Scaling an accounting firm is super hard. That’s mostly due to the way most firms approach their services.

One of the secrets to scaling, based on my experience, is to mandate a recurring bookkeeping offering amongst your clients.

This article will discuss why I recommend this approach and how to do it.

An Interesting Stat

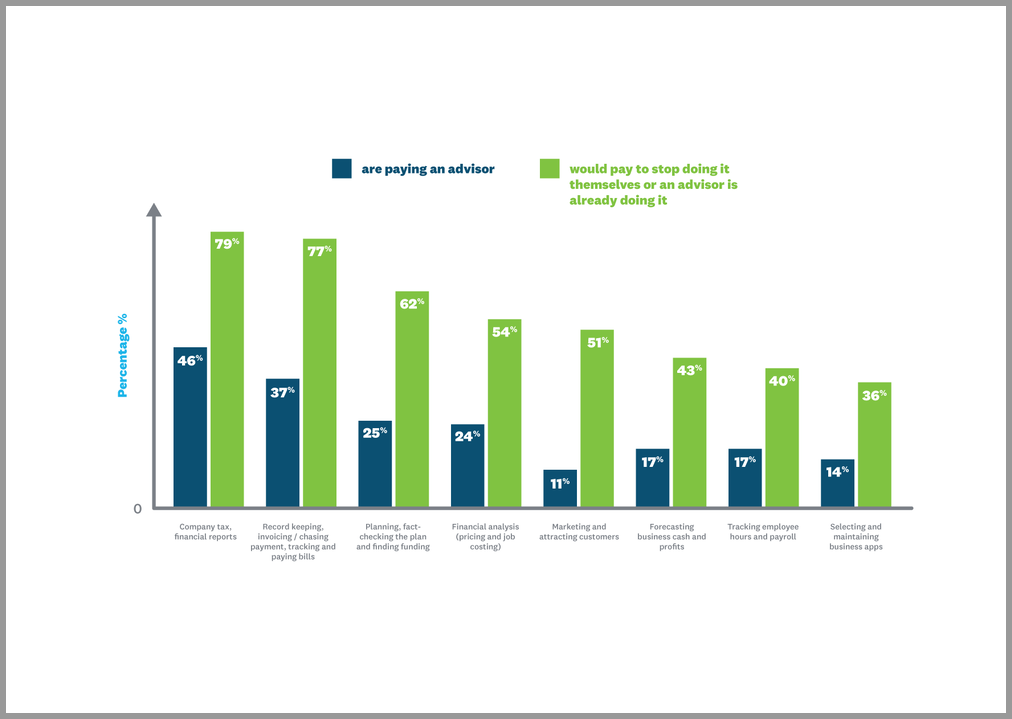

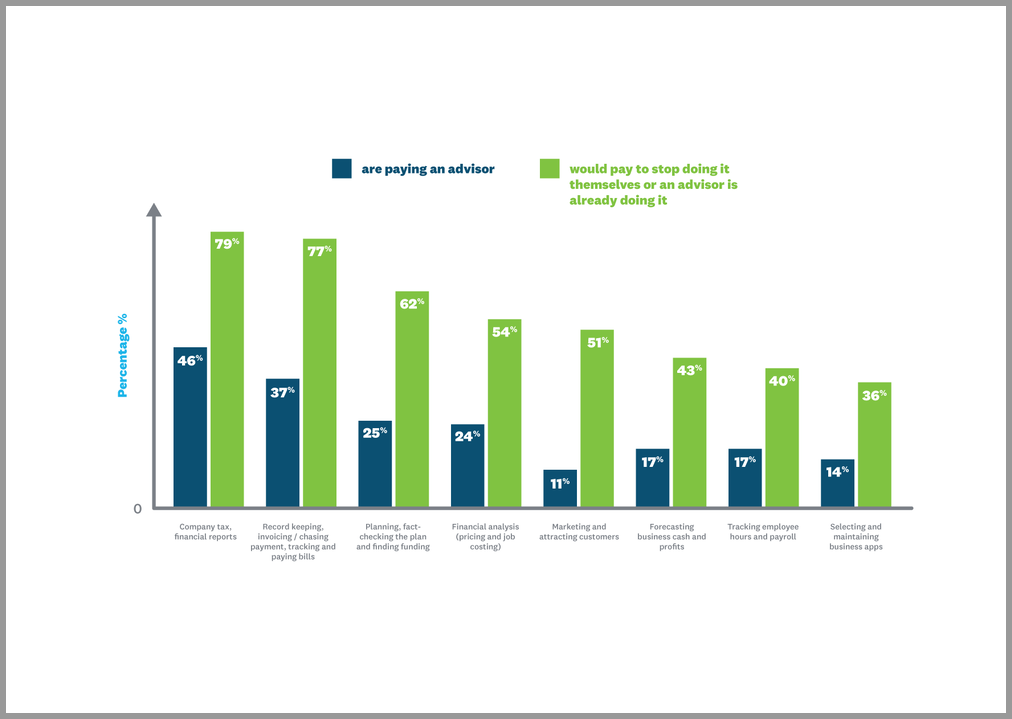

I was surprised by the following stat in a recent Xero survey of 1,500 small businesses in which I had pulled out 11 key takeaways for accounting firms:

In the second column:

77% would pay someone to stop handling recordkeeping (ie. bookkeeping and related tasks).

Yet, only 37% of those polled were receiving this service.

Why are accountants so off in this category?

It may mean one (or all) of the below:

- Accountants don’t want to offer this service

- Accountants aren’t understanding their clients’ needs

- Accountant don’t know how to price & package recurring work

I’ll touch on these points below in order to show the benefits of mandated bookkeeping and the steps you can take to implement it.

But First, A Story

Here’s me, pre-grey hairs, and looking a lot younger, just after starting my online firm in 2013. At that point, I was vehemently opposed to offering bookkeeping work:

I felt bookkeeping was easy enough for the client to handle themselves and I could focus on offering the recurring fixed price packages I had created for tax compliance and virtual CFO work.

Clients were buying these packages, the problem was, they weren’t receiving full value.

That’s because clients hated handling their books and as such, they were either late, incorrect, or both.

The basis of many advisory services is founded on timely, accurate data. Without it, the value of that service falls apart.

So I made the decision six months into starting my firm to make recurring (monthly or quarterly) bookkeeping services mandatory for any client we’d work with.

