If you’re looking to help your clients with A/R automation strategies to get cash into their bank account faster, you’re in the right place. In this post, I’m going to detail a recommended step-by-step process for how you can offer an accounts receivable service using Invoice Sherpa to easily turn overdue invoices into cash.

Let’s go!

The Basics of Automating AR

The typical sales cycle for many businesses looks like the following:

- Create a sales invoice

- Send it to your client

- Wait for your client to pay you

- If they don’t pay you, follow up periodically by email or phone

Step 4 has typically been manual, tedious and time-consuming if you’re looking at an effective collections process.

How do I know?

Because I used to work in A/R collections many years back.

And let me tell you, it’s not fun stuff!

But I learned a few things:

- There’s a direct correlation with persistent reminders and getting paid faster

- A tailored reminder message to different kinds of clients (rather than one generic message sent to all) improve your chances of getting paid faster

- Handling #1 & #2 takes a lot of time

Because of the time that effective collections can take, it’s often neglected, resulting in cash hitting your bank account later rather than earlier.

What is Invoice Sherpa?

Invoice Sherpa is an accounts receivable automation app that connects with QuickBooks Online & Xero to pull in outstanding invoices and to automate the collection of receivables in order to provide revenue accounting automation. It does this by automatically sending out tailored reminder messages with payment options to those with overdue invoices.

Above I mentioned that effective collections rely on persistent reminders and tailored messages to those with overdue invoices, which is what Invoice Sherpa helps automate.

Requirements to Automate this Process

Before getting started, make sure you have:

- Cloud accounting software like Xero or QuickBooks Online (and check here for 147 of my favorite cloud accounting apps)

- Clients with accounts receivable

- Books that are up to date regularly (ideally weekly bookkeeping)

- Software like Invoice Sherpa that can automate accounts receivable collections

Why I Like A/R Services

Here are a few quick reasons:

- It differentiates your firm (very few offer it)

- It increases client stickiness (the more services you offer, the more sticky the relationship)

- It provides tremendous value to your clients by helping them improve their cash position

- It’s an easy client accounting service to offer with the right tools & process

My Recommended Process

Let’s look at the steps involved to offer the service:

Step 1 – Connect Xero or QuickBooks Online to Invoice Sherpa

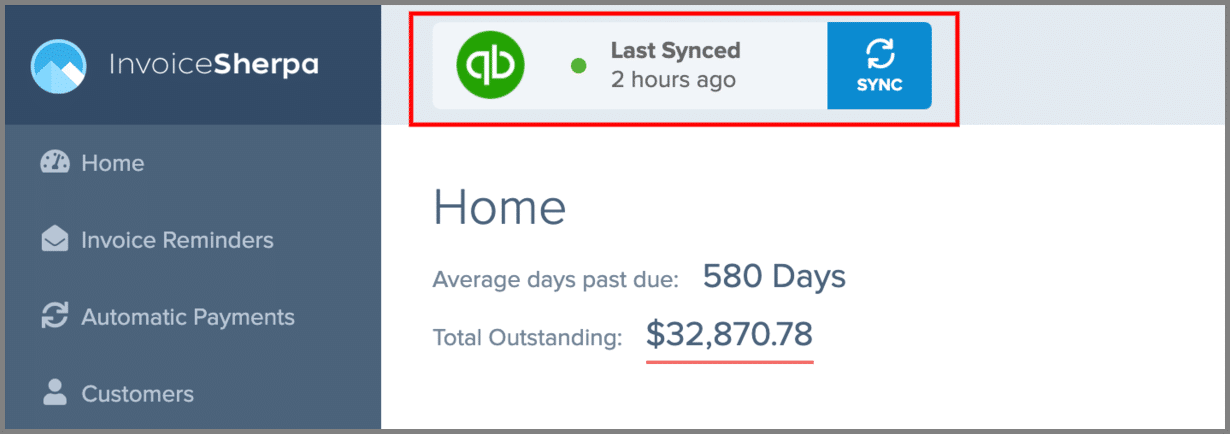

You’ll first want to integrate your cloud accounting software to Invoice Sherpa so that overdue invoices and customers are synced across.

In Xero, you’ll head to:

- Settings

- Connected Apps

- Search for Invoice Sherpa and add the app

In QuickBooks Online, just head over to the Invoice Sherpa sign-in page and login via your Intuit account.

