Most accountants start their accounting firm with the idea of starting a better life for themselves. One that involves less time in the office, more time to spend with family, and overall, an improved accounting work-life balance.

But accounting firm owners often get sucked into the typical traps of firm ownership where they’re working longer hours with more time away from the things they love.

Fortunately in this guide, I’ll be providing 10 tactics that you can immediately implement to help you improve your accounting work-life balance.

Let’s dive in.

Disclosure: This post was sponsored by Xero. Everything discussed is my honest opinion based on personal experience.

Table of Contents

- Why do Accountants Struggle with Accounting Work-Life Balance?

- 10 Tactics to Improve Your Accounting Work-Life Balance

- Where Will You Start on Your Accounting Work-Life Balance Journey?

Why do Accountants Struggle with Accounting Work-Life Balance?

Everyone has a different definition of work-life balance.

Some believe they have a balance working 80 hours per week, while others haven’t achieved enough balance working 30 hours per week, and some are still mixing up their professional and personal lives.

While everyone’s definition is different, here’s another example. I think work-life balance is about being able to spend the amount of time you want on the things you want.

If you’re not achieving this, then you likely haven’t achieved a work-life balance.

Ultimately though, public accounting firms have long struggled to achieve the good work-life balance they desire.

Why?

A few reasons:

- Running a firm is stressful. You’re dealing with people’s money, so the stakes are high, with the pressure from these high stakes being compounded by tight deadlines imposed on accountants throughout the year.

- The above factor is multiplied during the busy season, which runs a good 25% of the year where working crazy hours is a pervasive issue across the industry.

- Firm owners generally do a poor job planning, strategizing, prioritizing, giving advisory services, and focusing when it comes to their actual business. They’re too focused on getting their head above water to actually work on the business to avoid overwork from happening going forward.

All of the above is supported by findings in a Xero study that found that 42% of public accounting professionals’ said that their biggest barrier to their well-being is lack of time:

And it’s no wonder because that very study also indicated that less than half of these same public accounting professionals have daily habits to support their well-being:

Combine this with a 16% drop in Canadians’ mental health due to 2020’s pandemic onset and you only have a situation that makes stress & anxiety intensify, making balance in your personal life difficult. Keep in mind that accounting professionals often lean toward companies that offer flexible work schedules and the opportunity to work from home.

Given all of the above, it’s no wonder that public accounting firms complain about a lack of work-life balance and suffer from high stressors and anxiety levels.

10 Tactics to Improve Your Accounting Work-Life Balance

Luckily, there are some strategies that you can implement right now to improve your work-life balance so that you can save time and maximize enjoyment in your life.

1) Engage in Capacity Planning

In all the years I ran my firm, I never worked crazy hours in any given week nor did I ever have to work weekends.

There’s a reason for that:

Capacity planning.

It’s an incredibly powerful tool when it comes to avoiding overwork for yourself, achieving a better work-life balance for you as well as for your entire team. Work-life balance is a crucial factor in maintaining employee job satisfaction.

While I’m not a proponent of timesheets (ie. recording time and looking backward), I am an advocate of forecasting time forward to foresee and avoid any potential capacity crunches.

How?

- Assign a time forecast to each task

- Enter each person’s weekly capacity (ie. 30 working hours per week, etc.)

- Generate a report to compare forecasted time requirements to available capacity

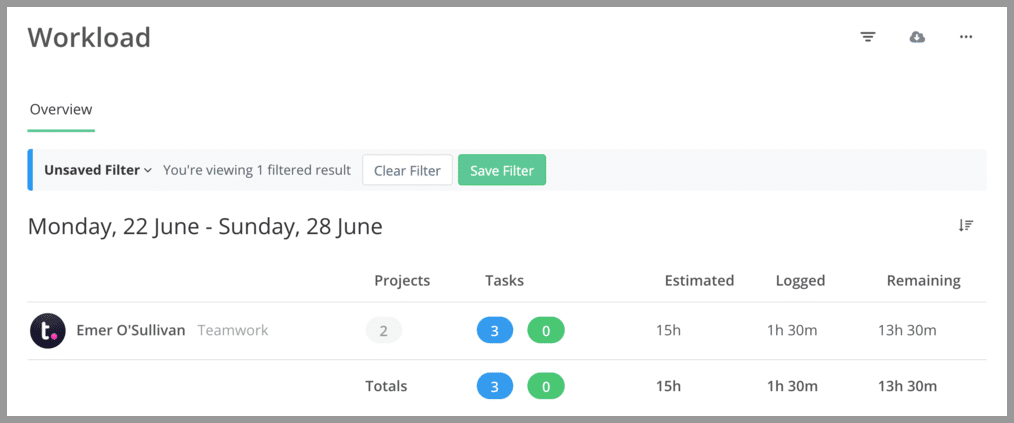

The report would look something like this one from Teamwork’s workload report for an individual (but can be viewed firm-wide as well):

You can see in the above example that this individual has 13.5 remaining working hours of capacity in the stated period. It tracks the work hours. If capacity was low or negative, you’d either need to shift work over elsewhere or plan for another hire.

