We’re in a bit of a weird time right now. We are seeing a lot of people, including myself, talking about the impact of blockchain on accountants & auditors and many are dissecting the technology from an extremely technical standpoint. Nobody questions the technology behind email & the internet for instance. We know that the use-case of this technology is to be able to disseminate information quickly and easily and we accept that. With blockchain however, we have found ourselves having to explain extremely complex technology to non-technical people (including myself!) and I’m not sure why that is in this instance.

In any event, let’s put this to bed. Blockchain is a proven technology to automatically record transactions, correctly & accurately. Whatever is recorded on a blockchain is permanent and cannot be changed. It is the ultimate audit trail. There is no debating this whatsoever. Its use-case, is to record and verify data. This is proven. And because of this, it has use-cases in the world of accounting, bookkeeping and auditing.

In Part 1 of my two part blog series on the impact of blockchain on accountants, auditors and bookkeepers, I examined the impact of blockchain on bookkeepers and discussed when we might see some disruption. I argued that blockchain could essentially help with the reconciliation process and help automate some of the functions that bookkeepers currently handle at the moment. This is the “record” part of blockchain’s use-case.

In this post, I want to talk about what generally follows the bookkeeping process, which is the verification of financial statements by auditors. This is the “verify” part of blockchain’s use-case and where I believe we can feel the impact of blockchain on accountants and auditors.

Purpose of Accountants and Auditors

For us to understand the impact of blockchain on accountants & auditors, we must understand the role of an auditor. An auditor’s job is to essentially take a company’s financial statements and tell the public (or third party) whether the financial statements are properly stated or if they are misstated. In order to do so, an auditor must perform a series of tests and procedures on the data within those financial statements. Since parties outside the company rely on the accuracy of a company’s financial statements for different business purposes, an auditor’s importance cannot be understated.

If you have ever undergone an audit, you will know that it’s a rather unpleasant experience. A lot of what it entails is really just verifying what you have done and ensuring its correctness. It involves auditors asking you for proof of transactions, asking to see whether the transaction really occurred during the period it was recorded, looking to see whether you may have skewed the books in any, way, shape or form and essentially, verifying whether the transactions occurred in the manner that you recorded them in your accounting system.

Due to blockchain’s use-case of being able to verify data, this is where the technology can replace a good chunk of what auditors do today. To be clear, I am not saying that blockchain will completely replace auditors (not anytime soon that is), but it will certainly shift the way in how their work is done.

