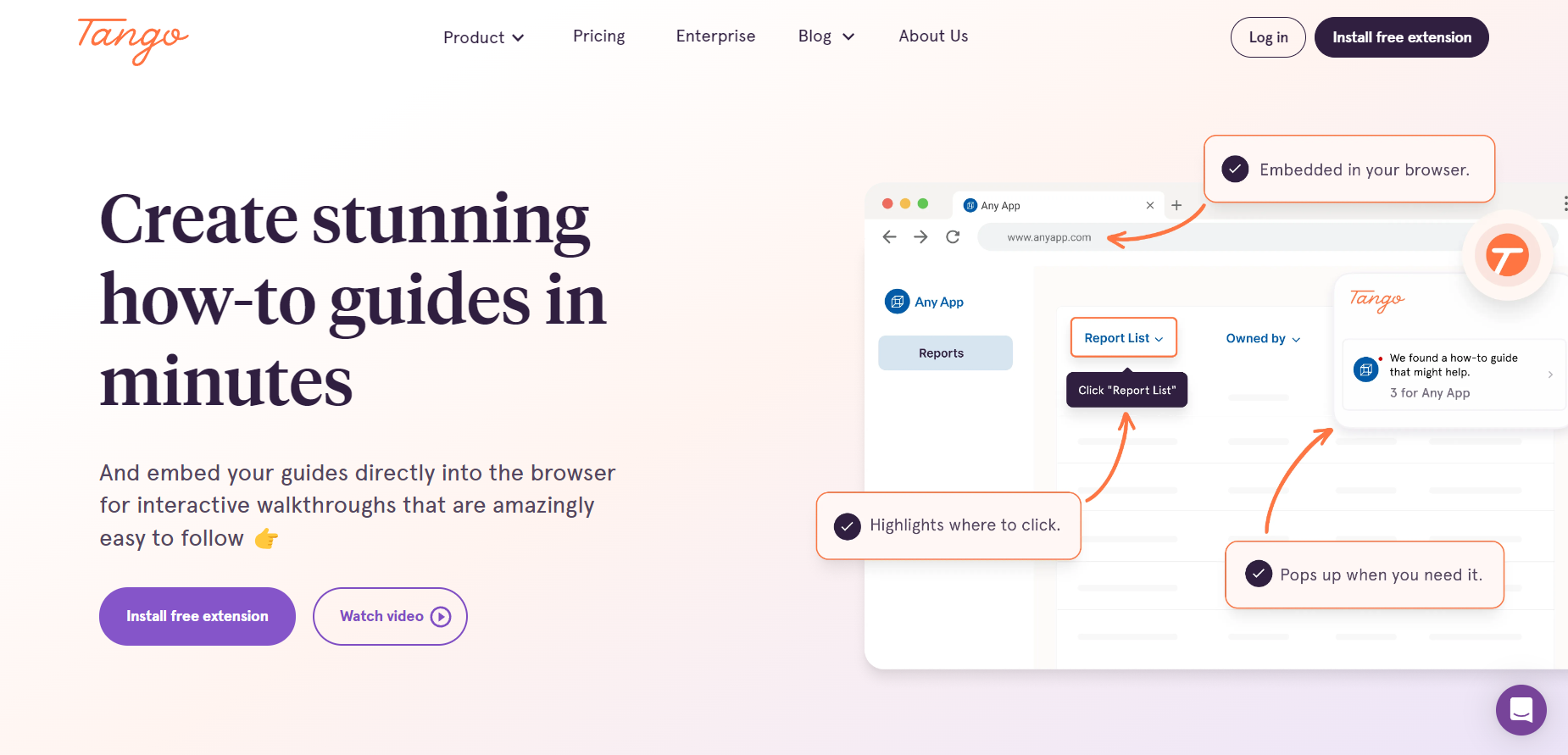

Use Google Docs, Word, or Tango to document how to complete your process step-by-step from start to finish.

Be thorough and highly detailed. A complete stranger should be able to perform the task simply by reading the document.

Step #4 Shop for Apps/Technology to Automate Your Processes

Now that you know what you need to automate your accounting processes, it’s time to find the right tools.