This would allow us to be in control of the timeliness & accuracy of the data to then be able to fulfill our obligations to deliver a valuable advisory service that actually would help the client.

The Benefits of Mandated Bookkeeping

While mandated bookkeeping started as an experiment, it quickly became a mainstay for so many reasons:

It’s an Easy to Start a Relationship

In order to sell something, you need to be able to alleviate a pain point.

And guess what?

Small business owners hate their bookkeeping!

It’s way easier to kick-off a relationship with bookkeeping than it is with advisory (which is usually a nice-to-have, not a need).

Just look at this chart again:

77% of business owners want to offload bookkeeping.

This makes it an easy sell.

(And if you’re uncomfortable “selling” a packaged, recurring, productized service offer, we’ll get to how you can do it below).

A Closer, Stickier Relationship

First, the more services you surround your clients with, the stickier the relationship is.

Second, the big benefit to a more formal, recurring relationship (thanks to mandated bookkeeping) means that you develop a much closer connection with your client.

Echoing this sentiment is a seasoned cloud-accounting expert, Bill Kimball, Head of Sales, Xero Canada, who I first met in 2015.

His view is that “bookkeeping provides a gateway opportunity for accounting professionals to step in and work alongside clients to provide answers and advice – and there has never been a greater time to start.”

He also believes that you should “help clients let go of the ‘do it yourself’ mentality and step into the role of a trusted advisor who understands how the numbers work and how they are connected. This shift to a ‘do it together’ mindset empowers accounting professionals to go beyond the back office crunching numbers and translate that data in a way that informs business decisions and tells stories.”