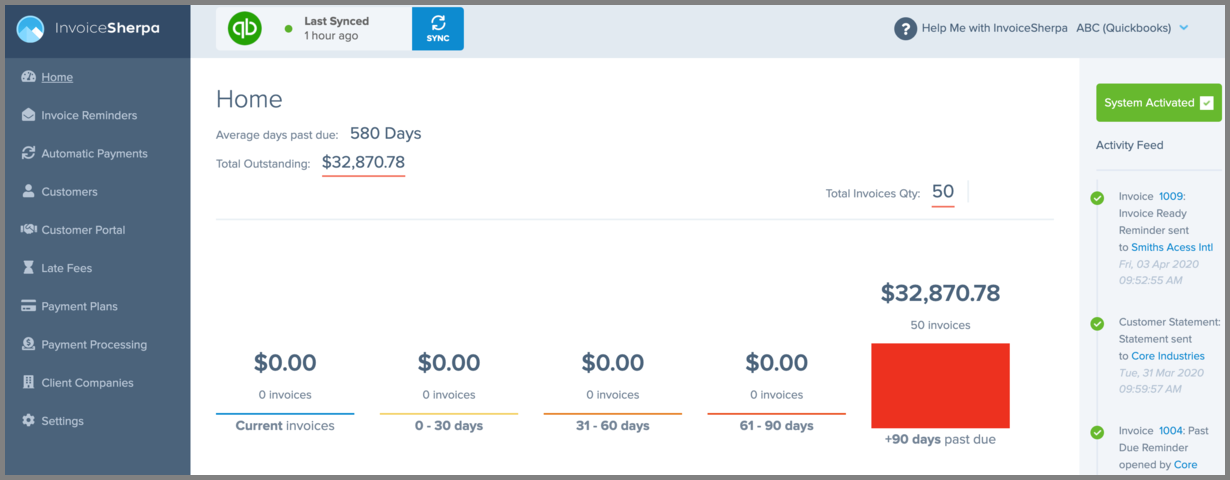

Once connected, you’ll see the last time the sync has taken place within Invoice Sherpa:

Step 2 – Setup Invoice Reminder Templates in Invoice Sherpa

The cornerstone of this kind of automation software is to automate sending tailored, persistent reminders until the invoice is paid.

So before you can offer the service, you need to setup your reminder templates where you are setting up the kind of reminder messages delinquent customers will get and when they’ll get them.

You’ll also need a few different templates because not all customers should be treated the same way. To keep things simple, you can segregate your customers into 3 buckets:

- Customers that always have overdue invoices

- Customers that rarely have overdue invoices

- Customers that never have overdue invoices

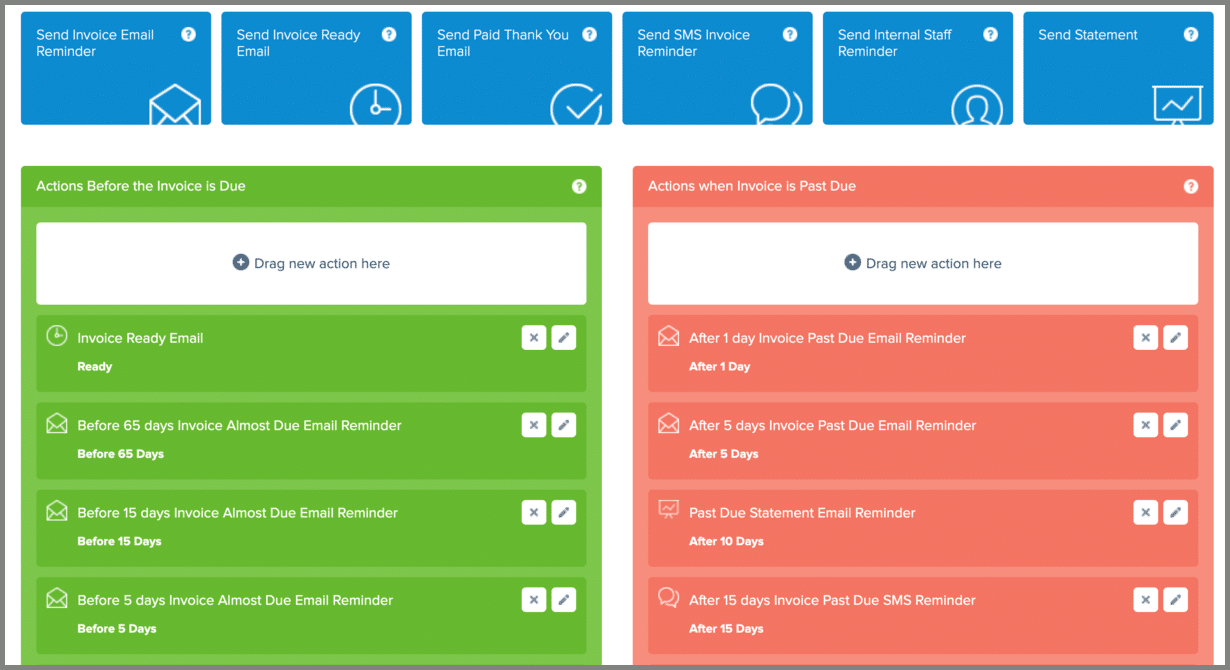

Here’s an example of a reminder template that’s being setup in Invoice Sherpa:

You can see that there are numerous automated actions here. Some worth mentioning are these reminders:

- 15 days before invoice is due

- 5 days before invoices is due

- 1 day after invoice past due

- 5 days after invoice past due

- Etc.

Reminders can be sent via email or SMS.

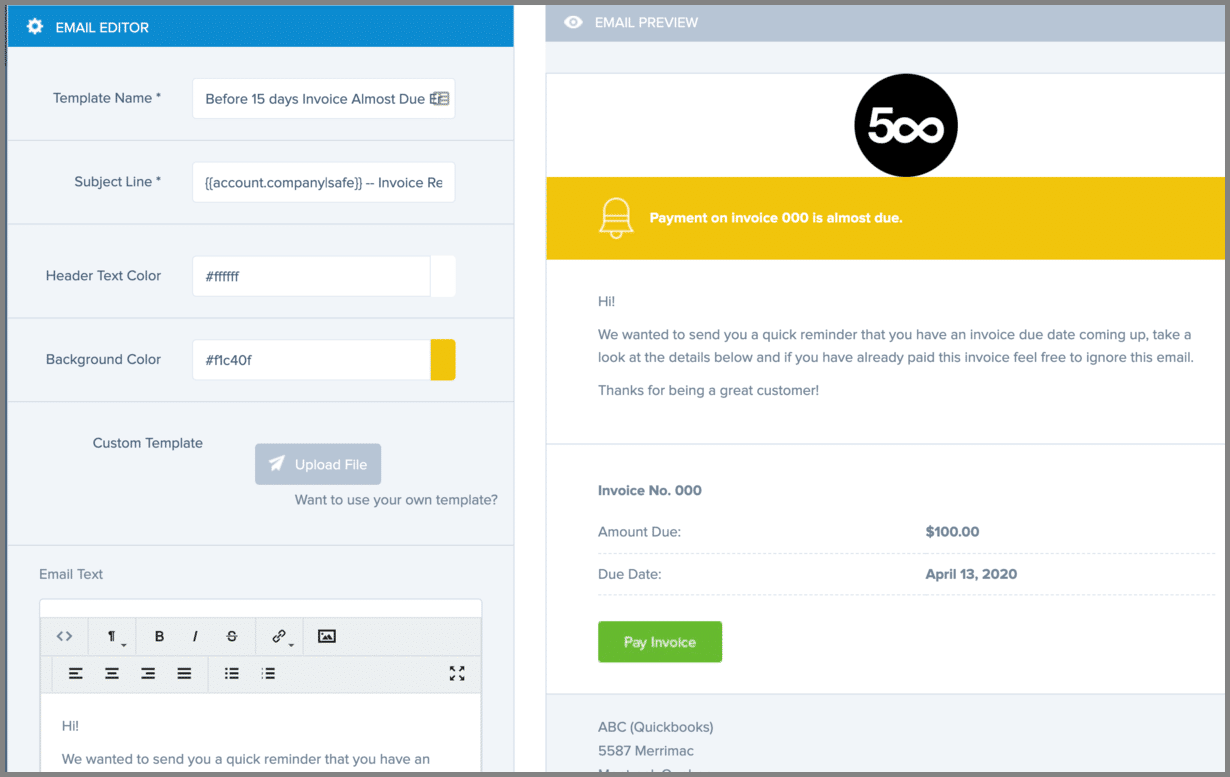

If you click into each of the reminders, you can also adjust the look, feel and message:

Here you’ll likely need to work with your customer to identify the different customer groups. It’s possible to setup a few simple buckets and for larger clients you may want a template dedicated to each one.