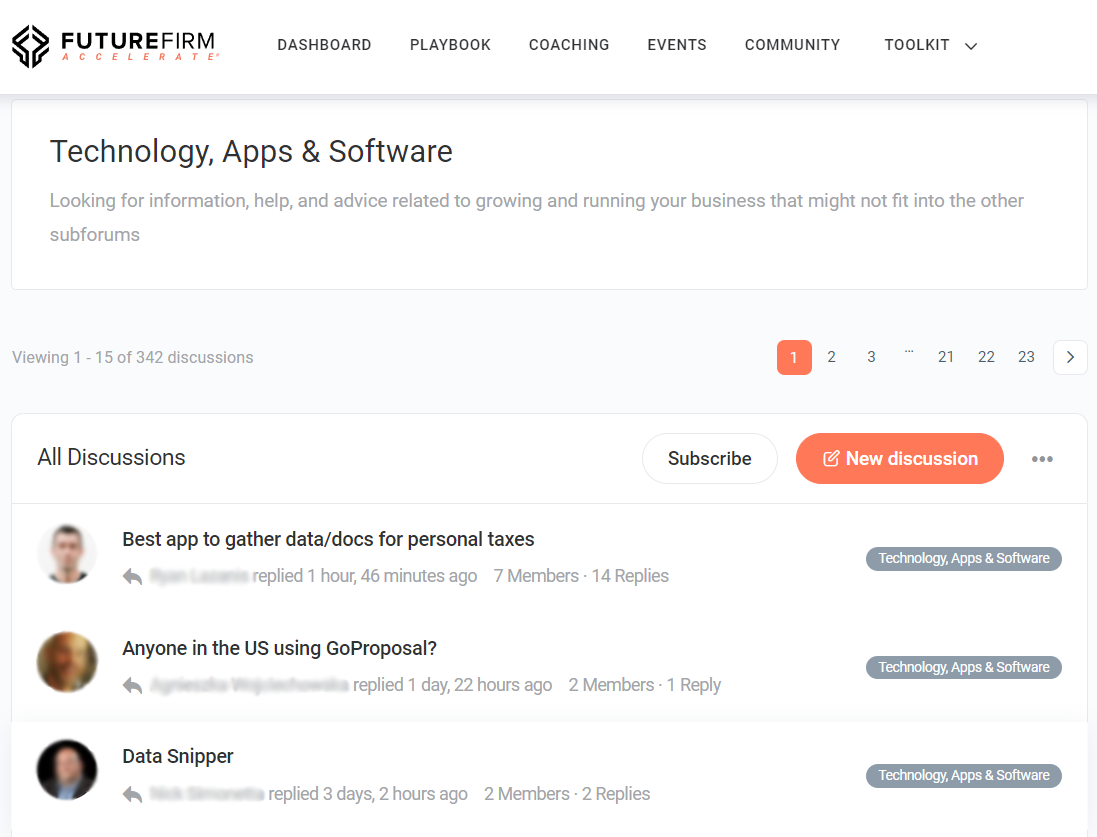

Look for software and apps that fit your business size and needs. Read reviews, try demos, and get recommendations from peers.

A big shoutout to the Future Firm Accelerate community for actively sharing their tips and recommendations with fellow members.

Step #5 Testing and Quality Assurance

Before fully relying on automated processes, thoroughly test them to identify and resolve any issues or errors.Begin by running small tests to spot any possible problems or mistakes in your automation setup.These trials help you adjust the automation settings to make sure your data stays accurate as you automate your tasks.Step #6 Re-Prioritize Your Processes QuarterlyRegularly monitor the performance of your automated processes and update them as needed to adapt to changing business requirements or regulations.Identify any bottlenecks or areas that may still require manual intervention.By checking in on your processes on a quarterly basis, you make sure your automation stays in sync with your business goals.

How to Automate Your Accounting in 15 Key Areas

If you’re looking to automate accounting processes, here are some steps you can take:

1) General Ledger Accounting Software

Cloud accounting software (ie. accounting automation software) for your general ledger is far superior to desktop accounting software when it comes to automation.

This is because it acts as the hub to which other pieces of software can connect it in order to seamlessly transfer data back and forth, which significantly reduces the time you spend on your accounting tasks.

The benefit here is automation can help you plug and play different apps in real-time to customize and automate just about any manual accounting workflow.

It’s like the App Store on your iPhone, only for accounting process automation software.

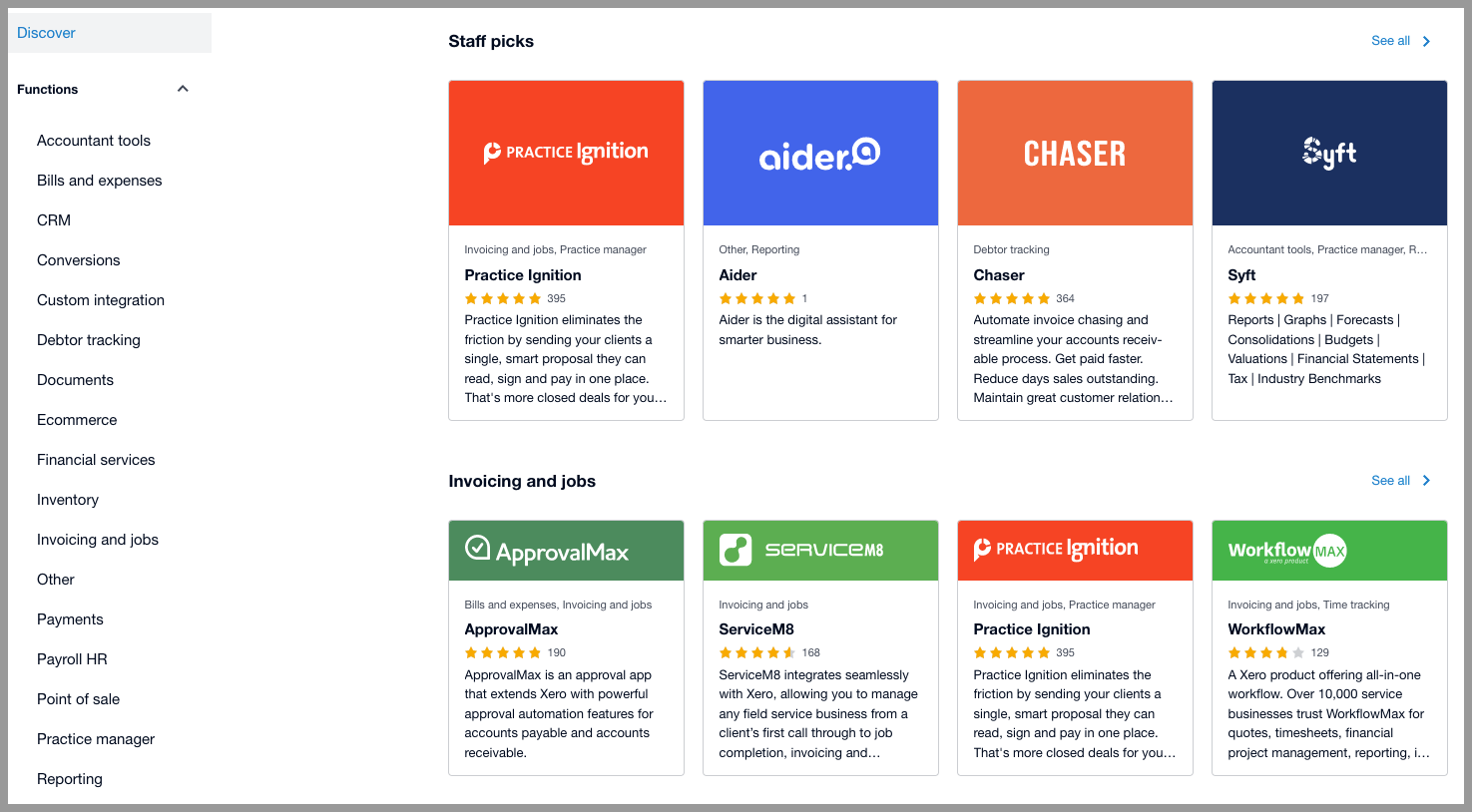

As an example, just check out part of Xero’s App Marketplace:

There’s a ton of cloud accounting systems to choose from, but the leaders have typically been Xero or QuickBooks Online. That said, Sage has also been making a big push with some pretty high-profile acquisitions.

