If you’re a CPA firm looking to outsource your bookkeeping, you’ll want to check out this post on the 7 different options for outsourced bookkeeping for CPAs.

In this article, I’ll run through some of the more modern options that might make the most sense for your firm at the moment.

Check it out:

Outsourced Bookkeeping for CPAs Terminology

Before continuing, there are 3 terms that I want to briefly define which will have an impact on the option you select.

Each has their own pros & cons.

Offshoring:

Here you are moving business processes and your in house accounting team to another country, typically one with a lower labor cost structure. What makes offshoring unique is that you essentially maintain full control over the financial data processing, which might be interesting if you’re providing client accounting services. When you offshore, you are hiring someone else in another country and they become your “employee”.

Instead of hiring a bookkeeper in Canada or the US, you might instead offshore the entire accounting department to the Philippines.

Outsourcing:

This is when you engage the services of a third-party organization to manage the financial data for you. You place your trust in this organization to manage the accounting data in the way in which they deem appropriate, with the task being accomplished by those whom they consider fit to do so. Outsourcing doesn’t necessarily need to take place in another country.

Here, bookkeeping functions are transferred to an organization and they divvy up the work the way they want to internally.

Onshoring:

Onshoring is the process of reassigning an accounting department duty to another city or area within the same country. Those that do not want to deal with linguistic and cultural difficulties, as well as foreign policies, frequently use freelancers or outsourced teams from inside their own country.

Options for Outsourced Bookkeeping for CPAs

TOA Global

TOA Global is one of the leaders in the accounting “outsourcing” (in quotes, because technically they offshore) world and they are quite popular with a lot of virtual firms. In fact, you often see them at conferences like Xerocon and QuickBooks Connect.

As their website states, they have almost 1,600 people on their dedicated team, deal with over 500 accounting firms, and have 9 different offices.

The work is performed in the Philippines, but they also have offices in the US and just recently in Canada.

You get to choose who you want from the available pool of talent when you offshore, and you can then train them on your accounting system’s unique financial information procedures.

What I like is that they are up to speed with a lot of the modern accounting software options out there, so if you’re a cloud accounting firm, this might be a good option.

Also, they can handle more than just outsourced bookkeeping for CPAs. They can also handle other aspects of the accounting cycle if you need. Just keep in mind that you might need to train them on some of your tax laws depending on where you’re located.

You may also utilize TOA Global to hire experts who’ll work on tasks related to financial statements, which could provide timely and accurate insights into your clients’ financial performance.

As you are hiring someone offshore, you’ll certainly pay less than what you would onshore, though TOA Global is also not the cheapest option out of the ones on this list.

Botkeeper

Botkeeper is a newer upstart based in the US and is part of the new accounting tech startups that I’ve often written about.

Their bookkeeping team is located in the Philippines though I’d say the model more resembles outsourcing rather than offshoring.

Botkeeper manages the financial records with the help of a financial software such as Xero or QuickBooks Online.

