In this blog post, you’ll learn about the top accounting technology in the profession along with some tips and tricks on how to leverage them.

So if you’re looking to leverage software to automate your accounting work, you’ll love this guide.

Let’s go!

Table of Contents

- Cloud Computing

- Artificial Intelligence & Machine Learning

- Optical Character Recognition

- Robotic Process Automation

- Blockchain

- Big Data

- The Metaverse

- Mobile Apps

- No-Code Development

1) Cloud Computing

One of the most transformational technologies that’s moving the accounting industry forward today is cloud computing.

Briefly, this technology allows you to store applications on the internet versus on your computer or server.

The implication is that this technology has allowed for:

- Unprecedented levels of accounting automation

- Anywhere, anytime access to information

- Closer collaboration with your team and clients

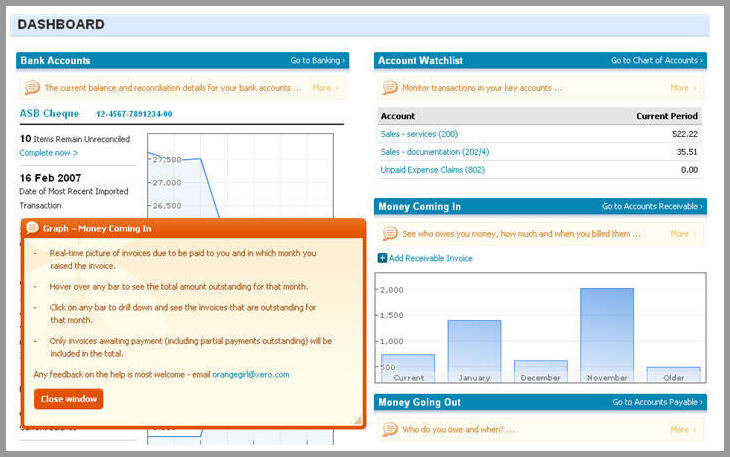

The early days of cloud computing in the accounting profession started in the 2000s, often said to have been started by Xero, which is now being used by many accounting firms and companies.

For kicks, here’s the oldest Xero screenshot that can be found on record (from 2007):

Here are some tips to leveraging cloud computing in accounting:

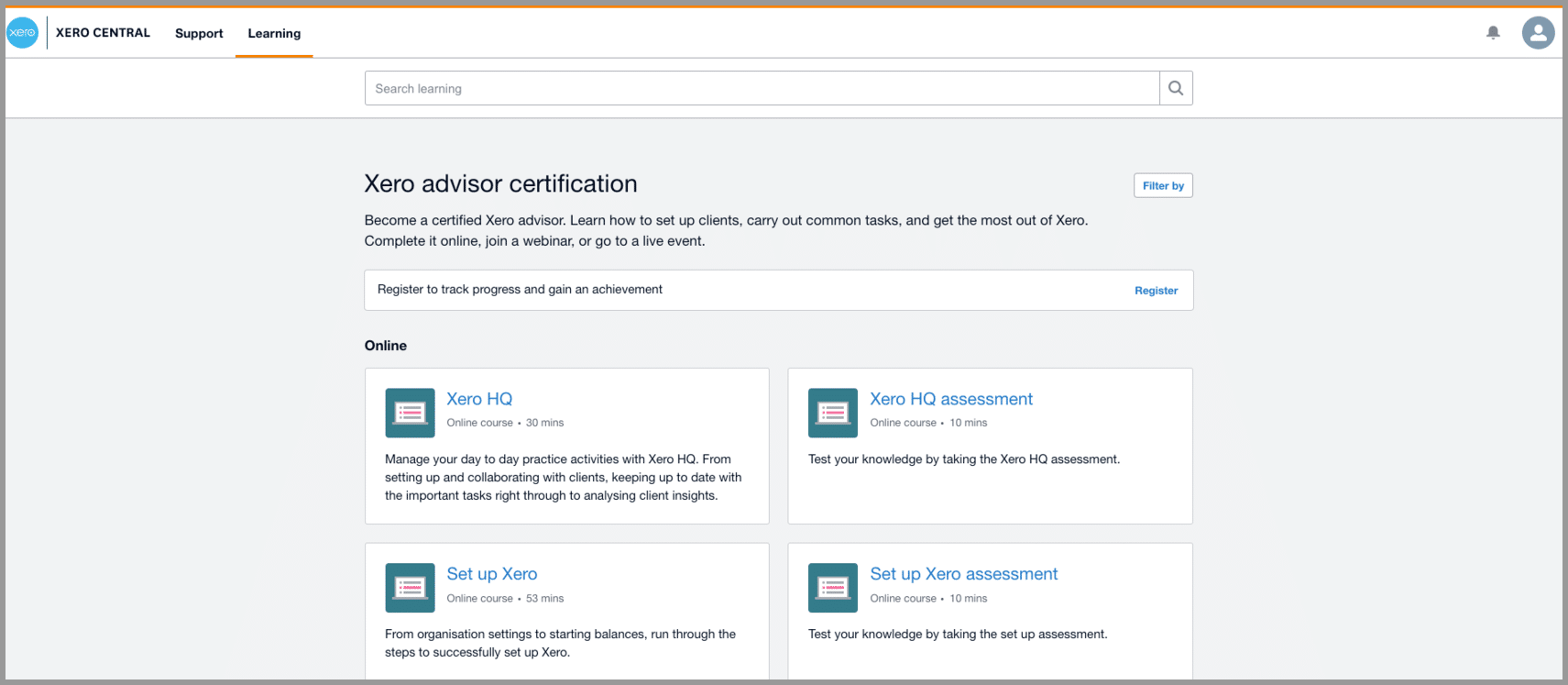

Tip 1: Become Cloud Accounting Certified

Master the popular cloud accounting systems, like Xero or QuickBooks Online, by becoming certified on their platforms.

Here’s Xero’s:

Here’s QuickBooks Online’s:

Tip 2: Pick 1-2 Other Cloud Accounting Apps to Master

Nowadays, if your accounting software tool relies on a local drive for storage and security, you’re missing out.

Take all of your accounting functions into the cloud, not just your general ledger.

Cloud computing technology allows you to work from essentially anywhere as long as you have a stable internet connection.

There are a lot of apps, but I would recommend mastering an app for one of the following:

- Expense claims & receipt management reporting

- Payroll

- Data analytics and small business performance

- And maybe one more if there’s a process that you handle regularly for your clients (ex: bill pay)

And once you have your apps selected, you’ll need to understand APIs and integrations in order to compile automated financial information.

Tip 3: Opt for Cloud Tax Software

All the benefits that I listed for cloud services apply to tax software as well. Tax software is starting to move online and the promise is that tax software will become far more integrated into your accounting suite to help automate the completion of tax forms, making tax preparation much more seamless and beneficial for your current and potential clients.

Over and above just automating completion of tax forms, however, we’ll also start to see tax planning become an automated technology, which is discussed later on in this article.

Sniff out a cloud-based solution for tax software available in your jurisdiction and get it implemented.

By doing so, your accounting department or firm can experience enhanced efficiency and seamless integration for automated tax preparation and planning.

2) Artificial Intelligence and Machine Learning

In the realm of digital advancements, AI is currently one of the most widely discussed topics, not only in the context of accounting technology trends but across various industries and fields.

Artificial intelligence (AI) is the simulation of intelligence by machines where it can mimic human judgment to help solve certain problems, whereas machine learning (ML) is a subset of AI where the computer can “learn” from experience to help automate certain tasks.

Let me share something I shared a couple of months ago with my newsletter subscribers.

I used an AI voice cloning service (at the 4-minute mark) and ChatGPT to automate advisory services to a (fake) client.

It took me just over 6 minutes to do the whole thing. This demo underscores the limitless potential of AI in transforming traditional service delivery models.

Here’s another example of how this technology can change the way we do things:

Botkeeper (disclaimer: I’m an advisor to the company) is an outsourced bookkeeping service that’s heavily leveraging AI and machine learning technology to automate mundane accounting services and big chunks of work.

On the graph below, you’ll see that automation (AutoPush) steadily takes more of the work as time passes (from 0 to 41% in 5 months).

And the reason why they’re saving so much time is that the very nature of the technology gets smarter as it ingests more data.