2) Expense and Accounts Payable Processing

Ditch the shoebox of receipts and mountains of paper that need to be manually entered into accounting software and replace it with some nifty automated accounting apps.

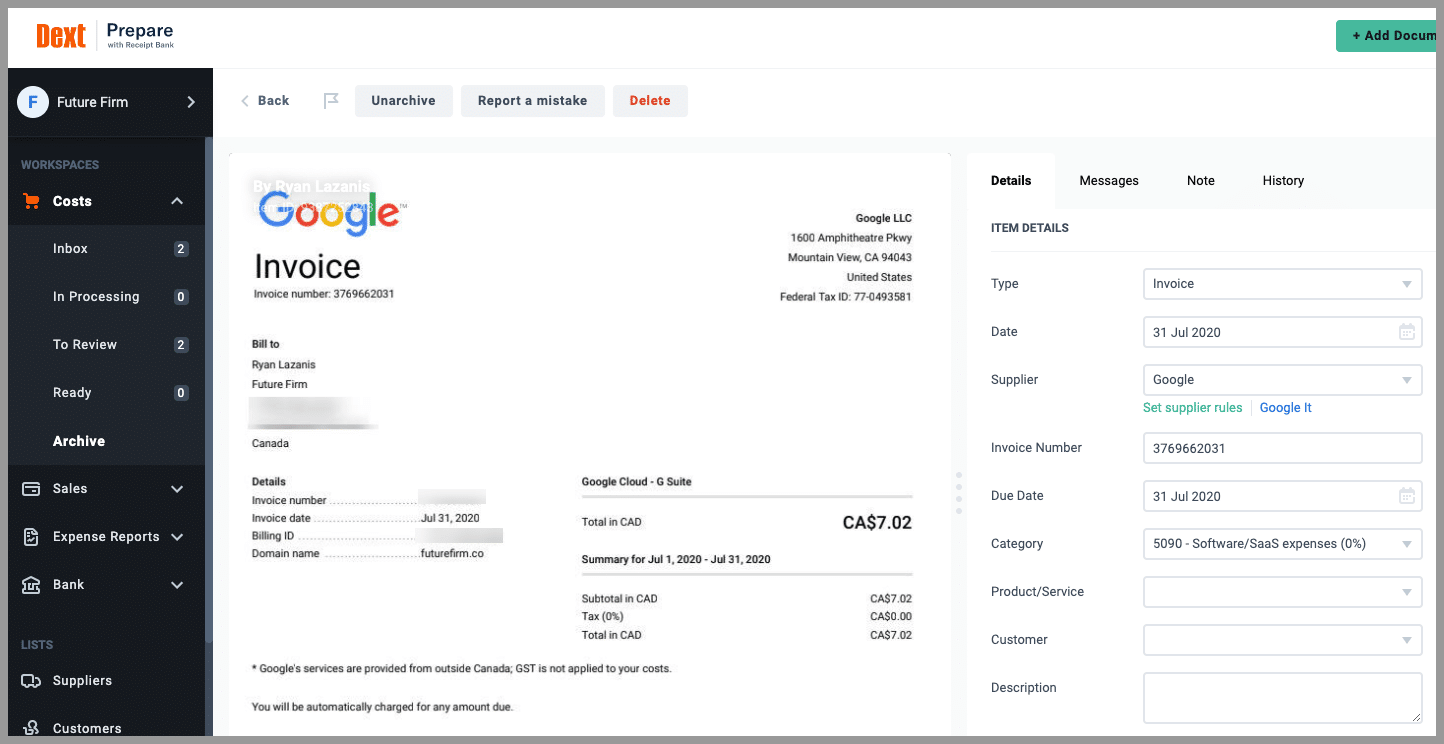

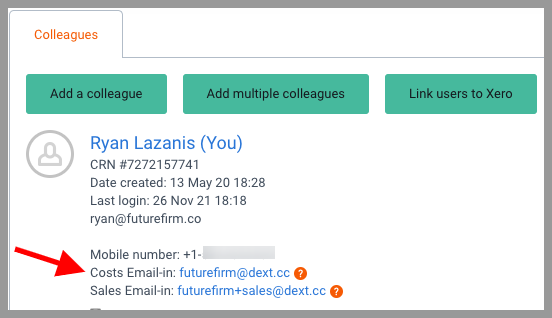

Through a combination of robotic process automation and artificial intelligence, apps like Dext & Hubdoc allow you to streamline accounting processes and 100% eliminate all manual data entry associated with entering expenses into an accounting system when delivering client accounting services.

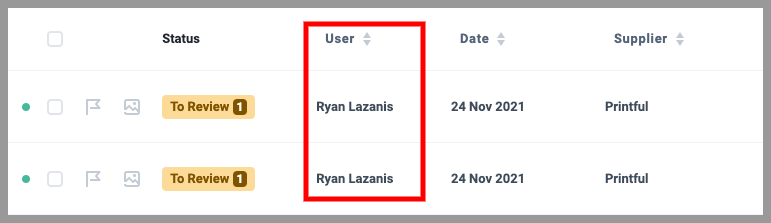

It looks like this:

- Snap pics of your receipts with your smartphone or forward electronic copies by email into the app

- The app scans the docs and extracts the required info automatically in real-time (ie. elimination of manual accounting data entry and human error)

- The extracted financial data syncs with your cloud accounting software

3) Payroll

Legacy accounting process automation software systems usually come with a payroll module. I still see some accounting firms using it even though it involves:

- Manually inputting figures into the accounting management system

- Manual processes calculating the net pay

- Relaying that info to the client and/or cutting checks themselves.