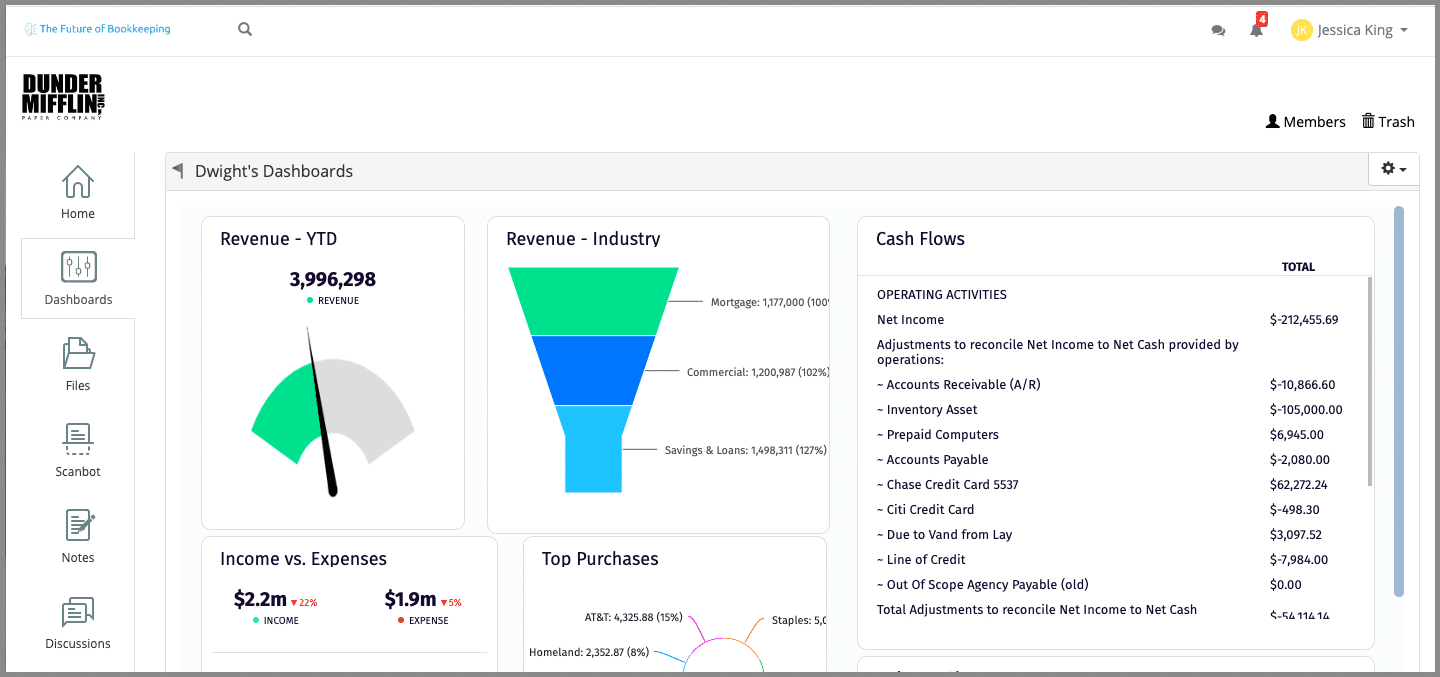

What’s interesting about Botkeeper is that they don’t just provide your CPA firm with outsourced bookkeeping assistance, but an entire software platform (pictured below) to go along with it. The platform has features that allow you and your accounting firm to automate the bookkeeping process via the use of cloud based accounting software, to track the work and to collaborate with the Botkeeper team.

The other interesting thing is that you don’t have to worry about Botkeeper starting to offer other services down the road, thereby encroaching in the work that your firm does. They are firmly centered around helping you get rid of the bookkeeping work that you don’t want to do.

They’re mainly focused on the US.

I had the chance to interview Botkeeeper’s CEO and I wrote up a pretty extensive article on how their service works.

Bench

Bench is another accounting tech startup that offers outsourced bookkeeping and tax preparation services to businesses. Based in Canada, but only exclusively servicing small businesses and firms in the US.

One of the big differences between Bench and some of the others is that they use their proprietary bookkeeping software to handle the books. So if you’re looking for outsourced bookkeeping to be handled on Xero or QBO, you’ll want to look elsewhere.

You’ll notice on their website that they have an accountants partnership program, which to me, tends to feel like it’s geared towards smaller tax shops:

Based on what I know about Bench (mostly cash-basis accounting, focusing on smaller businesses and some pretty basic reporting), I would wager that’s the case.

That being said, their accounting services cost is competitive, making them a worthwhile consideration.

Their partnership model takes 2 approaches:

- A referral arrangement where they can work directly with your clients

- A white-label solution where they can work on the back-end and you can handle the client relationship

Overall, I believe Bench is a platform you can rely on to get streamlined solutions for bookkeeping and accounting processes.

Paro

Paro is a bit different than the other options listed here.

They are an online network of accountants, bookkeepers, and tax experts that your modern accounting firm may use to acquire expertise on-demand.

Everyone is based in the US, so it’s certainly more in line with onshoring.

And while they can help with long term staffing needs for your accounting firm, they also have a large focus on helping you with your interim financial reports needs if you’re in a jam.

Like Uber, they act a bit like a match-making service where they help you fill a talent gap on-demand using their available pool of talent.

After a brief consultation call, Paro will match-make your financial services needs to an expert from their accounting services platform.

Following that, you’ll get a price and a scope of work for the help you’re looking for.

Once you approve the quote, the selected expert will be onboarded onto your team. They will work closely with you to seamlessly integrate into your existing bookkeeping processes.

Paro will also provide tools and technologies to facilitate collaboration and communication for its outsourced bookkeeping services, ensuring efficient and effective workflows.

Upwork

When considering hiring staff for outsourced bookkeeping and other crucial processes, Upwork often emerges as a popular recommendation. That being said:

Approach with caution.

While you can get some really cheap outsourced bookkeeping for CPAs with Upwork, I’ve never seen anything good come out of it. In fact, I’ve seen many disasters!

Upwork is a freelancing marketplace where you can locate and hire freelancers, such as bookkeepers, to help you manage your company’s accounts payable and accounts receivable processes.

I’m not saying there are no good bookkeeping freelancers on the platform. But you generally get what you pay for.

QuickBooks Live

Here’s an interesting option for firms that might be heavy in the QuickBooks ecosystem.

QuickBooks Live is a pretty new experiment by Intuit which I covered in my wrap-up of the last QuickBooks Connect conference.

It’s slightly controversial as the software provider is now getting into the services game as well. But at the same time, it also gives another option for outsourced bookkeeping for CPAs.

To be clear, QB Live is targeting small businesses, not firms.

From a consumer standpoint, it works just like Uber. You connect to their platform, answer a few questions and they connect you with a live bookkeeper to help out with the bookkeeping.

Nothing is advertised online about how they can help firms, though, when I attended QuickBooks Connect, the session on QB Live said they were getting requests from firms who wanted to outsource their bookkeeping, so it might be an option to speak with them about it.