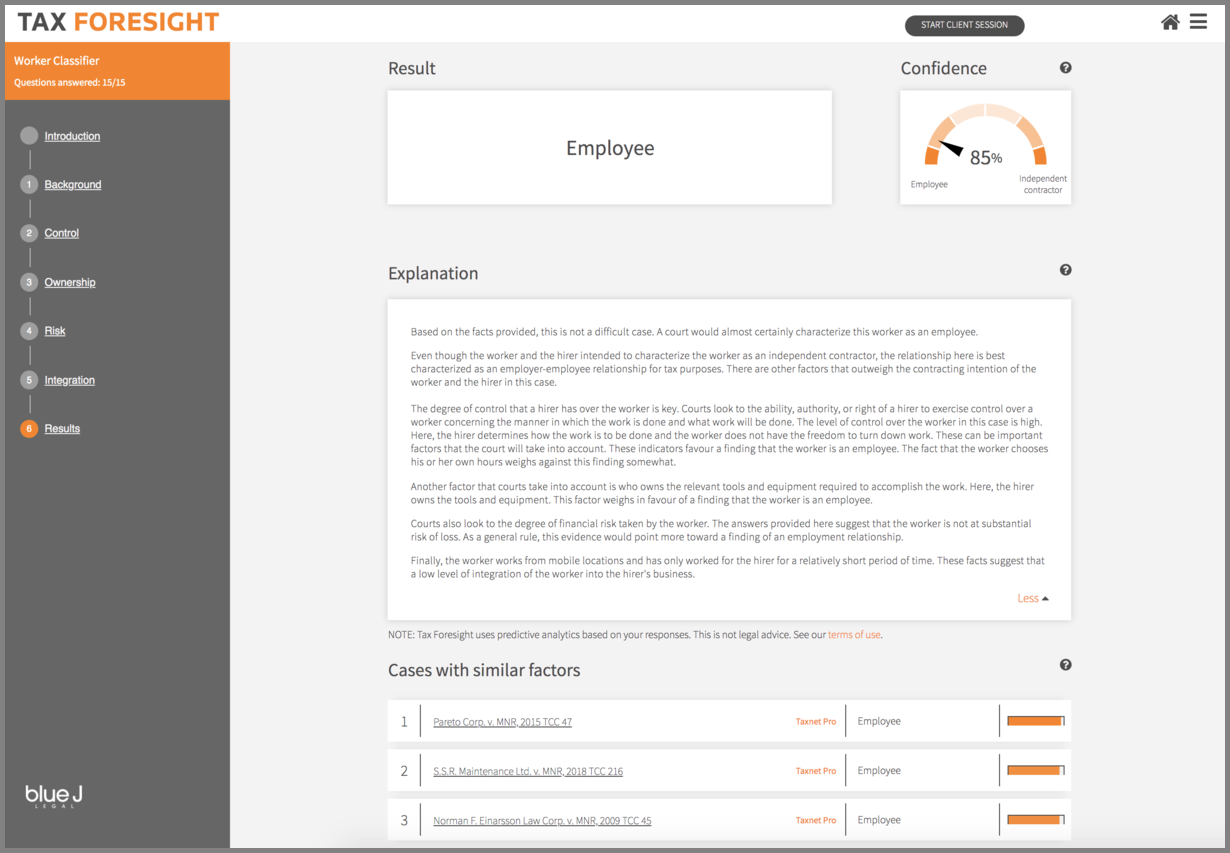

Tip 1: Leverage AI in Tax Planning

Blue J Legal is a piece of software that can predict the outcome of tax cases to help automate aspects of tax planning (as well as certain advisory services).

In this example, we have provided the software with facts on a given tax issue. The software then scanned related tax law and court cases to provide a degree of confidence on what the outcome would be if that very issue went to court:

Tip 2: Seek an AI Accounting Technology for Audit

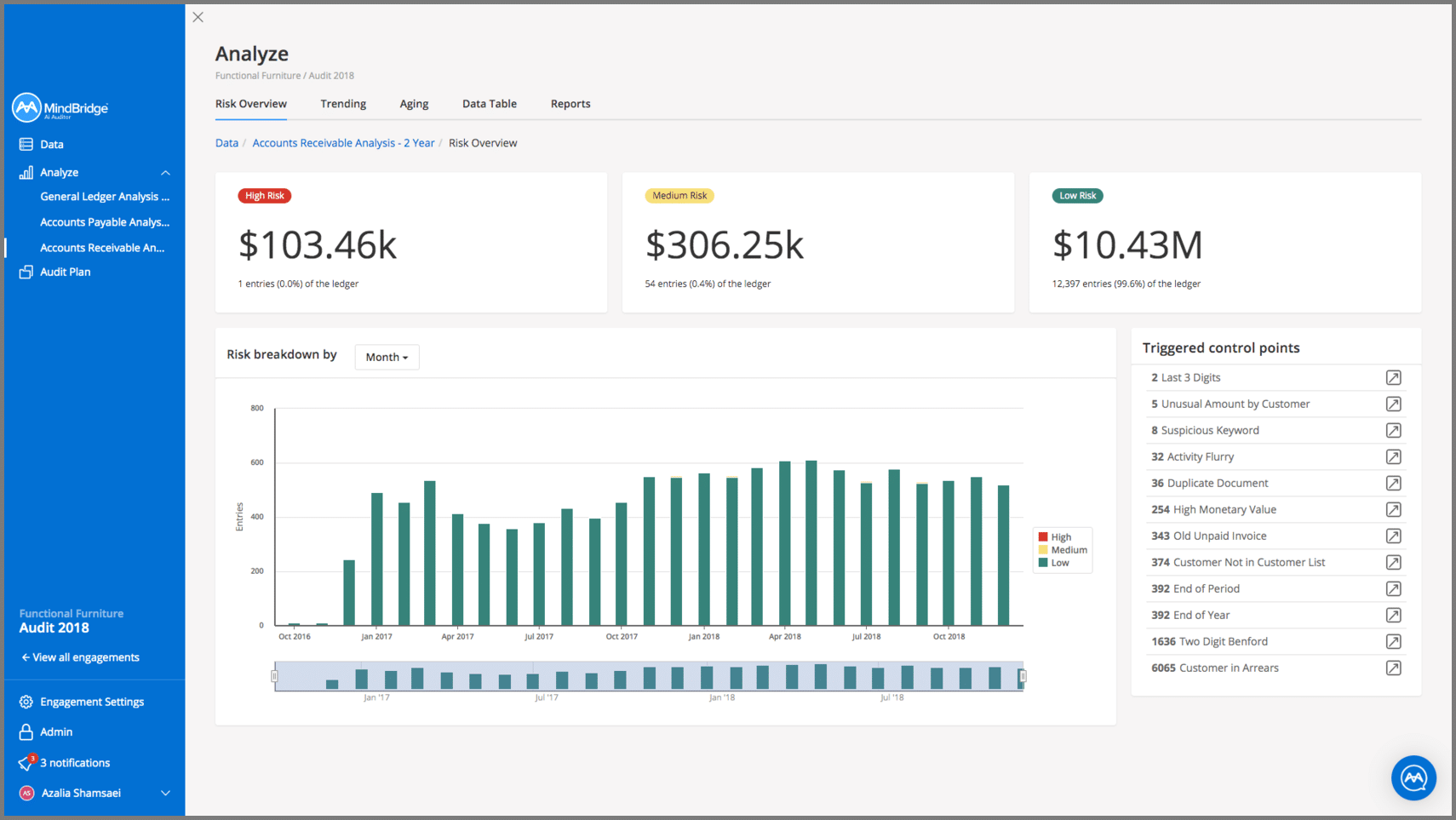

Traditionally, the audit process would sample large sets of figures and perform certain tests to provide a level of assurance over that data. It was not feasible to look at the entire information set in great detail, however, due to the amount of time (and therefore costs), it would take to do so.

What AI has brought to the field is a way to use technology to run through as large of a data set as you want, in great detail, to point out risks that you might not have previously seen through the samples an auditor had selected.

AI makes it possible to analyze data at a wider scope in a shorter amount of time.

For example, in the image below, MindBridge‘s software ran through an entire set of books and identified $103,460 of high-risk transactions, $306, 250 of medium-risk transactions, and $10,430,000 of low-risk transactions:

Basically, the software will highlight anomalies and from there, you can tailor your audit much more easily to help with your audit risk management.

Tip 3: Leverage ChatGPT To Minimize Repetitive Tasks

ChatGPT has become one of the most widely used free AI technologies available today. Its chatbot interface is designed to offer responses to a wide range of commands, from email creation to complex web coding queries.

Since its launch in late 2022, ChatGPT has gained immense popularity, reaching 100 million users in just about two months.

According to a report from Tipalti, an accounting software company, 76% of finance executives concur that manual tasks are still a heavy burden to their teams.

ChatGPT can be a major catalyst in freeing you and your team of such tasks.

One possible use of ChatGPT for accountants is creating a process document from a tax agency form.

After providing some more information, you can get results like the one you see below:

If you want to find out more powerful ChatGPT prompts you can use to streamline your firm, we have a complete ChatGPT training available in Future Firm Accelerate.

