Artificial intelligence in accounting is currently transforming the industry.

In this article, you’ll:

- See concrete examples of how AI is currently being used in the profession

- How you can start using AI in accounting right now

- Understand the benefits and risks of AI

- Plus more…

And by the way, since this article is about AI, the remainder of it, with our guidance, will be written by AI 🙂

An explanation at the end of this article describes how AI was used to produce this post.

Enjoy!

Table of Contents

- What is AI in Accounting?

- Can AI Replace Accountants?

- Benefits of Artificial Intelligence

- How is AI Used in Accounting?

- How to Get Started With Accounting Intelligence

- How AI Was Used to Write This Article

What is AI in Accounting?

AI in accounting refers to the use of artificial intelligence (AI) technologies, such as machine learning algorithms and natural language processing, to automate and enhance various accounting processes.

This includes tasks such as financial reporting, audit and compliance, fraud detection, and data analysis.

AI in accounting can help improve accuracy and efficiency, reduce costs, and provide valuable insights and predictions for decision-making.

In fact, ChatGPT wrote the above description:

Can AI Replace Accountants?

Artificial intelligence (AI) can perform various tasks related to accounting, such as data entry, analysis, and report generation.

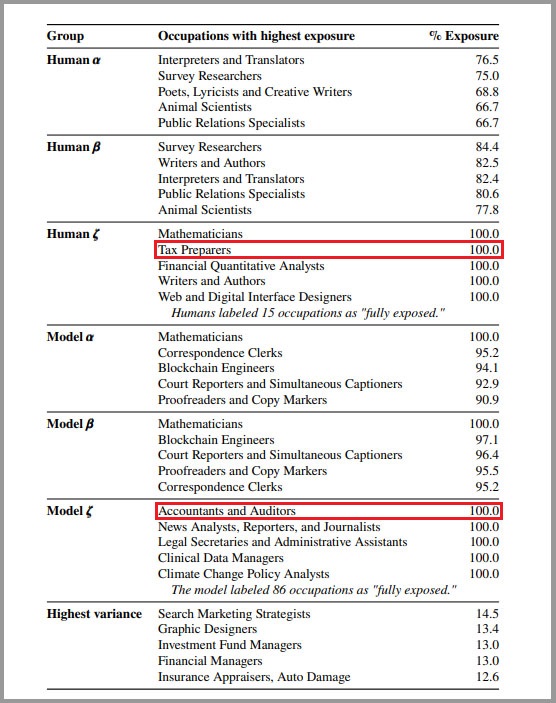

In fact, according to a recent study by OpenAI, maker of ChatGPT, occupations like accountants and tax preparers are some of the most exposed to AI:

Here’s a video of ChatGPT preparing a tax return:

Due to the changes AI is bringing to accounting, not only are roles beginning to shift, but we are also witnessing the emergence of entirely new business models.

Here’s chatCPA, a bot trained by CPAs that you can chat with for only $6/month:

That being said:

Advanced technologies like AI can assist and improve the work of accountants, but they cannot entirely replace them because of their inability to perform essential human skills such as judgment, communication, and critical thinking.

Therefore, CPAs are still essential for decision-making and complex accounting tasks that require human oversight and maintenance to ensure accuracy and ethical use.

Benefits of Artificial Intelligence

Let’s take a look at the benefits of Artificial Intelligence (AI) in accounting and our daily lives.

1) Increased Efficiency and Productivity

AI makes it easier to do repetitive accounting tasks, which frees up time for more important tasks. This makes workers more productive and efficient because they can focus on what they do best.

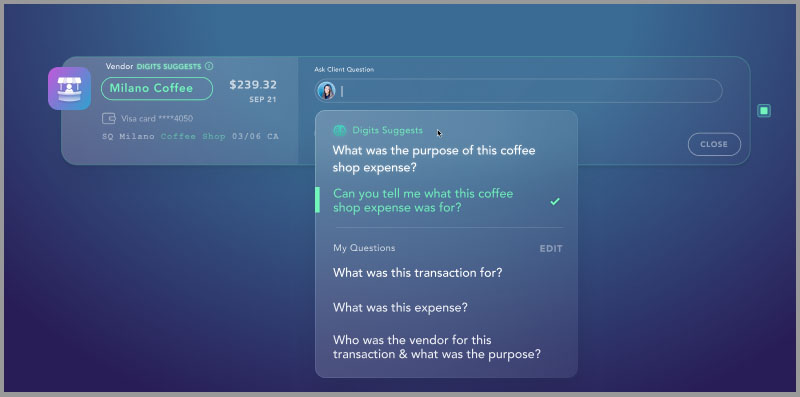

Here is an example from Digits, where AI can assist accountants in raising questions about client transactions:

This AI creates questions for accountants to send to clients or modify, saving them time and effort from retyping.