D&V Philippines

While there are a ton of outsourcing options out there (and I certainly am leaving quite a few out!), I wanted to briefly mention D&V Philippines. This company, which is situated in the Philippines provides outsourced accounting services, and has been active in the cloud accounting space for many years.

Their dedicated team may also assist you with some of your other accounting needs and financial reporting requirements in addition to bookkeeping services.

And while I won’t comment on pricing here, they are quite competitive.

When it comes to outsourced bookkeeping for CPAs, you might want to add them to the evaluation.

Cloudstaff

CloudStaff [affiliate link] provides a diverse talent pool of highly skilled accounting professionals.

They that you have the flexibility to select the candidate who aligns best with your specific needs and preferences.

What sets it apart is that it takes the burden of IT and HR setup off your shoulders, saving you from the complexities often associated with remote staffing. This way, you can focus your energy on your core business activities.

In essence, CloudStaff streamlines the entire process of finding, onboarding, and managing remote talent, making it easier for you to scale your firm and achieve your business objectives.

Why Should I Outsource My Firm’s Bookkeeping?

Outsourcing your firm’s bookkeeping can offer several benefits, depending on your specific business needs and circumstances.

Hiring an online bookkeeping service, for example, can help in accounting and bookkeeping, ensuring accurate financial reporting for your business.

Here are some compelling reasons why you might consider outsourcing your firm’s bookkeeping:

- Reduce Labor Costs

Outsourcing can be more cost-effective than hiring and training in-house bookkeepers or accountants. You can avoid expenses related to salaries, benefits, and office space.

- Access to Specialists

Outsourcing firms often employ experienced professionals who specialize in bookkeeping and accounting.

You can benefit from their expertise and stay up-to-date with accounting regulations and best practices.

- Focus on Core Business Activities

Outsourcing your bookkeeping tasks allows you to redirect your time and resources toward core business activities like sales, marketing, and strategic planning.

- Accuracy and Compliance

Professional bookkeepers are trained to maintain accurate financial records, reducing the risk of costly errors.

Moreover, outsourcing firms are typically well-versed in tax laws and regulations, helping you avoid compliance issues and penalties.

- Easily Adapt to Growth

As your business grows, your accounting needs may become more complex. Outsourcing can accommodate this growth by providing flexible solutions.

- Access to Technology

Outsourcing firms often have access to cutting-edge accounting software and tools, ensuring efficient and up-to-date financial management.

- Flexibility

Outsourcing providers can tailor their services to match your specific needs, whether you require full-service bookkeeping or assistance with specific tasks.

While outsourcing bookkeeping has numerous advantages, it’s essential to choose a reputable and trustworthy outsourcing partner.

Carefully evaluate potential providers, check their references, and ensure they align with your firm’s goals and values before making a decision.

When Should I Outsource My Firm’s Bookkeeping?

Deciding when to outsource your firm’s bookkeeping depends on various factors, including your business’s size, growth stage, financial complexity, and your own capacity and expertise.

Here are some common scenarios and signs that indicate it might be a good time to consider virtual bookkeeping services:

- Time Constraints

As your business grows, so do your responsibilities. If you find that managing bookkeeping tasks is taking up too much of your time, outsourcing can free you to focus on core business activities and strategic planning.

- Inconsistent Records

If your financial records are often incomplete or inconsistent, it can lead to costly errors and compliance issues. Outsourcing can provide consistent and reliable record-keeping.

- Growth and Complexity

As your business expands, your financial transactions and reporting requirements may become more complex. Outsourcing can help you manage this increased complexity effectively.

- Seasonal Demands

If your firm experiences seasonal fluctuations in financial activity, outsourcing can offer flexibility by providing additional support during peak times and scaling down during slower periods.

- Unpredictable Workload

If your bookkeeping workload varies greatly from month to month, outsourcing can provide flexibility by allowing you to pay for services as needed.

Remember that the decision to outsource your firm’s bookkeeping should be based on a careful assessment of your unique circumstances and needs. It’s crucial to choose a reputable outsourcing provider and establish clear expectations and communication channels to ensure a successful outsourcing relationship.

The Best Outsourced Bookkeeping for CPAs Option

The answer will come down to you, which will depend on:

- Price

- Whether you want onshore, offshore or outsourcing

- Which vendor you connect best with and trust most (obviously)

Hopefully, the above provides your firm with some insight into some of the more modern options available when it comes to offloading the bookkeeping in your firm.

Good luck!

Ryan, thanks for this list. Our firm currently uses two different “outsourcing” firms, one you mentioned (TOA) and another you didn’t (Initor). Initor is in India, and we have had great success with a bookkeeper there. Just another consideration for your followers. Thanks for the great work you do!

Thanks for sharing Mark!

Thanks much Ryan, I am a one man operation at the beginning of this process and your insights are most helpful. I’m in Canada and leaning towards offshoring with TOA and you’ve given me much food for thought.

Glad you find it useful 🙂

Thanks for the blog, its interesting to read.