If you’re interested in automation in accounting firms, you came to the right place.

Below I’ll outline 11 tactics that I have personally used to take my cloud firm from scratch to sale in only 5 years.

But first…

Why Automate Your Firm?

There are a lot of ways to implement accounting automation. And the more you automate, the more time you’ll save.

For example, integrating robotic process automation or RPA will drastically reduce human input or manual processes required for updating financial data, spreadsheets, documents, and various applications.

This means that your margins will improve and that you can do more with less. Automation is one of the reasons why some firms are growing 3.32x faster than the rest according to a recent report by Xero.

In case you’re not aware, automation in modern accounting systems has been on an upward trend for quite some time and shows no signs of slowing down.

This technology harnesses artificial intelligence to streamline operational efficiency for accounting professionals for various processes, including manual data entry tasks for financial reports, accounts payable, invoices, payroll, and more, to save time.

But saving time also means that you and your team’s mental health can improve as well.

Running a firm is stressful. And with COVID-19 causing “unprecedented levels of anxiety” according to the Mental Health Index, stress levels are on the rise.

According to Xero, 42% of accounting professionals report not having enough time as their biggest barrier to their well-being.

So freeing up time will not only allow you to improve your margins, but also allow you to focus on your wellbeing.

Without further ado, let’s take a look at some tactics that can help!

Tactic 1 – Mandate Cloud Accounting Software For Your Clients

Make using cloud accounting software mandatory for every client you work with.

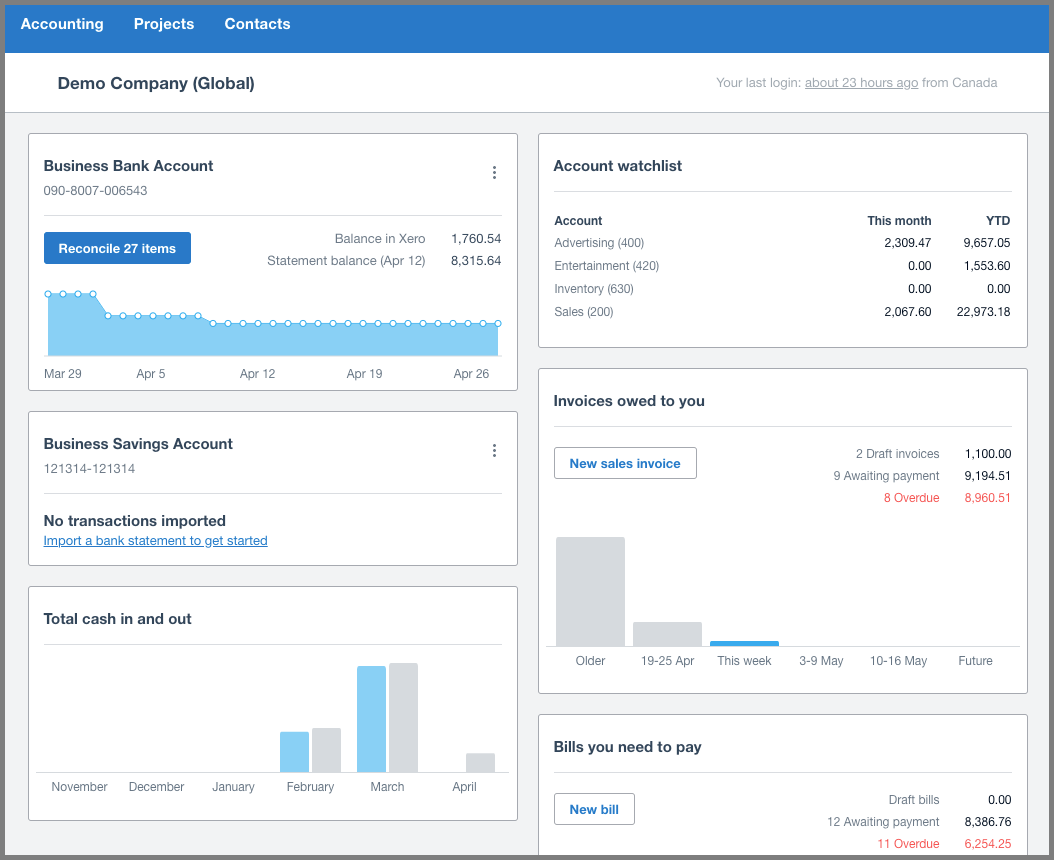

When I started my 100% virtual firm in 2013, I decided to go all-in on Xero to leverage things like:

- Bank feeds

- Automated reconciliations

- The app marketplace to automate all kinds of workflows

My firm would not be nearly as successful had it not been for cloud accounting software like Xero.