You can completely eliminate overwork in public accounting firms with a good capacity planning process. A better work-life balance is a key to achieving better job performance.

2) Hire Early

Why are firm owners so busy with all kinds of client work?

One of the main reasons is that they don’t hire early enough.

They’ll hire someone when they’re already loaded up to 110%. And once they hire someone, maybe their capacity will drop to 75%, and then they’ll start accepting more and more clients and load themselves back up to 110% and repeat the cycle. This process is dreading especially during the tax season.

The trick to breaking the cycle is to always hire early so that the owner or managing partner is not loading themselves up with client work so that they can focus on the business.

Firm owners should be focused on spending 0% of their time on actual client work and a minimal amount of time actually dealing with clients, not the other way around.

By hiring early, you won’t get stuck with everything always falling on your shoulders and you can maintain a better and healthy work-life balance.

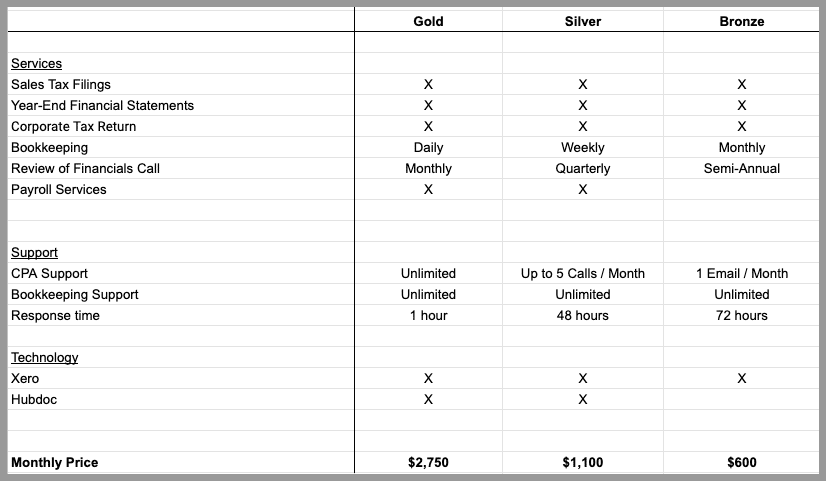

3) Use 3-Tiered Pricing to Control Capacity

One of the benefits of 3-tiered pricing is that it puts you in the driver’s seat when it comes to managing your capacity and accounting services, not the client.

Let’s say you have a potential client who is high caliber, but they need a lot from you right now and you wouldn’t be able to adequately deliver it all due to lack of capacity. They want 1-hour response time, they want daily bookkeeping and all the bells and whistles.

If your accounting firm offers 3-tiered pricing, then you can push customers on to the plan that makes the most sense for your firm at the moment, instead of loading yourself up.

For instance, you could give them exactly what they want in a Gold option, but you would price that option very high, perhaps like this:

Here, I’ve included the things that would really drain me and my firm’s capacity in the gold plan, like daily bookkeeping and 1-hour response time, and I’ve priced that option very high compared to the other plans.

In this example, I’ll offer the client the option to sign up for everything they want, but I’ll most likely be able to push them to the silver plan, which comparatively looks much cheaper. This saves my firm needed capacity, allows me to hire someone, and then be in a position to upsell the client to some kind of hybrid option between the gold and silver plan once there’s enough capacity on the team.

The key here is not to constantly load yourself up and 3-tiered pricing can help in this area.

4) Only Do Work That You Enjoy

It’s your business. Focus on that fact. You’re in complete control. So why spend time in areas that you absolutely despise?

For instance, if you hate audit services, then why offer them in your accounting firm?

Part of ensuring a better work-life balance in your accounting firm is making sure that you’re spending time in the areas that you love and that you’re passionate about.

Otherwise, you’ll just make yourself miserable, and even more awful during the busy season.

Too many accounting firm owners get caught up in just making money that they forget that there’s more to life than that.

So if you want a good work-life balance, cut out the stuff you hate doing and just focus on what you love.

5) Only Work with Clients You Love Working With

By the same token, stop working with clients that drive you nuts. Most public accounting firms do this. This adds long hours week per week. This is a surefire way to add stress to your life. No amount of money is worth dealing with an unreasonable client that keeps you awake at night.