3) Optical Character Recognition (OCR)

A big part of what many accounting firms and accounting professionals do is process and enter financial documents into an accounting system.

Incorporating accounting technology such as optical character recognition (OCR) software enables accounting firms and professionals to streamline their workflow by automating the extraction of machine-readable text from various financial documents, including bills.

For example, a bill includes all kinds of information such as the invoice date, due date, payment terms, nature of expense, supplier name, supplier address and more.

Optical character recognition technology allows you to automatically extract this machine-readable text through the use of software.

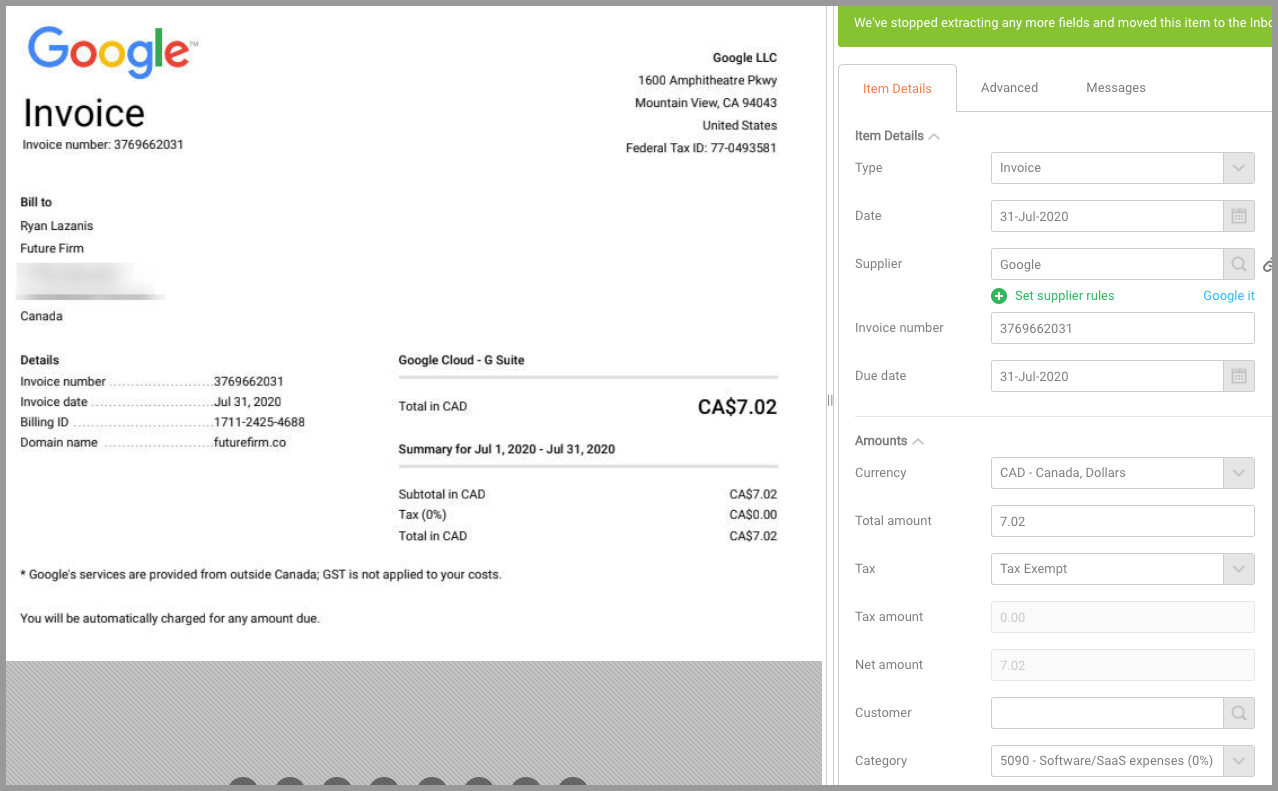

I might have the following invoice that I can send to a piece of software like Dext to automatically extract the data for me and then send it into my accounting system:

OCR works really well when you’re dealing with large amounts of machine-readable structured data, such as sales invoices or bills, that all need to be processed in a similar manner.

Tip: Use API’s Where Possible

What you need to know about APIs is that they allow you to easily connect and integrate different pieces of software together to make it far less time-consuming and to automate your financial data.

This is important because you’re able to automate entire workflows so that new data pushes seamlessly into your cloud accounting system all without entering manually.