What helped is that I focused on one cloud accounting system, as opposed to many.

That allowed my firm to automate the day-to-day accounting needs of my clients. It also helped us become power-users of the system and model processes around it.

Cloud technology is one of the top accounting technologies to implement to leverage automation.

Tactic 2 – Streamline Your Business Model with Mandated Bookkeeping

One of the best moves I made early on with my firm was to institute mandatory bookkeeping for each client I worked with. It completely streamlined the operation.

Bookkeeping was not optional for clients.

Why?

Because I wanted tight control of the data. By doing so, I could predict and plan every other workflow and service offering in the firm. It all revolved around the bookkeeping data.

So if you provide tax work and advisory, but no bookkeeping to go along with it, you’re at the mercy of your client.

To leverage automation in accounting and to streamline your firm, take control of the bookkeeping process.

Tactic 3 – One Process for Everything

If you mandate cloud accounting software and if you mandate bookkeeping work, guess what?

You’re now able to set up one process for everything in your firm:

- One process to onboard a client

- One process to handle their month-end books

- One process to complete the year-end

- Etc.

Most firms have a gazillion processes for everything because they try to be everything to everyone.

If you’re in this category, you’ll never be able to automate.

Your accounting operations will be filled with repetitive tasks and manual processes that are prone to human error.

If you want to automate and save time, you need to standardize workflows and innovate bookkeeping.

And that can only happen when you have one way of doing things.

Tactic 4 – Remote-First to Leverage Automation in Accounting

Long before this whole COVID-19 situation hit, I mandated a remote-only approach to working with clients. Even if a client was 3 blocks away from my office at the time, the meeting would still need to be remote.

Kinda weird, I know.

But:

It’s far more efficient to hop on Zoom than to commute around, wait at someone else’s office, hook up to wifi, set up your computer, and make small talk. I’d wager it takes double the amount of time rather than just quickly connecting on Zoom and getting right down to business.

You might think your clients want to spend all day with you, but trust me, they don’t!

So even when COVID-19 passes, implement at least a remote-first way of working with your clients.

Tactic 5 – Advanced Automation in Accounting: Hire a Technology Lead

If you implement a bunch of the tactics above, you’ll be a much more technology-forward firm and well on your way to saving tons of time.

At a certain point though, you need someone to manage the technology, source & implement new automation solutions and train the team on it.

Integrating an automated accounting software system into your firm may require serious hours and focus to get it up and running.

Enter your firm’s Technology Lead.

When I was growing my firm, I found myself spending too much time on technology and not enough on sales.

And while I loved handling the tech aspect of things, it wasn’t where my time should have been spent.

So I hired someone to help oversee all things technology at the firm.

The only problem was, I shipped away some of the coolest aspects of my job.

In short, let your Technology Lead worry about your firm’s automated accounting system and other digital tools while you focus on strategic operations. 😉