Yikes.

But with automated accounts via payroll automation, payroll can run with taxes deducted and properly submitted along with all corresponding forms in just a matter of minutes.

See how easy it is with an automated system like Gusto:

4) Month-End Reviews

Before the books are closed, it’s typical for senior accountants to review the books to spot any accounting errors or potential issues.

This task ties up valuable resources, especially if the manager has to review many files per month.

There are more tools than ever to help automate the month-end review process to spot errors before it even gets to the manager’s desk.

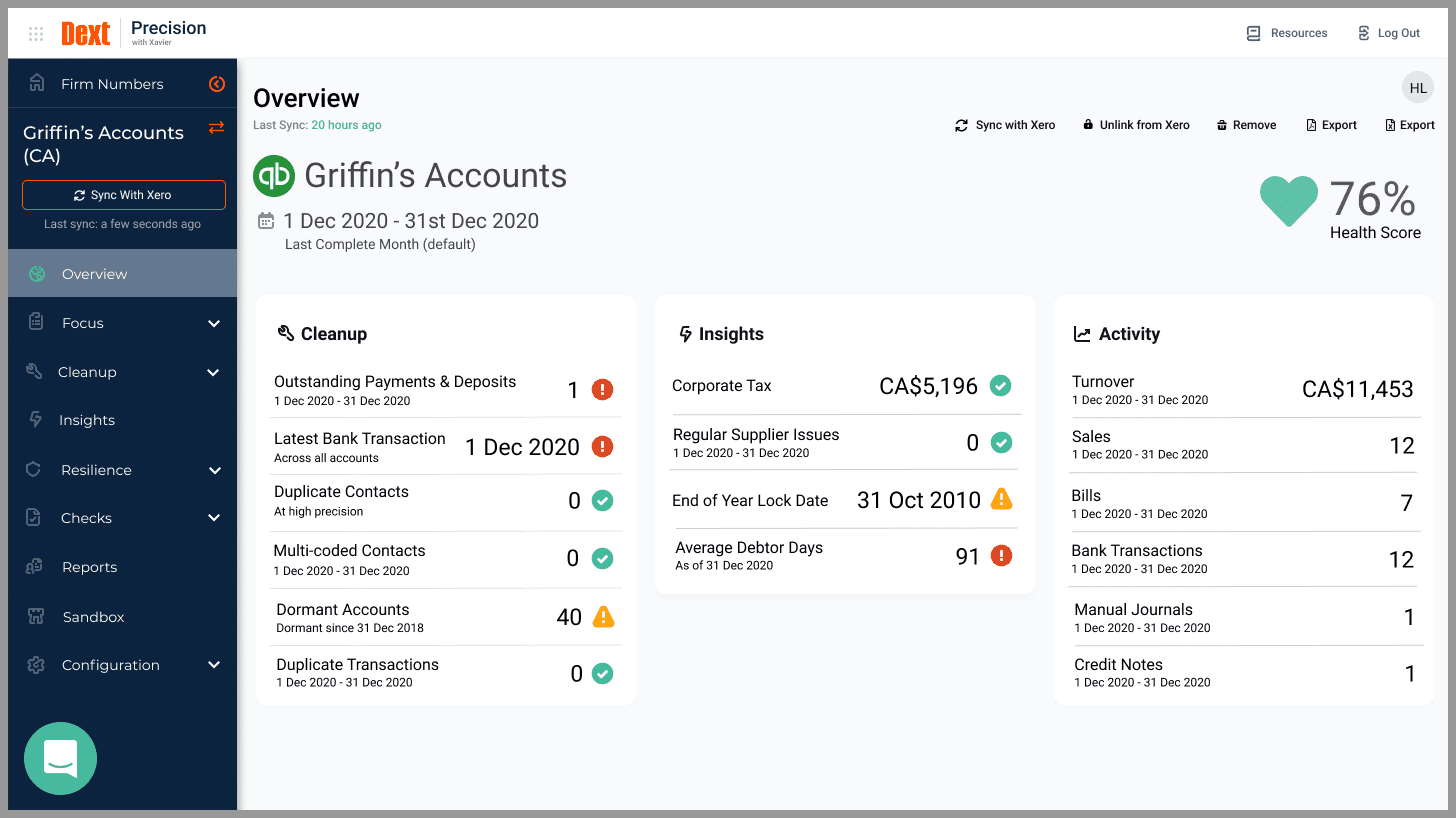

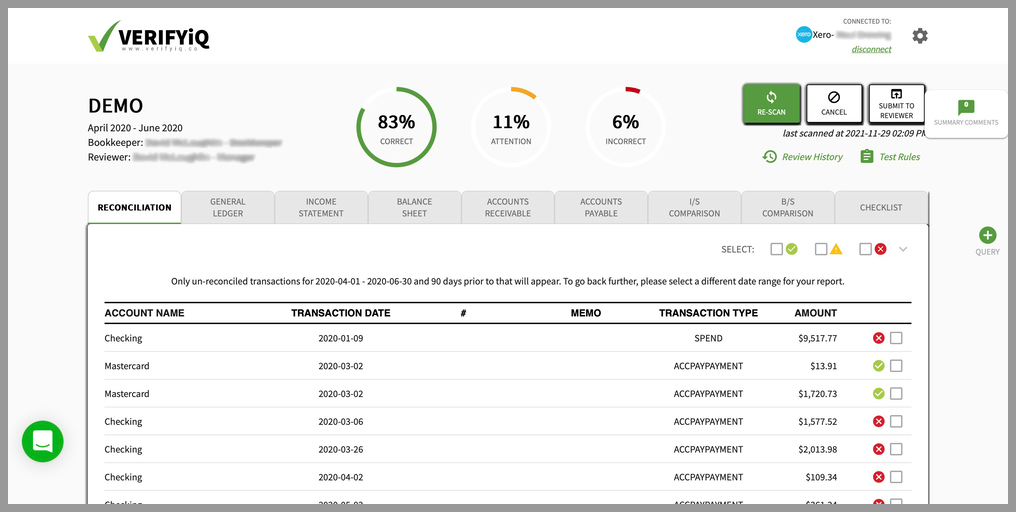

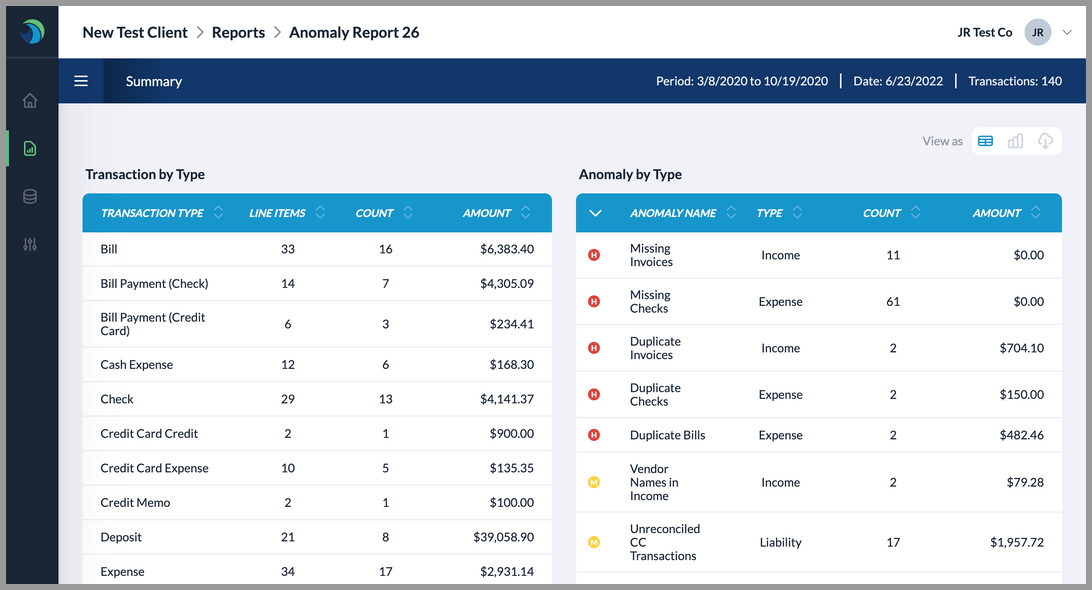

Dext Precision, as an example, will scan the ledger for the period in question and point out warnings for things such as duplicates, unreconciled items, problems with bank reconciliations multi-coded contacts, and a whole lot more.

It will then provide you with a health score so that low health scores can be reviewed by the preparer before sending to the manager for sign-off:

VerifyIQ is similar to Dext Precision and checks the books for errors and outputs a score with tips on how to correct any errors:

Other options include Keeper, which is a project management system that integrates with QuickBooks Online to help automate the collaboration on month-end closes or Scrutinize, which also has a nifty two-way sync with QuickBooks Online:

5) Working Paper Schedules & Adjusting Journal Entries

As part of the month-end or year-end procedures, accounting professionals often create a variety of schedules for deferred revenues, fixed assets, loans, prepaid, etc. to prepare their financial statements.

With some cool computerized accounting software like Flowrev though, you can automate the creation of certain schedules (ex: deferred revenues) and have your adjusting journal entries posted directly to your accounting system.

For working papers, you no longer need to rely on outdated software like Caseware.

All eyes are currently on Countable, a much more modern working papers and financial statement preparation software that connects to Xero & QBO to automate the year-end process.

Here’s an overview:

6) Accounts Receivable

Most firms help their small business clients with different finance and accounting operations like their books, bill pay, payroll, accounts payable, etc., but when it comes to the A/R part of the revenue cycle, they’re invisible.

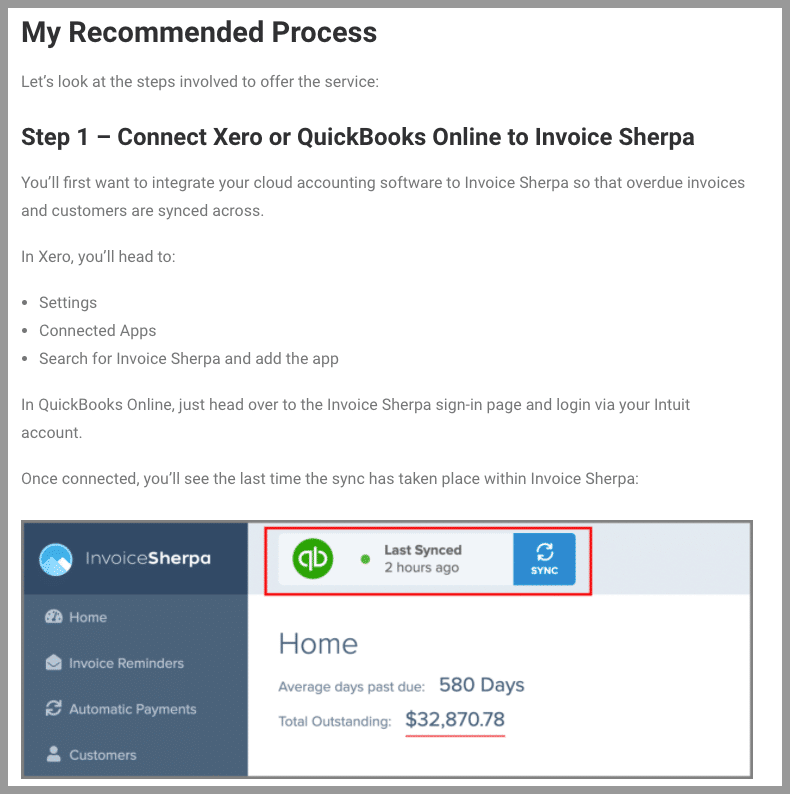

My view is that apps like InvoiceSherpa are the next logical service offering that accountants can provide via automated accounting to simplify life for their clients to help automate accounts receivable.