Improving and having a better work-life balance has everything to do with cutting out the stuff that adds anxiety to your life and spills into your non-work life. Focus on the ones you love working with.

6) Reverse Engineer Your Ideal Life and Stick to an Action Plan

Many firm owners are stuck on the hamster wheel.

Partly because they’re trapped in the cycle of wanting to make more and more money. And partly because they don’t really know where they want to specifically go.

This is certainly true for me as well.

I just wanted to grow my firm as big as possible, because I thought that’s what a business needs to do. And I ignored the ultimate end goal of what I was working towards (because I never defined it).

This meant I was working more hours than I wanted to and that I was dealing with stress & anxiety from being faced with a myriad of opportunities that I didn’t know how to prioritize since there was no plan in place, and I wasn’t getting the work-life balance that I wanted.

My personal time is also affected.

This was especially true around the time when I was getting offers to buy my firm.

I was very confused and it was negatively affecting me. I lost my focus.

And then I had a breakthrough:

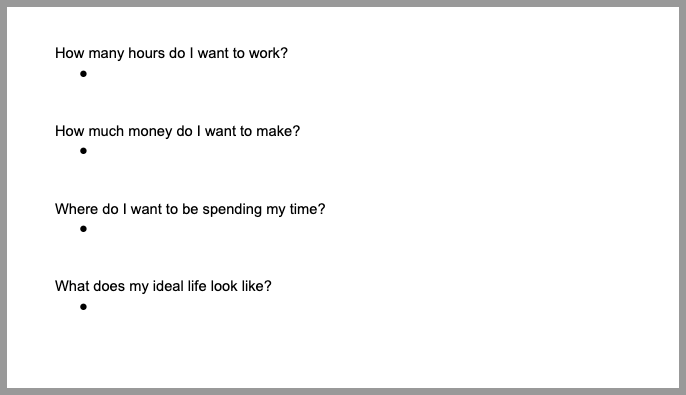

I’ll start at where I want to ideally end up and then reverse engineer what I need to do to get there.

And to do that, I very simply just filled in these blanks:

This helped me get clarity on how much I need to be happy in life and where I wanted to be spending my time. It helped me paint my ideal life and determine my main focus.

With these items all crystal clear, then I just needed to work backward to arrive at what I need to be doing now to be on track for my ideal life so that all my decisions are consistent with where I want to end up.

With my ultimate desired destination clear, this allowed me to reverse engineer the steps I need to be taking right now to be on the path towards my ideal life.

And I carry forward this concept in business as well, where I set up a strategic plan to arrive at my desired destination, consistent with my personal goals (in my Future Firm Accelerate® online coaching program I call this a Roadmap) and reverse engineer my goals for the next 90 days to be on track.

By setting these goals, I keep my focus and I block out anything else that comes my way. It reduces stress and saves me tons of time. And I diligently update my Roadmap every quarter.

7) Accounting Work-Life Balance Relies on Just Saying “No”

In the public accounting profession, poor work-life balance comes about from spending too much time in work-related activities. So one way to improve work-life balance is to simply find ways to cut down on your time at work, even during the busy season.

And it’s actually easier than you think to save yourself a few hours a week.

It involves just saying, “no”!

Once you have your Roadmap with 90-day priorities established (see point 6 above), any request for your time that doesn’t fit into those 90-day priorities should be rejected. Keep yourself focused on the goal.

As a business owner, you’re probably bombarded with people in your inbox asking you for 5 minutes here and 15 minutes there. Whatever it is, if you are spending time in an area that isn’t advancing the completion of your 90-day priorities, then you just politely say no.

All this time saved will accumulate into something substantial.

8) Live by the 80/20 Rule

As a business owner, it’s so easy to get wrapped up in all kinds of tasks and activities. But when you take a step back, how important is that activity really? How much will it actually move the needle forward? How big of a priority is it? Will it give me the healthy work-life balance I need?

Most of the stuff we do in the public accounting profession probably generates very little results.

Tune in to the kinds of things that you’re busy with which may not actually be important at all. If you can do that and cut those things out, you’ll save yourself a ton of time, attain a flexible work arrangement, thus helping you on your quest to achieve a better work-life balance.

9) Get Support from a Community / Mentor / Coach

It’s important to recognize that if you’re suffering from a poor accounting work-life balance, that you’re not the only one in that boat. There are a ton of people just like you who share your exact situation. Remember that having a good work-life balance is crucial to performing well at work.

If you spend your week at work always like a busy season, then that’s a sign. If you feel like you’re going in circles and if you’re having trouble breaking the cycle when it comes to overwork and longer hours, then sometimes just connecting with others who are in your shoes or who have been in those shoes is helpful so that you can get alternate perspectives and achieve that support and balance you need.