2) Automated Tasks and Reduced Human Error

The use of automated tasks in accounting and finance has the potential to improve the accuracy and efficiency of financial processes significantly.

The potential for human error is decreased when routine and repetitive processes are automated, which ultimately results in more reliable financial data and reporting.

3) Improved Customer Experience

Using ChatGPT to draft emails can save you time. Currently, my team and I are utilizing AI for customer support.

Here’s an example of a situation where I used AI to respond to an unhappy client:

Your team can also benefit from this technology, not just you as the owner.

In fact, at Future Firm, our team uses ChatGPT to improve customer service by enabling faster response times and providing more personalized attention through the use of AI.

4) Enhanced Data Analysis and Predictions

AI algorithms are capable of quick data analysis. This makes AI an effective tool for predicting and identifying trends.

AI helps individuals and businesses manage financial data efficiently by analyzing transactions, cash flow, budget, and accounting data to identify trends, errors, and areas of improvement.

5) Generate More Accounting Leads

One of the benefits of AI is that it can help you create content that can be used to boost your brand and generate more leads.

Here’s how ChatGPT suggests how you can use AI to bring in more clients:

ChatGPT not only wrote entire sections of this blog post, for demonstration purposes, but also made suggestions, saving time, and ensuring high-quality content with human input.

6) Cost Savings

AI’s process automation can save accounting firms time and money by automating routine tasks, freeing up workers to focus on strategic initiatives, and enabling businesses to increase productivity and profits while cutting expenses.

7) Creation of New Job Opportunities

One of the most significant ways that AI is creating new job opportunities is through the development and deployment of AI systems, cloud-based systems, or AI-powered tools.

As AI technology grows and the accounting industry discovers different accounting software can help hasten the repetitive tasks for accountants.

This can pave the way to new job opportunities and new learning in accounting operations and business processes as AI still needs human supervision and maintenance.

8) Improved Quality of Life Through Automation of Repetitive Tasks

Accounting software and a few applications can improve your quality of life as these finance tasks are automated, and data management, accounts payable, expense reports, or internal accounting processes can be less hassle with the use of AI.

AI can improve overall job satisfaction and enable people to have more fulfilling careers.

How is AI Used In Accounting?

AI is used in accounting to automate repetitive tasks, identify patterns in financial data, and provide insights to help businesses make better decisions.

Some specific use cases of AI in accounting include:

1) Invoice Processing and Reconciliation

Invoice processing and reconciliation are essential components of accounting and finance departments.

However, these tasks can be time-consuming and prone to errors, which can result in delayed payments, inaccurate financial reporting, and, ultimately, negative impacts on the company’s bottom line. That’s where AI comes in.

For instance, using Dext reduces the need for manual data entry:

By scanning documents in real-time and automatically collecting the relevant data, the app eliminates the need for manual accounting data entry and reduces the risk of human error.

2) Fraud Detection

AI-powered fraud detection systems are capable of analyzing large volumes of financial data to identify irregular patterns and anomalies that could indicate fraudulent activity or other financial irregularities.

Accountants can efficiently monitor financial transactions and improve the accuracy and efficiency of their auditing processes.

3) Predictive Financial Analysis

Having access to data is crucial for predicting financial outcomes, and AI excels at analyzing enormous quantities of financial data, providing real-time insights into a business’s financial health.

Futrli is a great example of AI-powered technology that demonstrates this capability.

Futrli’s machine learning identifies patterns, empowering firms to make informed decisions on risks and opportunities, as well as enhancing financial planning, risk management, and fraud detection.

Predictive analytics can be used to forecast cash flows, which is critical for businesses to manage their working capital and make investment decisions.

By analyzing historical data and market trends, AI can provide accurate predictions of cash inflows and outflows, enabling businesses to plan their financial strategies accordingly.

4) Budgeting and Forecasting

By budgeting and forecasting software, accounting firms can automate and streamline these processes, resulting in significant time and cost savings.

With its ability to analyze financial data, AI can help businesses develop accurate and reliable financial forecasts, which can be used to support strategic decision-making.

AI can also provide real-time insights into a company’s financial performance, enabling businesses to identify potential risks and opportunities early on.

5) Tax Compliance and Preparation

AI analyzes financial data to identify tax deductions and credits, saving time and helping firms minimize tax liability.