Effective A/R collections rely on two things:

- Sending enough reminders for payment on overdue invoices

- Tailoring reminder messages depending on who you’re sending them to

To see how easy it is, I developed a 10-step process to automate A/R collections using InvoiceSherpa.

Firms can also use an A/R automation app to help automate collection of their billings after they’ve put a contract in place with their client.

7) Bill Pay

Still cutting checks or sending once-off wires to pay suppliers in your accounts payable department?

Financial professionals, it’s time to move to something far more streamlined when it comes to automated accounts payable.

There are many apps that can help with automated accounts payable and bill pay, whether it be mainstays like Bill.com or Plooto, or others like Routable that enable “if this, then that” automated accounts payable approval rules.

Here’s a 60-second clip of what automated accounts payable looks like in action with “if this, then that” rules:

8) Expense Reports

Compiling employee expenses reports can be exceptionally manual and error-prone if you’re handling these accounting processes the old school way with spreadsheets.

I personally like using Dext’s Expense Report module where each employee has their own login and dedicated email-in address:

And when that employee emails in their receipts for their expense report, Dext will show that user on the expenses in-processing screen:

Which makes it very easy to just sort items by an employee and create the expense report directly within Dext before sending them over to Xero or QuickBooks for reconciliation against the payment.

Easy peasy!

9) Banking & Credit Card Data

We rely on bank and credit card transaction data to help us reconcile a set of accounts.

Cloud accounting software helps to pull in that data automatically via bank feeds which smooths your accounting workflows, but there are 3 issues:

- The feeds from bank accounts break frequently, causing re-authentication to be required

- Duplicate or missing transactions sometimes occur

- The transaction information provided by your bank often lacks sufficient detail to identify the transaction

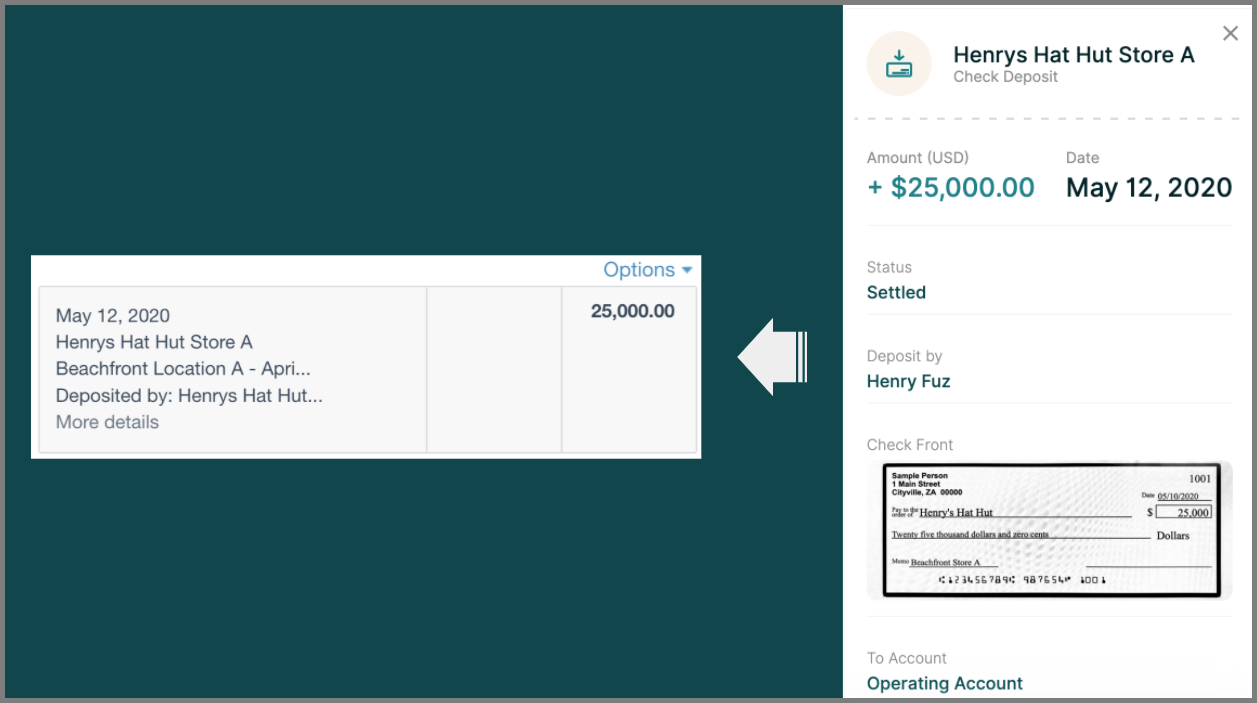

Relay, a modern banking product, is a great example of how you can set up your banking in a way that avoids these security issues.

First, it has direct bank feeds with your automated accounting software, contrary to most of the other banks that connect via an intermediary, which is often the source of broken feeds or transaction issues.

Second, instead of seeing vague transaction information in your system, such as “Check Deposit” or “Online Payment”, requiring the accountant to ask their client what this transaction is, Relay allows you to choose what data gets pushed into your automated accounting system:

This provides you with far more context on the transaction itself, eliminating the back and forth with your client, making your automated accounting process faster and easier, and there is no need to go through mountains of paper records.