For instance, there are a ton of free Facebook groups that support firm owners (I have one here or I do enjoy Kellie Parks’ The Workflow Wateringhole one as well).

Or you can look for something a bit more structured, like a mastermind group, professional development programs, or a variety of mentorship and coaching programs.

I tend to be a bit impartial to my online coaching program, geared towards modern firm owners though.

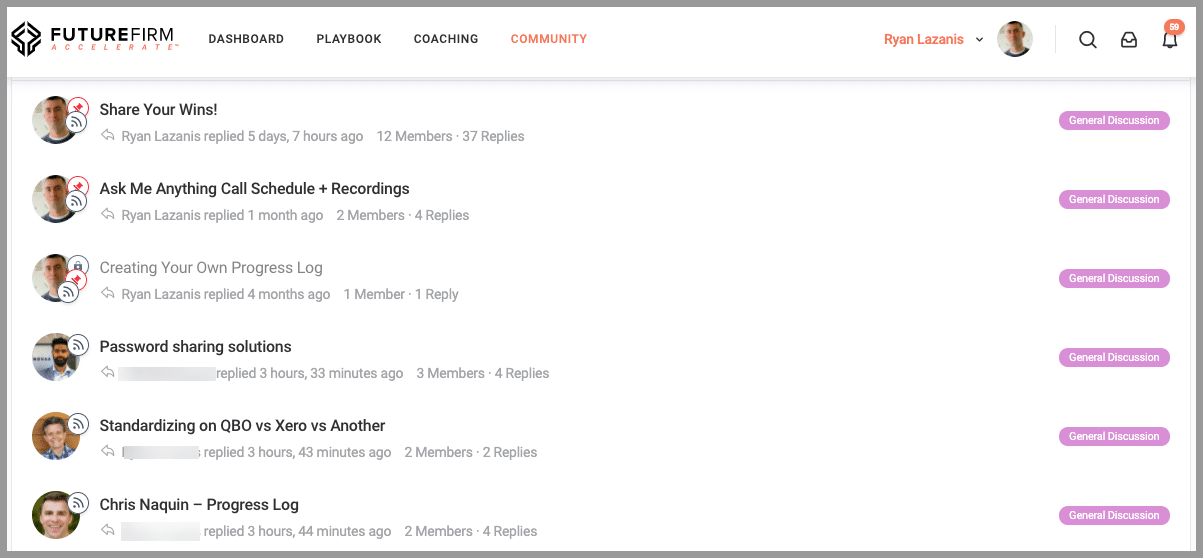

For instance, a supportive accounting community will share their wins, share their progress, and also share their challenges so that they can get the help they need to quickly create the business they want:

10) Engage in a Regular Hobby

Remember what happened to Jack Nicholson in the movie The Shining?

The famous quote goes:

“All work and no play make Jack a dull boy.”

We need time away from work, time away from the computer, more time with ourselves, and something else that stimulates our minds. These will help us lead to having a good work-life balance.

My personal hobby is CrossFit. One of the reasons I like it so much is because it takes my mind off of work. And I try to be active with it 4-5 times per week. It’s therapeutic.

In the field of public accounting, I firmly believe that over and above vacations, engaging in some kind of hobby regularly is one of the keys to keeping your mind out of work, thus leading to a happier and healthier accounting work-life balance.

Where Will You Start on Your Accounting Work-Life Balance Journey?

Hopefully, some of the 10 tactics listed above give you a good head start. Improve work-life balance. Learn how to separate your professional and personal life, as well as your family life. Engage yourself and your team with flexible work schedules. Good work arrangements are strongly regarded as one of the most important aspects of long-term job satisfaction. Avoid long hours. Take a little time out from the busy season and more time on yourself. Prioritize your physical and mental health.

But now I’d love to hear from you.

Which tactic will you implement first to make your lives easier?

Are there other tactics that help promote a healthy work-life balance in your life?

Which tactic do you like the best?

Some have already achieved the work-life balance they want, some haven’t yet. It’s not too late!

Either way, let me know by commenting below!

I love seeing your Gold/Silver/Bronze breakdowns. This is super helpful. Thanks for the article. Well done!

Glad you liked it Mary 🙂

Where can you find the Xero study that you talked about?

I’ve had to turn down clients since I did not have enough capacity. Hiring early is key for us. Excellent article Ryan. Best wishes.

Where can you find the Xero study that you talked about?

Here you go! https://www.xero.com/blog/2020/05/enabling-wellbeing-for-canadian-accounting-professionals-during-mental-health-week/