Tactic 6 – Automate Candidate Screening

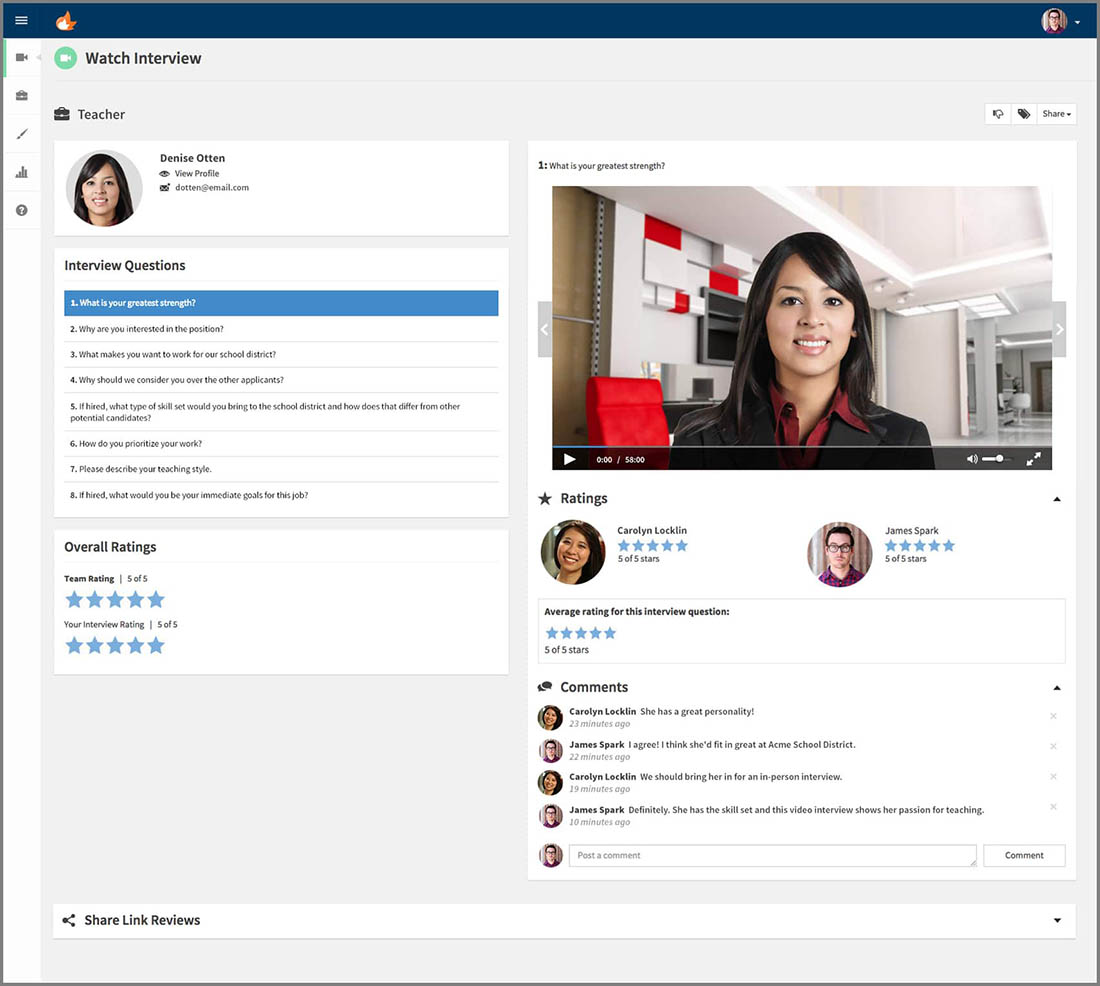

Since I advocate for an online firm model, I expect all those joining my team to be “online friendly”. One test that I would implement at the outset for new candidates was for them to complete something called a one-way video interview as part of the screening process.

Candidates applying to the firm would be asked to answer a series of pre-recorded questions using their webcam on their own time.

Once complete, you’d be able to watch their responses like this:

This software helped me automate the recruitment process and save countless hours in candidate screening.