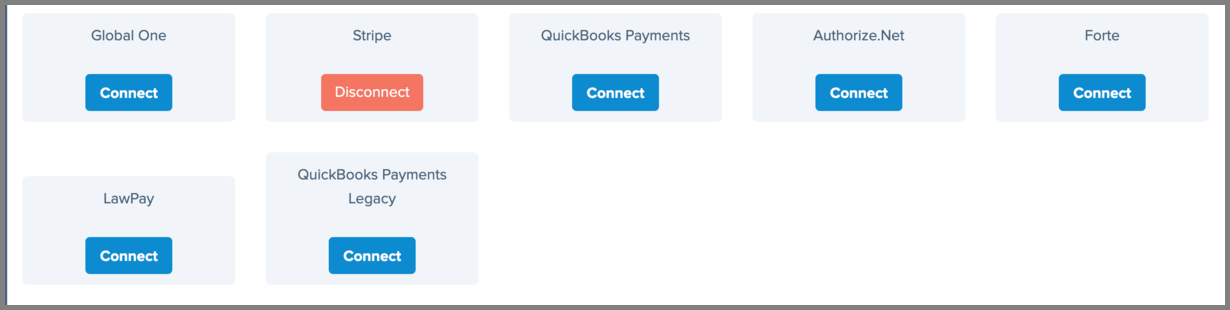

Step 3 – Connect a Payment Gateway in Invoice Sherpa

Head on over to Invoice Sherpa’s settings and connect your client’s payment gateway so that their customers can click on the “pay invoice” button once they receive the automated invoice reminders.

Step 4 – Assign Imported Customers to a Template in Invoice Sherpa

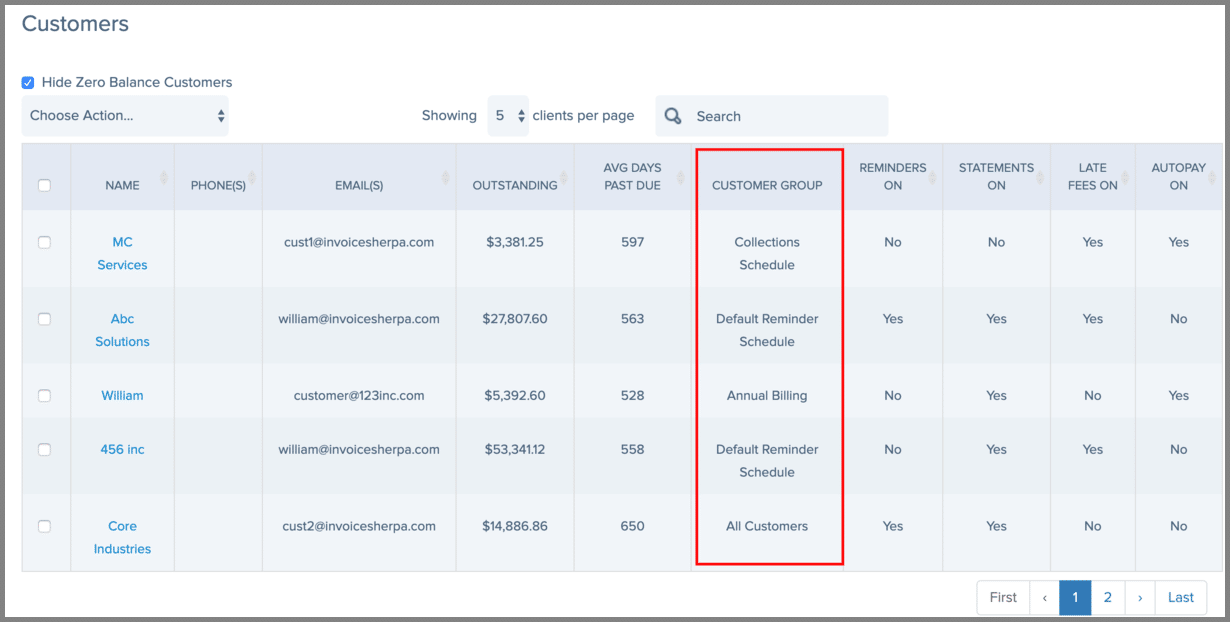

Head on over to the “customers” tab and assign each of the imported customers from Xero/QBO to a template that you created in Step 2:

Here you can shoot over a spreadsheet to your client with all their customers for them to populate to ensure you’re allocating their customers to the right template.

Step 5 – Update Your Client’s Books

You can’t offer these kinds of automation in accounting services unless books are up to date.

Here, I’d recommend a weekly bookkeeping service where books are reconciled weekly. You can’t have an app like Invoice Sherpa sending automated reminders weekly if payments and the bank are only reconciled monthly. That would potentially result in customers receiving invoice payment reminders although the payments have already been sent.

If you only provide a monthly bookkeeping service, then you’ll only be able to provide monthly email reminders through Invoice Sherpa (and your templates in Step 2 will need to reflect this).