The Impact of Blockchain on Accountants & Auditors

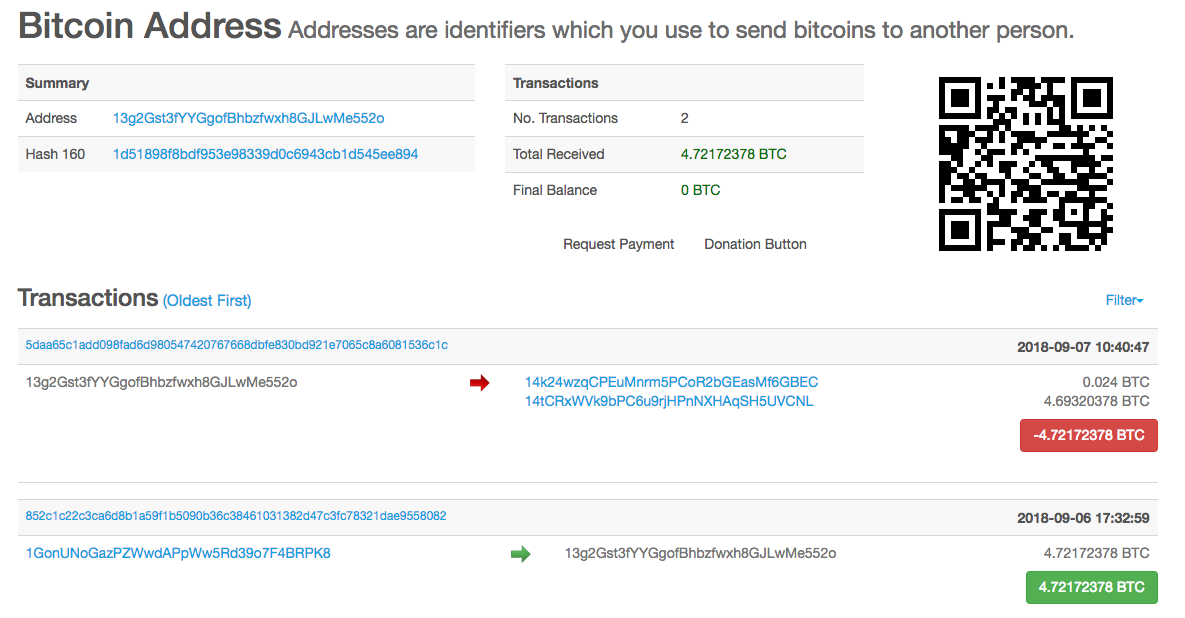

As I mentioned in my intro paragraph, blockchain is the ultimate audit trail to see how things have been recorded on the ledger and when. Let’s prove it. In my Part 1 discussion of the impact of blockchain on bookkeeping, I posted an image of the following bitcoin address:

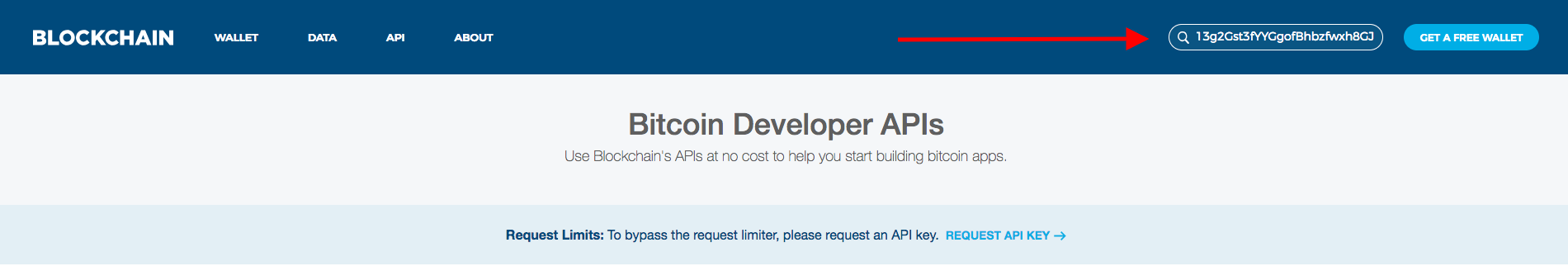

Go to blockchain.info right now (a site where you can search the main bitcoin blockchain) and enter the following bitcoin address in the search box in the top right hand corner of your screen: 13g2Gst3fYYGgofBhbzfwxh8GJLwMe552o

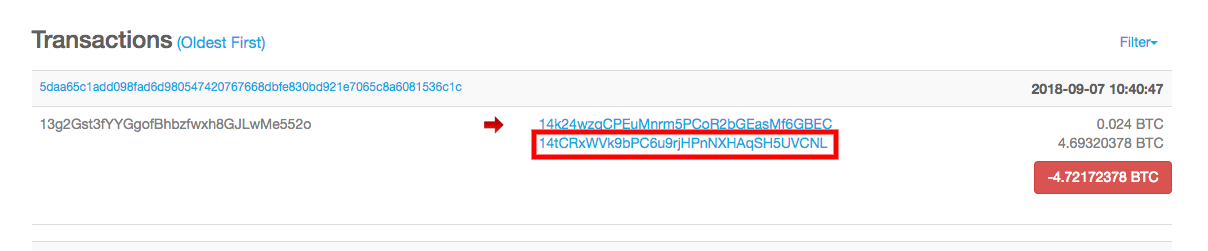

That will bring you to the first image in this paragraph. From there, we can literally go down the rabbit hole to track where all these transactions came from and went to. You can see that the address we are searching received 4.72 bitcoins on Sep. 6 and then the next day, these transactions were sent elsewhere, with the chunk of them (4.69 bitcoins) being sent to the following address: 14tCRxWVk9bPC6u9rjHPnNXHAqSH5UVCNL