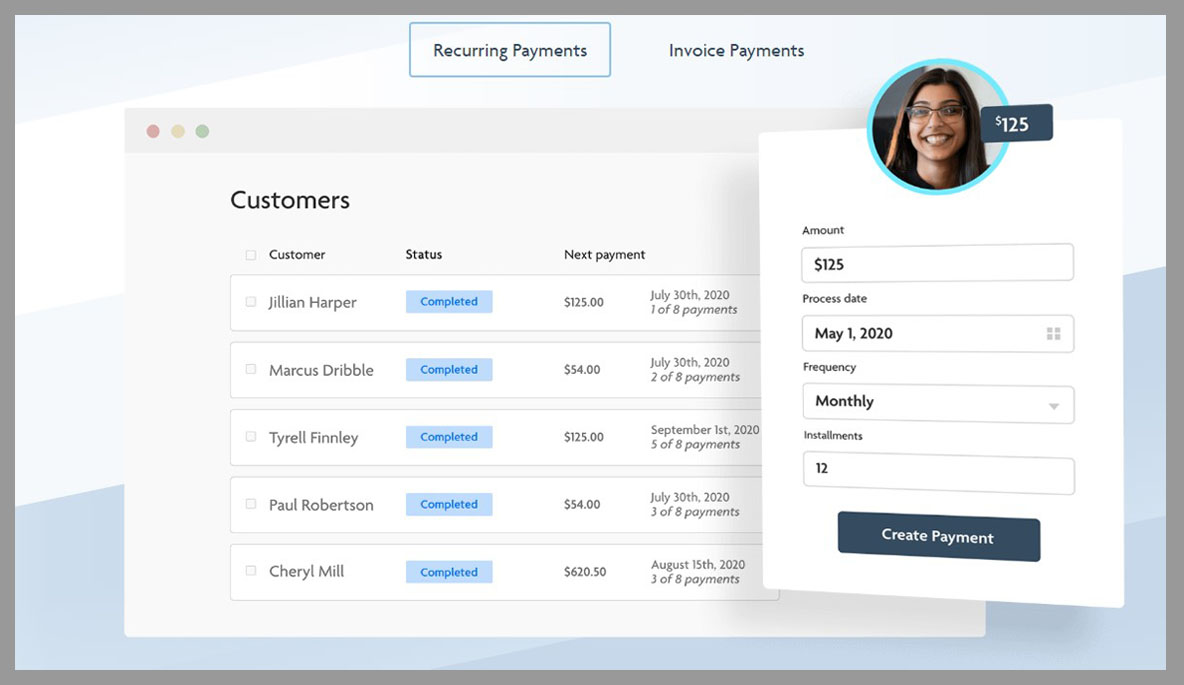

Tactic 7 – Subscription Clients Only. Ditch Once-Off Clients.

The idea is to get your firm running like a machine. That’s not possible if you have clients that only need work from you once a year. Scheduling once-a-year work with great certainty is unpredictable due to a variety of factors.

By putting all your clients on a subscription with monthly recurring work (remember, bookkeeping at the core of it all), you can have everything working in tandem, all on one process, all invoiced and billed monthly.

No more spending hours on invoicing, no more collections.

I would personally only accept one-off projects for non-subscription clients if:

- My firm had excess capacity at that point in time

- They were willing to pay an above-market price (I’d rather save capacity for new subscription clients)

- They paid in advance of work commencing

Only accepting subscription clients helped me automate and streamline my firm in more ways than one.

P.S. If you’re looking for a great book on subscription business models, check out this one:

For more books that I like for modern accounting firms, click here.

Tactic 8 – Automatic Payments to Help with Automation in Accounting Firms

Here’s a simple one. If you have all clients on a subscription, then you should be billing them automatically each month.

I prefer pre-authorized debits (PAD) versus credit cards in terms of fee savings so I instituted PAD for every single payment.

In Canada, I like apps like Rotessa, but there are other options like Practice Ignition, GoCardless (I actually use the Xero + GoCardless integration myself), and more.

Tactic 9 – Engage in Asynchronous Communication to Eliminate Meetings

Asynchronous communication is when two or more people are communicating with each other, though, not at the same time.

It’s a real time-saver but it can only be achieved through software.

My favorite software to accomplish this is called Loom.

Want to see what it looks like?

Here’s a short clip I recorded specially for you!

If you want to see concrete ways on how I used Loom in my firm, click here.

Tactic 10 – Implement Practice Management Software with Collaboration Features

In the accounting profession and other industries, practice management software is a must-have tool used for improving communication, productivity, and efficiency.

Practice management software allows you to track work and deadlines.

But really good practice management software allows you to efficiently collaborate with your team and clients to get work done more quickly.

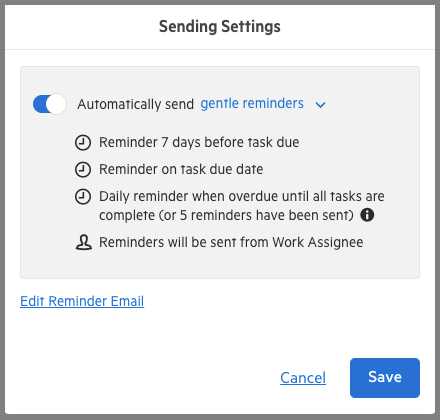

As an example, Karbon allows you to assign tasks to your clients (ex: send me your May 2020 bank statement) and then automatically follow up with the client based on a pre-defined frequency until they complete the task, like this:

The above is an excellent example of utilizing automation and collaboration to help you save time.

But you also want to make sure the app allows you to collaborate with your colleagues. Things like commenting on tasks, adding notes, and adding files to projects are just some of the basic requirements that a practice management system should be able to handle to automate work getting done.

Tactic 11 – Advanced Automation in Accounting: Zapier

If you haven’t used Zapier yet, you’re really missing out.

I would call it the glue between different pieces of software and using this app will certainly improve automation in accounting firms.