While OCR technology is great, what we really want it to do is extract the data for us and then send it into your accounting system, automatically, and this will happen thanks to API’s.

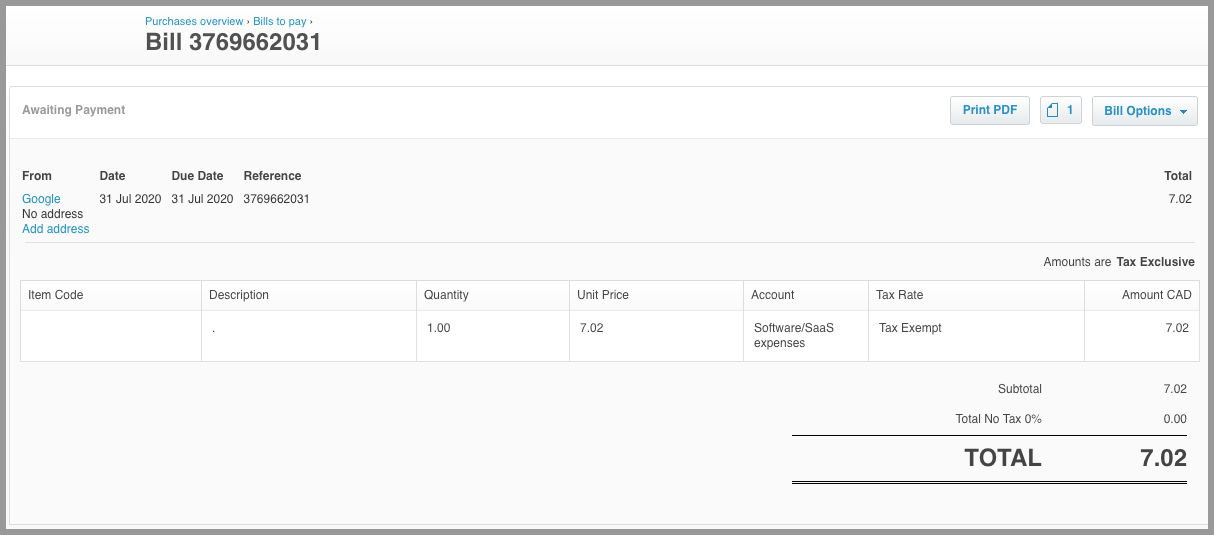

When two pieces of software are connected via their API’s, then you’ll be able to get the invoice shown above automatically entered into your accounting system as a bill as shown below:

4) Robotic Process Automation (RPA)

In high demand is RPA, one of the more popular of the latest technologies to help companies automate rule-based tasks in accounting and to eliminate manual entry.

Accounting technology like RPA is good when you have a lot of repetitive and time-consuming tasks that need to be treated in the exact same manner each and every time.

In its simplest form, an example of RPA could be setting bank rules in your QBO account. The created rule will scan your transactions and then automatically treat the transaction according to the rule.

But if you want to take it up a notch, you can create your own “bot” to manage all bank rules across multiple QBO files all at once like this nifty vid demonstrates:

Here are some other simple tips:

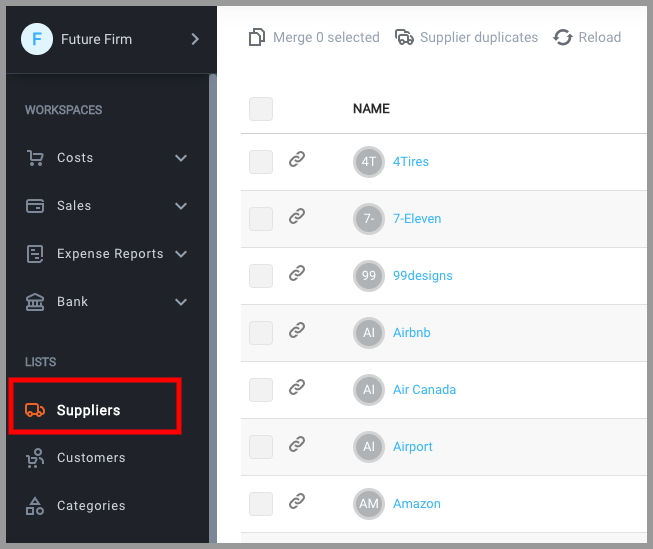

Tip 1: Use Supplier Rules in Dext

Save time by processing receipts in Dext by clicking on the “Suppliers” tab to bring up all suppliers in the system:

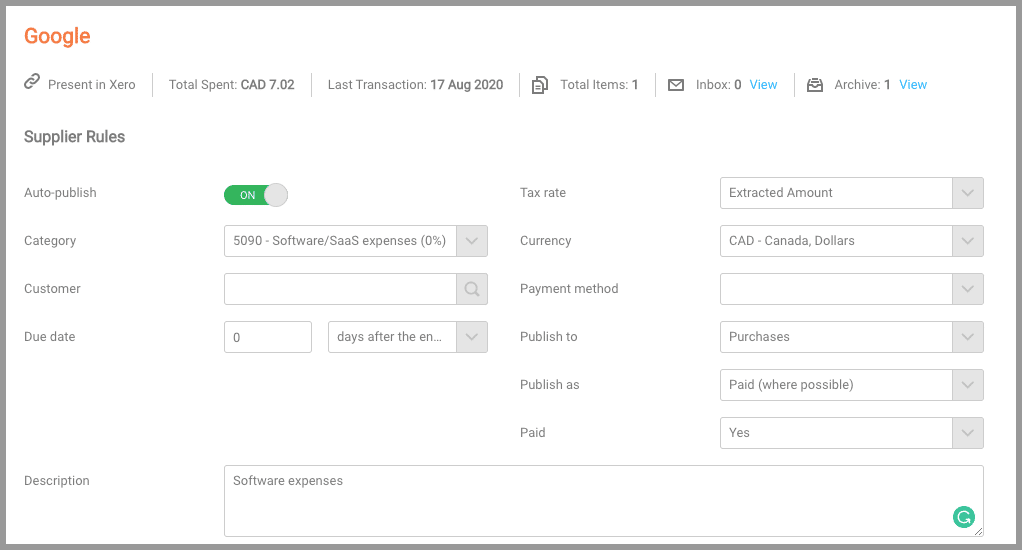

And then by clicking into one of the suppliers, I’d see this:

Here I’ve done a few things:

1. I’ve completed all of the necessary fields

2. I set “auto-publish” to on

What this means is that I’ve set the rules for how this supplier should be treated each and every time. When Dext sees an expense from Google, it will extract the information exactly how I’ve set the rules and then automatically push it to my accounting system.

Overall, this process reduces manual data entry, which translates to less human error and better efficiency.

Tip 2: Review Bank Rules Regularly In Your Cloud Accounting Software

It’s great if you’ve set up bank rules in Xero, QBO, but make sure you’re regularly reviewing/adding/updating them.

5) Blockchain Technology in Accounting

I became involved with bitcoin and, correspondingly, blockchain in 2013.

As I studied the space, I couldn’t help but notice the parallels that this technology had.

So in 2014, I wrote an article titled, “How the Technology Behind Bitcoin Could Transform Accounting as we Know It“.

To be clear, there has been a ton of hype around blockchain and smart contracts but the real-world application of this technology in our field so far has been marginal at best.

That said, I believe it’s important to understand and monitor the technology trends happening to see how they may apply to your business operations in the future.

To read more on this subject, see how I believe blockchain can transform the audit profession and how it might also shake up the world of bookkeeping.

6) Big Data and Data Analytics

Accounting professionals do far more than just process information. They also analyze financial data and advise on it to help improve financial reporting and business strategy when it comes to managerial accounting.

Big data typically refers to processing large amounts of unstructured data over a variety of data points.

But the important thing to understand it’s not just about having lots of data at your disposal. It’s about how you analyze that non-financial and financial data in a way that helps your business and your clients.

Tip: Start Simple

Before you jump head first into the world of big data and data analytics, consider starting on a smaller scale.

As an example, there are several dashboard apps out there that compile your financial data into some pretty snazzy reports to assist you with your managerial accounting data analytics.