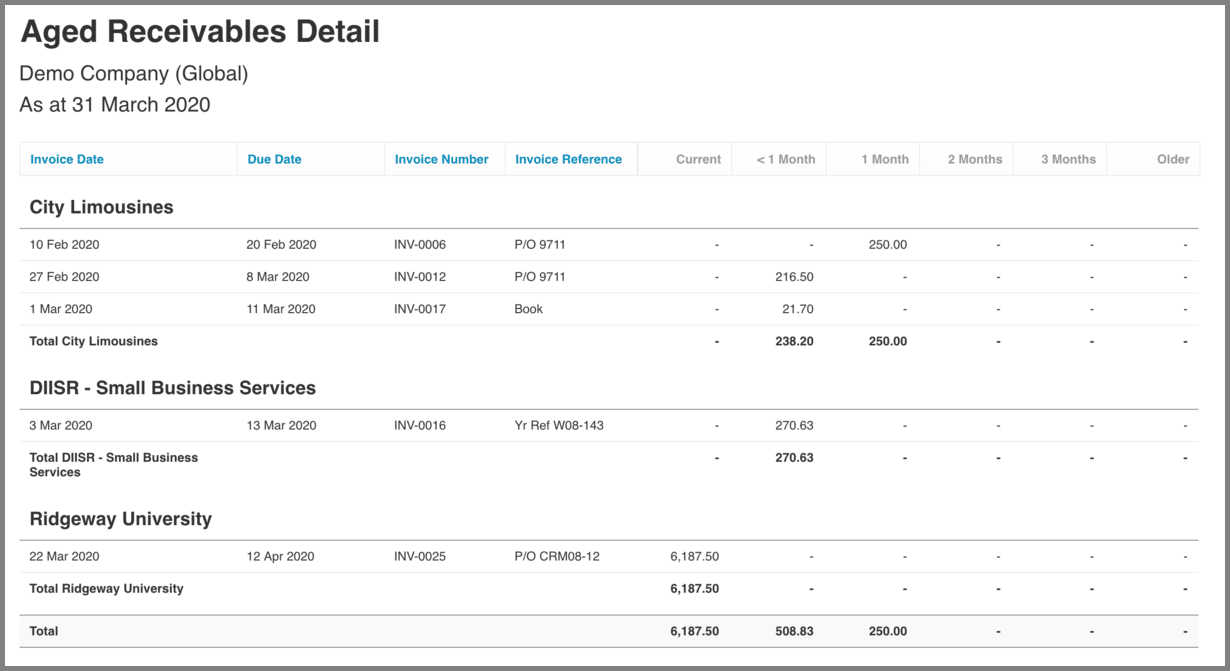

Step 6 – Send an Outstanding Invoices Report to Your Client

If you have invoice reminders automations set to run every Wednesday (for example), then I suggest sending an aged A/R report over to your client before Wednesday hits for them to approve.

For example, let’s say your client has a check sitting on their desk that they haven’t cashed yet, you want to make sure that invoice reminder automations will only run on valid outstanding invoices.

Step 7 – Invoice Reminders Are Automatically Sent Out Via Invoice Sherpa

Nothing to do here! The automations will run according to the templates you set up 🙂

Step 8 – Reconcile the Books 1-3 Days After Step 7

Nothing fancy here. We simply want to account for any payments received thanks to the automated reminders.

Step 9 – Send Client an A/R Collections Report

Again, no need to be fancy here, but I recommend formalizing the offering by sending off an updated A/R report to show the results of your collection efforts.

Step 10 – Rinse and Repeat Steps 4 – 9 Every Collection Period

What I like most about this kind of service offering (and is currently one of my 3 recommended services to offer) is that it allows you to offer a pretty repetitive (therefore scalable) service offering. It’s really a rinse and repeat process once the setup is done.

I’d recommend going back to Step 4 every collection period to capture new customers imported into Invoice Sherpa to make sure they’re assigned to a template.

Is This the Only Way to Offer A/R Automation?

Absolutely not.

There are other apps you can use and other ways to modify the service offering. Heck, you can even include premium phone collection services on top of it all. What I’m outlining above seems to be the very basics of rolling out this service using Invoice Sherpa.

When it comes to pricing out the service, I recommend a fixed monthly price. You can read my guide on setting prices in your firm if you have questions.

Most firms aren’t providing this kind of service and with cash being so incredibly important these days, I think it’s a worthwhile service to provide to your clients.

Thank you, Ryan

It was a very useful suggestion.

Outstanding invoices and maintaining accounts receivable is becoming hectic now a days, so obviously we need a better n easy way of handling this & it’s very helpful.

Glad you liked it!