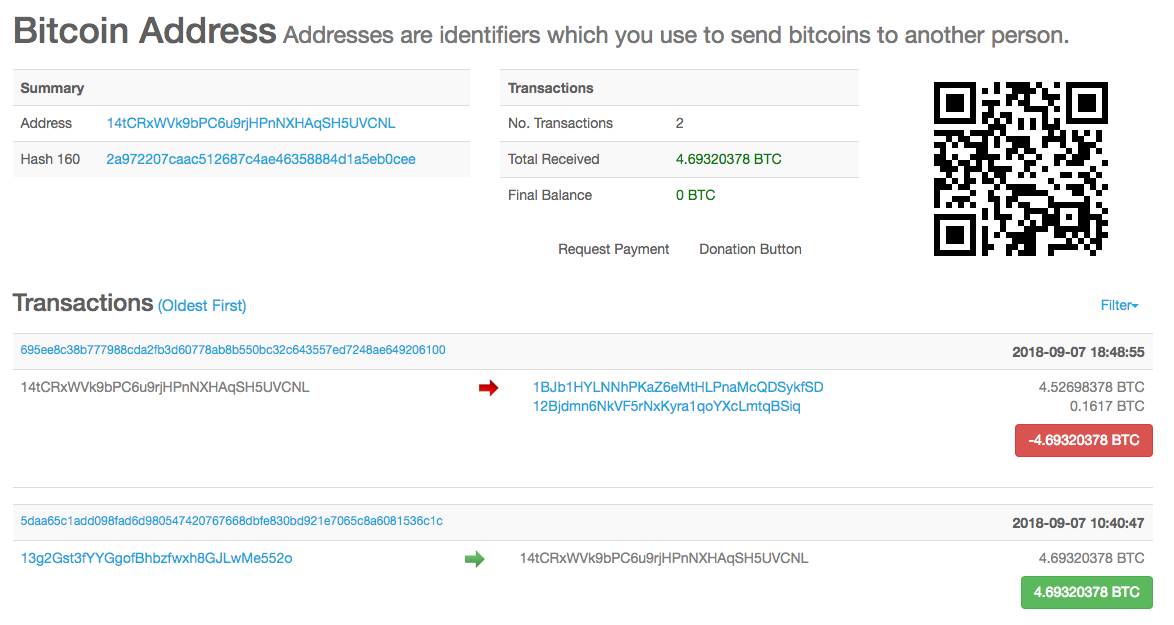

Click on that one. That will bring us to a new address:

We can literally perform this exercise for hours and track everything to see where things are going and being a bit of a geek myself, I have to admit this is actually kinda fun. Now, keep in mind we don’t know who owns those addresses (though in online forums, large transactions are tracked, debated and sometimes even solved for who they may belong to, which goes to show the level of transparency that can be provided on public blockchains), but once that part is verified (an area where auditors can clearly play a role), an auditor no longer needs to question the accuracy of transactions and when those transactions occurred. An auditor would use the blockchain as the source of truth during the audit. It’s all there in clear view.

The impact of blockchain on accountants and auditors will mean that most of the current non-value added work will be eliminated. Collecting records, inspecting when certain transactions happened, determining whether things were recorded accurately in the books, verifying certain IT controls (since we know how a blockchain operates)…. this kind of work will be eliminated. But auditors will need to have knowledge of how to inspect things on the blockchain and to apply accounting principals to determine whether the books are prepared in accordance with proper accounting standards. Here are just a few areas that auditors will be able to assist in:

- Verifying who’s blockchain address is who’s

- Ensuring that historical purchases of assets are fairly valued (ex: we will be able to see the initial cost of the asset from 3 years ago, but should this be written down for whatever reason?)

- Determining any deferred revenues (ex: we will see a sale on the blockchain, but have the revenue recognition requirements been satisfied?)

So once again, we see a re-shaping of roles due to technology. Going through the nitty gritty details in the way auditors have done to conduct audits for the past few decades will slowly fade as more trust is put into this powerful technology and instead, auditors will be able to focus on applying knowledge to ensure proper presentation of the financial statements rather than dealing with low value menial tasks.

When Blockchain Will Impact Accountants & Auditors

Five years ago I had a conversation with a then-CEO of a large, well known blockchain startup where he basically said, “your job as an accountant will not exist in a few years.” I believed him. Well, I’m still here and so is the firm I founded, but I do believe we are heading in a direction where a large part of what accountants and auditors do will be disrupted, but it won’t be tomorrow. It will be a few years still. Much of what I write about in my post about blockchain impacting bookkeepers from a timing perspective applies to accountants and auditors as well.

The bottom line is that we need a large chunk of transactions and financial data flowing through blockchain-enabled software for the impact of blockchain on accountants & auditors to be felt. We may still be 5 years away from that. If, for instance, only 5% of a company’s transactions are hitting the blockchain, then accountants and auditors will need to handle their work in the same way they are handling it now.

Catch me speaking at NYU on the subject of blockchain and accounting at a Roundtable on Oct. 29, 2018. For more discussions on the topic of blockchain and other disruptive technologies affecting the accounting more, please subscribe to my newsletter.

Great post!