An accounting automation software system is designed with multiple functionalities. However, you’re not maximizing its features unless it’s integrated with other tools.

Chances are, you have a ton of tiny tasks that are repetitive. They might not take you a lot of time to complete, but add them up over the course of a year and you’d be surprised.

In my firm, I had a ton of zaps running, which helped my team and I automate all kinds of little annoying tasks.

The key is to identify those tiny repetitive tasks and to automate them.

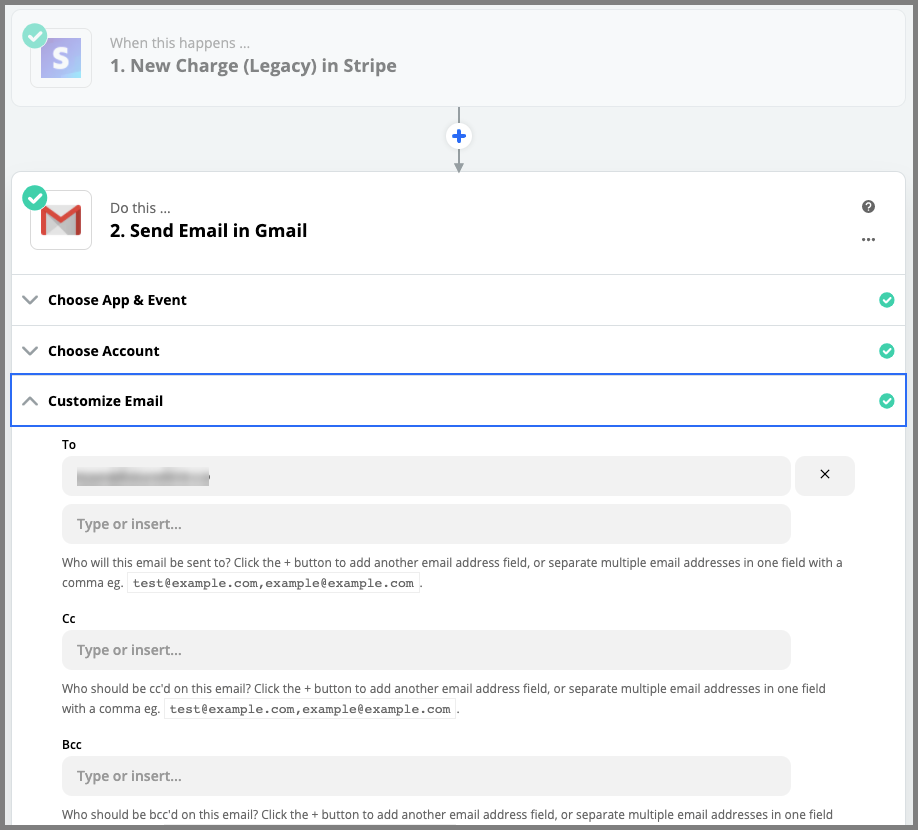

For instance, I need to know when someone pays me using Stripe because that will kick-off a certain workflow.

I could manually check on a daily basis, on I could set up a “zap” using Zapier.

I’d connect Zapier to Gmail and configure it so that every time I’m paid with Stripe, Zapier would send me an email.

Here’s an example of part of this “zap”:

Automation in Accounting Firms: Over to You

Remember, increasing automation in your firm will not only help your margins improve and help you grow faster. It will also lead to the improved mental health of you and your team.

Hopefully the above gives you some tactics to get you one step closer to becoming an automated machine by using automation in accounting.

My biggest piece of advice for automation and streamlining your firm is to create a standardized model. That means being picky about the clients you accept, the services you offer, and the technology you put them on to get you one step closer to getting your entire firm running like a machine.

Are there any other tactics that I’m forgetting?

Which tactic will you implement first?

Which one do you like best?

Comment below to let me know!

Thanks Ryan .. Awesome content as always .. Curious – what tool did you use for 1-way video interview?

Sparkhire!

Really good read, appreciate it Ryan

Glad you liked it Samuel. Hope you’re well!

Thanks for the content. I just get concerned with the bank feeds – are clients who use this effectively breaching their contract with their bank for sharing their username/pwd with someone else? Who is liable if there is a breach??

I guess it’s as secure as online banking. If you can bank online, you can surely do your accounting online. Whenever you sign up for any software that uses bank feeds, you can read about how the vendor treats security at their company.