10) Reconciling Uncategorized Transactions

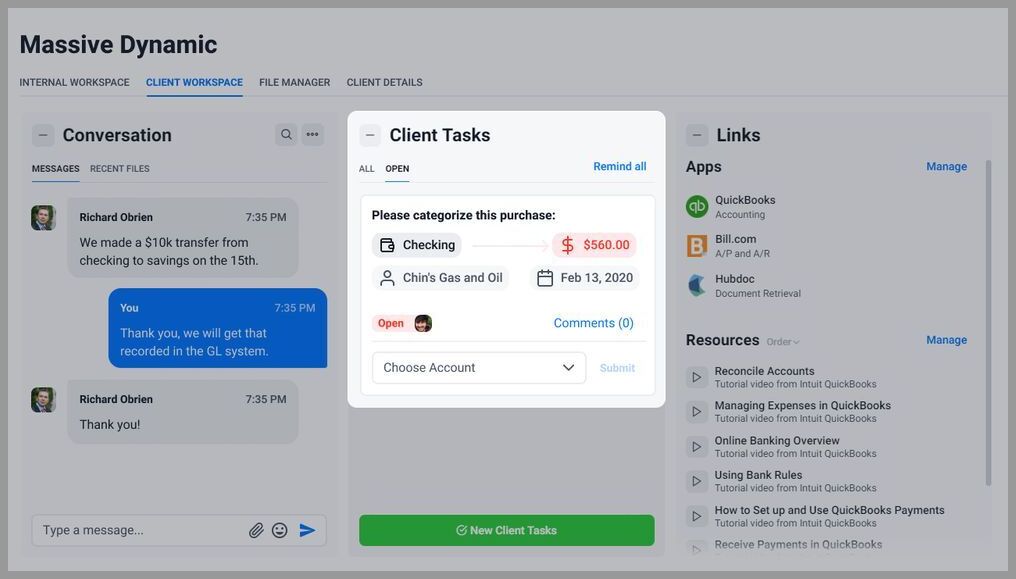

Gathering input from your clients when it comes to missing information on uncategorized transactions has long been an inefficient process for accountants.

These repetitive tasks are being automated through several apps today:

Uncat lets you send a link to your clients with all uncategorized transactions in QuickBooks Online and lets them proceed with the info directly on their screen (ie. no spreadsheets required).

Here’s Kate from Bookkeeping Sidehustle getting a tour of the app:

And then you have Keeper and Client Hub, which are popular practice management apps, which in addition to tracking tasks and collaborating with your accounting team, can also handle pulling uncategorized transactions in from QBO and set them as client tasks for them to assist with:

11) Cash Flow Forecasting

Cash flow forecasts have typically been manually produced in an Excel spreadsheet by firms or an accounting department.

Luckily, there are quite a few excellent options to automate your cash flow forecasts and provide more financial automation where you can:

- Pull data from your accounting software

- Integrate with A/R and A/P to adjust cash flow forecasts based on payment dates

- Engage in scenario planning

I’m a big fan of Fathom‘s (affiliate link + discount within) cash flow forecasting module which provides a great balance between simplicity and power. I think they knocked it out of the park.

Helm’s integration with Veem, where you can create a plan to pay your payables from your cash flow statement and then actually have Veem trigger the payments to your suppliers. Very cool feature for accounts payable that the finance team loves.

12) Accounting Advisory

Providing advice to clients via advisory services was typically reserved for partners and more senior-level staff, which therefore made them hard to scale.

But over and above automating transactional accounting tasks, with smart software and some automated tools, advisory services can be performed by accountants and finance departments at almost any level at scale.

First, you can set yourself up on Clarity to pull in reports of financial data from your cloud accounting system. Here you can see the app shows you 7 simple KPI’s based on where the business processes are at now:

On the next screen is where we engage with the client to adjust various parameters. By doing so, we can see the overall impact on cash & profit to get them closer to what their goal might be.

So if someone is looking for an extra 65k in profit for a given period, I can play with the parameters in many ways to achieve that number.

In this example, It increased the:

- Revenues by 15%

- Revenue per employee by 10%

- EBITDA by 15%

To arrive at this result:

This then kicks off the next step of the process with a multi-step action plan that staff at any level can complete with the client:

With part of this virtual CFO and advisory work being automated and with the other part being streamlined, this is one example of how advisory work can be democratized and scaled to help your clients make better business decisions.

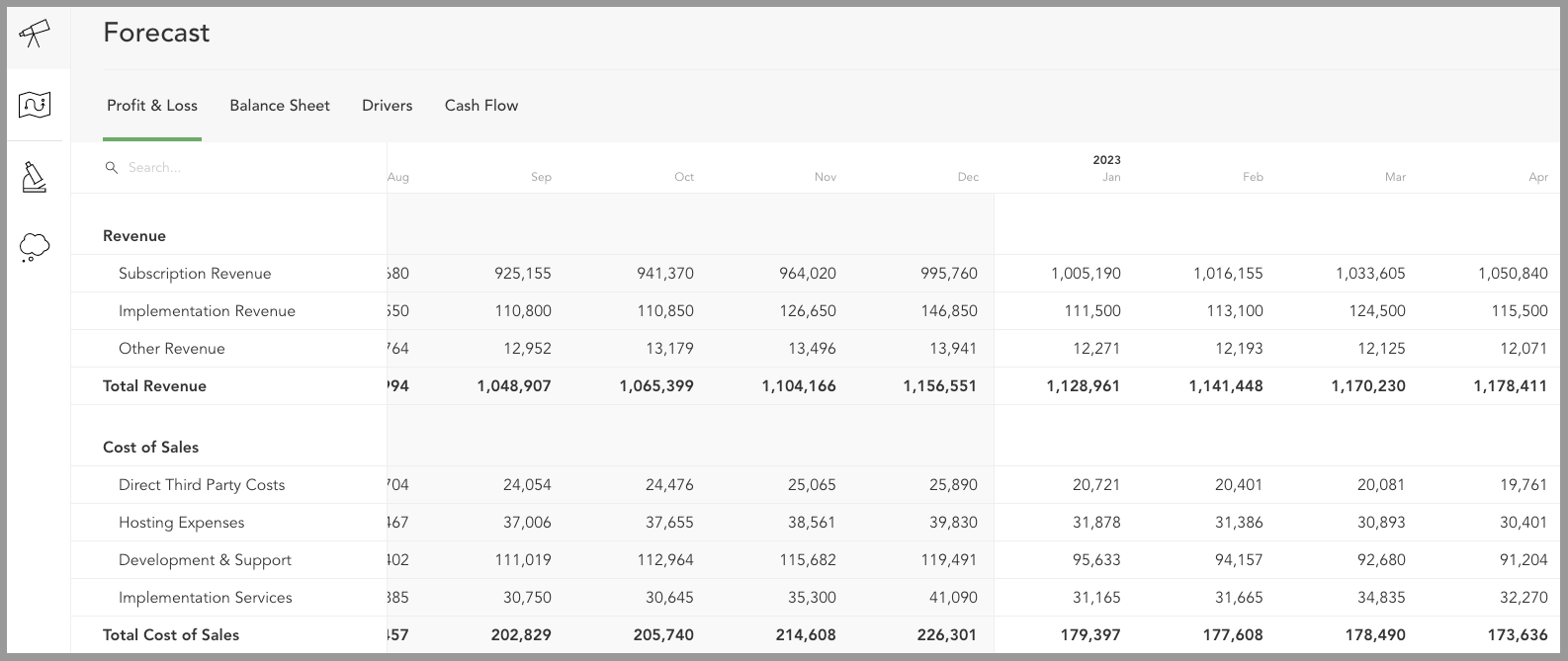

13) Financial Modeling

When it comes to financial modeling, you need information about:

- Previous financial reporting information

- Salaries and the corresponding breakdowns per employee

- Upcoming sales pipeline

Gathering and assembling this information to construct your model takes time.

Through the power of cloud accounting and management software, however, small businesses can leverage some pretty sophisticated integrations to help you assemble your models much more quickly.

One such example is a financial planning & analytics app called Jirav which helps automate the financial modeling process.

As you can see, it can integrate with many other data points to suck information into the accounting system, providing efficiency in reporting and finance processes:

With the Gusto integration, you can pull in details of staff costs:

And with the:

- Salesforce integration you can pull in your sales pipeline to model out revenues

- Xero/QBO integration you can pull in actuals

Which can help you reduce manual processes to automatically produce your financial model along with a whole variety of data analytics to help add value for your clients:

14) Financial Risk Management

The great thing about AI, machine learning, and robotic process automation is that it can process and “understand” large amounts of data to ease decision-making by scanning data analytics.

MindBridge has been helping to automate the work auditors have been doing for years by scanning 100% of the data, rather than just a sample, to spot potential issues.

But over and above its use to improve operational efficiency and reduce mundane accounting tasks in the audit profession, the tool can also be used to help companies spot errors and risks in the books as well.

Here’s a good video of how MindBridge works in action:

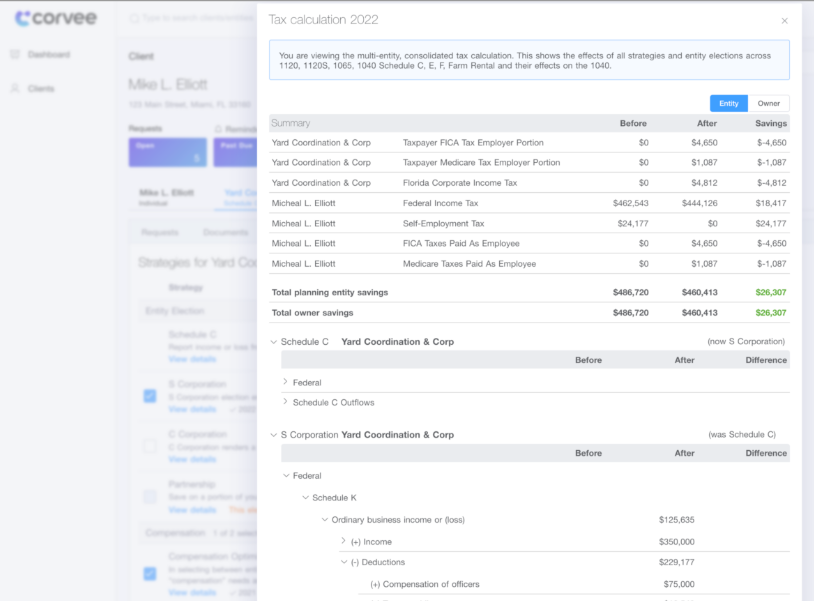

15) Tax Planning

Automation is now hitting the tax space pretty hard with several apps that have gained popularity as of late to help with tax planning.

Corvee is quite popular and boasts they can help automate up to 1,500 strategies just by importing a tax return:

TaxPlanIQ and TaxMasterNetwork provide two similar tools as well which I know are quite popular.

The US seems to be more advanced than most in this area, but each jurisdiction has at least a few options that exist to automate tax planning.

Over to You

So that’s my up-to-date guide on accounting automation for the accounting profession, business leaders, and the accounting community.

Now I want to turn things over to you!

What do you think? Will accounting be automated?

Which strategy are you going to try first?

Let me know by dropping a comment below right now.

Perfectly agreed with your view sir, AI in Accounting is no longer a Hype, Am just imagining what if a business has implemented all these, I wonder How well they can coordinate and manage their business with few clicks.

First, I would like to bring more movement towards opting cloud accounting services by SME’s, they should focus on how well they can use existing Options in the ERP itself and would recommend these API integrations if they are not available in the package.

And so I am focussed on transactional automation right now as advisory shall be focussed once this is automated.

RPA has huge potential to save a lot of time and money for financial organizations. Think about the profit margins that can be gained by having multiple machines run repetitive tasks 24X7X365.

Can I please get the Guide?

Unfortunately there is no PDF guide. It’s just this blog post.

That is really helpful. I’ve never tried most of these.

Glad it helped!

A very well composed and much informative blog. This was very helpful. Thank you for sharing.

You’re welcome!

Great read! Automation can find applications in many industries. Avrohom Gotteheil has some interesting thoughts on how to leverage automation in the right places.

You Are awesome, Really explained very deeply. keep Sharing

Does an overreliance on a multitude of third party apps not create a huge technical and cost dependency?

And what about CPA compliance when apps such as Receipt Bank send your client’s sensitive data to offshore data extraction centers?

Hi Pablo. With regards to technical dependency, possibly, but there are alternatives you can always jump to. Regarding cost dependency, I always look at ROI, not costs. These apps provide ROI. For compliance, you can look at their security precautions and come to your own conclusions regarding your own appetite for risk.

Nice article it helps to the improve the knowledge for the accounting students. Thanks for sharing.

This is a great article, thank you for sharing the valuable information. Which is the best tool for accounting automation??