It also detects errors or omissions in tax filings to ensure compliance with regulations and maximize tax savings.

6) Bookkeeping and Data Entry

Bookkeeping and data entry are essential tasks for businesses to maintain accurate financial records.

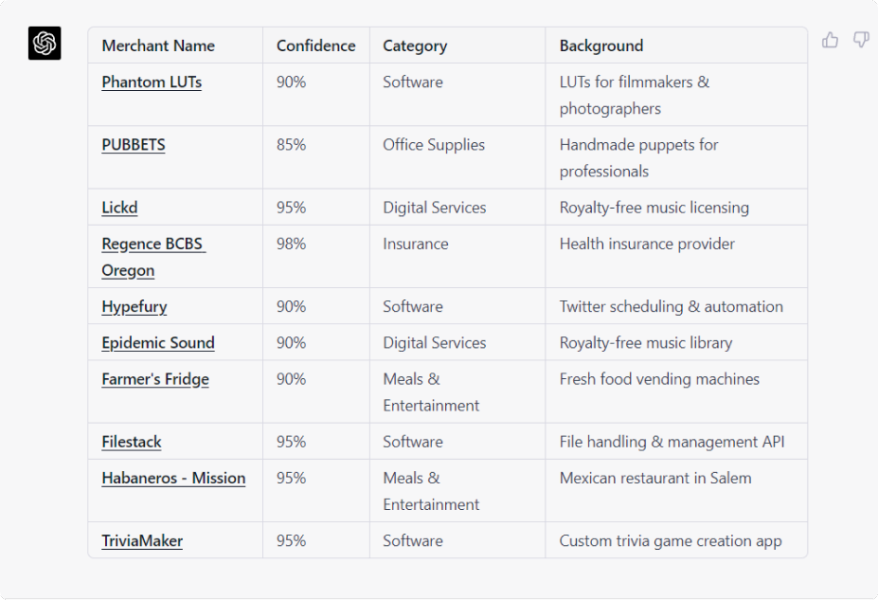

Here’s an example of Jason Staats feeding in uncategorized transactions into ChatGPT and it producing insights into those transactions with the click of a button:

While AI has the ability to classify accounting transactions through machine learning, it’s important to use it alongside human expertise.

7) Audit Support

AI-powered audit support tools can assist auditors and accountants in performing financial statements and record to ensure they are accurate and relevant to accountant standards.

AI can also help with document management, enabling auditors to easily locate and access relevant financial records and data.

This can significantly streamline the audit process, reducing the time and resources required to complete the audit.

How to Get Started With Accounting Intelligence

Accounting artificial intelligence (AI) has the potential to revolutionize the way businesses manage their finances. However, getting started with accounting AI can be a daunting task for many organizations.

Here are some steps businesses can take to get started with accounting AI:

1) Determine Tasks that Can Be Enhanced through AI

Start by identifying the accounting processes that can benefit from AI, such as data entry, invoice processing, and fraud detection. By prioritizing the most critical areas for improvement, businesses can maximize the benefits of accounting AI.

2) Choose the Right AI Technology

There are many different AI technologies available for accounting, including machine learning, natural language processing, and robotic process automation. Accounting firms should carefully evaluate each technology and choose the one that best meets their needs and budget.

3) Hire or Train Employees with AI Expertise

Everyone at Future Firm has been tasked to educate themselves and use ChatGPT at least once a week.

In this podcast blog, I explained how AI can be properly integrated into a firm’s operations and how it can increase business growth and competitiveness.

4) Start Small and Scale Up

Begin by implementing accounting AI in a small area of the business and gradually scale up as the technology is refined and employees become more familiar with its use. This approach will help businesses minimize risks and maximize the benefits of accounting AI.

5) Monitor and Evaluate the Performance

Regularly monitor and evaluate the performance of accounting AI to ensure that it is meeting the desired goals and objectives. This will help businesses identify areas for improvement and optimize the use of accounting AI.

How AI Was Used to Write This Article

While the outline of this article was produced by a human, some entire sections of this article were written by AI, purely for demonstration purposes to show you the capabilities of AI today and because we thought it was a neat idea to have AI write an article about AI 🙂

Some sections that were written by AI were edited by a human as well.

Take Advantage of Using AI in Your Firm

As technology advances, accountants and firm owners can now save time, streamline their workflows, and increase their accuracy by using AI-powered tools and software.

However, it’s important to note that AI is not a replacement for human expertise and judgment.

Accounting professionals will always be essential to provide valuable insights and analyses.

What are your thoughts on implementing AI in your firm?

Let me know in the comments below!