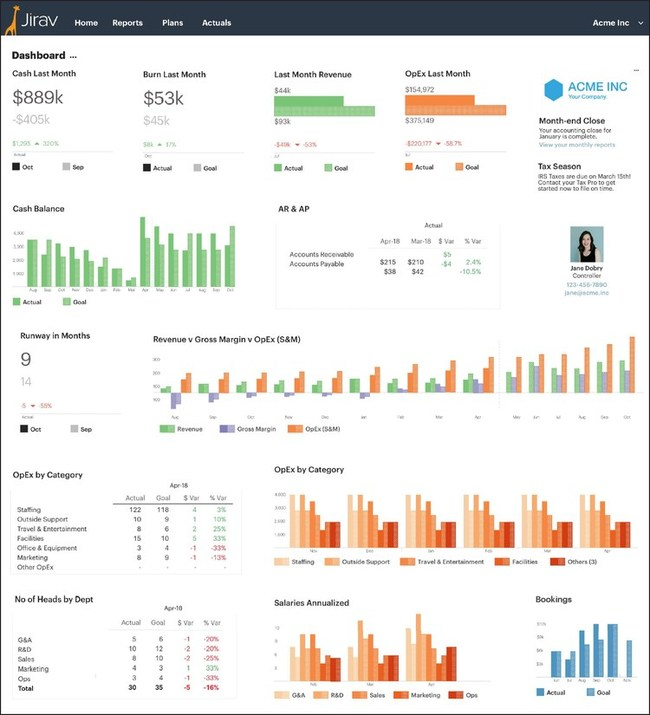

As an example, here’s what Jirav’s dashboard looks like after you’ve connected the app to a variety of different data sources to help leverage your financial information for corporate growth decision making purposes:

7) The Metaverse

Here’s a fun one…

The metaverse is an online world where people interact via digital avatars and it’s starting to get a lot of buzz.

Here’s how Meta (formally Facebook) sees work in the metaverse taking place (4:09 of the video):

What’s interesting is that one of the top 40 accounting firms in the US was the first to actually buy up digital real estate in the metaverse (yup, it’s a thing, see their metaverse office below) to serve their clients and truly work in the digital world – a great marketing strategy move by the way.

Tip: Familiarize Yourself 🙂

While the metaverse is one of the top emerging technologies in the accounting industry and one that’s seriously pushing digital transformation, there’s not much to do just yet when it comes to how this technology that might affect the way you work.

For now, just read up on it as it will surely develop in the accounting profession in the years to come.

8) Mobile Accounting Software

No longer do you have to be chained to your desk to get the books up to date and to provide great advice on the numbers.

Thanks to mobile devices, there’s a variety of accounting tasks that you can handle, from reconciling your books, to invoicing, to processing expense reports, and more.

Even if your task is to create expense claims, there are various software solutions and mobile can help you streamline the process of such tedious and time-consuming tasks.

It won’t be too long from now that just about any accounting process you can think of is doable without using a desktop or laptop.

We won’t go into a ton of detail here, but here is a tip to help you get the most out of mobile accounting technology:

Tip: Search the App Stores

This one’s a pretty simple tip when it comes to accounting technology, but obviously, before you can handle your accounting work on the go, you’ll want to make sure you have the right apps on your smartphone and/or tablet. Just search the app stores for the accounting apps you use the most.

9) No-Code Development

The fusing of technology and accounting is really taking shape like never before through no-code development.

With no-code development, we’re creating new applications and accounting automation tools specific to the accountant and client’s needs.

Specifically, no-code accounting technology allows you to build software applications and automations quicker and easier than traditional software development.

Here’s one of the few accounting firms that are leading the way on this trending emerging technology to offer no-code development as a service to help their clients automate more of their accounting.

Here are a few tips to get going

Tip 1: Setup a Simple Zapier Automation

While there are a ton of no-code tools on the market, such as Airtable, Integromat and more, Zapier tends to be the most popular of the bunch and is the easiest one to tip your toe into.

The possibilities are endless, but if you’re curious to see how some accounting experts are using it to automate parts of the business accounting processes, including their client onboarding process, check this out:

Tip 2: You Don’t Need to Figure This Out Yourself

I’m seeing a lot of accounting professionals spending a lot of time trying to figure out how to master no-code tools themselves. Some of this can be very technical and time-consuming.

Remember, you can outsource this work out, or you can hire someone on your team to help you with this technology.

Wrap-Up

I hope you enjoyed my guide to accounting technology help you remain relevant in this fast-changing world.

Now I’d love to hear from you 🙂

Is there a new accounting technology that you’re most excited about?

Which of the new related technologies do you want to leverage first?

Which tip in this guide did you like best?

Let me know by commenting below!

Terrific read.Always find the step to optimize the receipt bank integrations with accounts package the most amazing time saver if it works but takes so long to optimize and high risk of rhe disaster you refer to.crypto side of things is like science fiction but so the future and present and offers great opportunities.interested in how to find overseas clients who are like minded.

Thanks for checking it out Barry.

Wow, this material is incredible. Thanks Ryan!

You’re very welcome 🙂