Easy Upsell to Advisory

If you handle the books, you have a pretty deep understanding of your client and their operations. Because of this, spotting (and landing) advisory & tax planning opportunities become far easier.

Standardization of Your Entire Service Delivery Process

You can only scale a professional services model with standardization in place.

I don’t care how much technology you have in place. Without standardization of clients & processes, you cannot scale. Period.

The beauty of mandated bookkeeping is that handling your clients’ books puts your firm in complete control of everything.

You control the data and therefore you control when every other service (taxes, forecasts, etc.) for that client is completed. Not the other way around.

The level of planning and standardization available to you is unparalleled when you control the books.

This is the secret to a lean, mean, accounting firm machine.

How to Transition to Mandated Bookkeeping

Move all your existing clients and future clients over to a mandated recurring bookkeeping model.

Easier said than done, right?

Here’s a few high-level steps for you to follow to push you along:

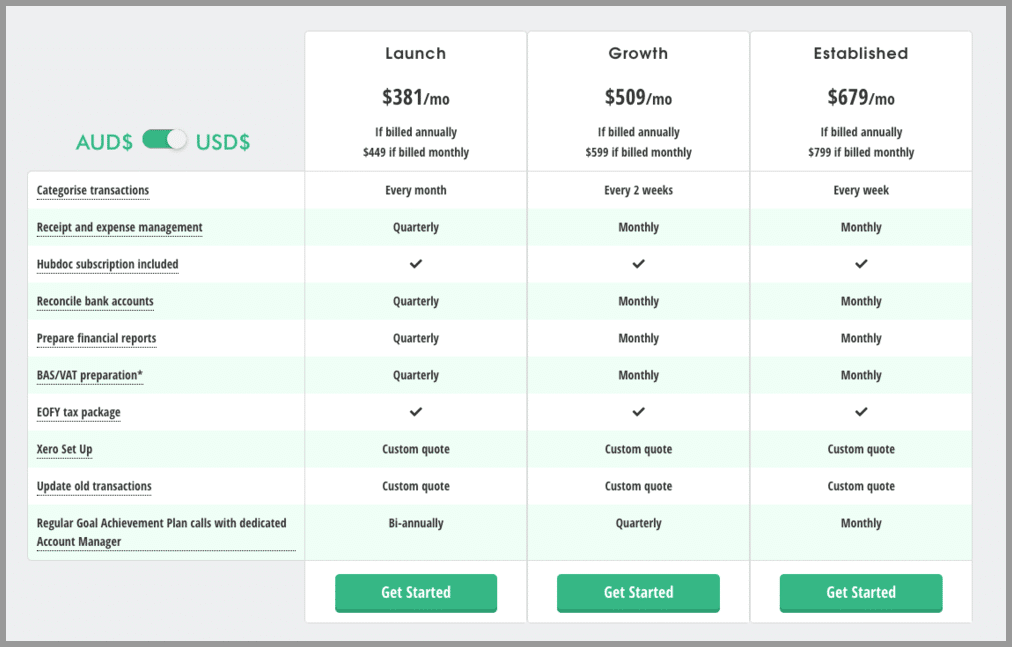

Step 1 – Productize Your Offer

The trend right now is pricing your services in a subscription model. And to do that, you need to productize your offer.

The way I like to think about a productized accounting offer is to divide your “product” into 3 categories:

- Services

- Support

- Technology

What services will you offer? What level of support will you be providing to your client throughout the year? And what technology will you include in the plan?

Map those out in a pricing table that looks like this from the Bean Ninjas and you have a productized offer on your hands:

Step 2 – Conduct a Needs Analysis Call With Current Clients

Now that you have an offer, it’s time to approach your current clients to get them to move to a recurring bookkeeping model.

And honestly, it shouldn’t be too complicated given that the numbers speak for themselves (ie. 77% would pay to offload this work).

All it comes down to is a needs analysis.

Understand what they’re currently doing for bookkeeping, understand their current bookkeeping processes, and then identify areas where you can improve how it’s being done.

The main selling points should likely be:

- You can make their lives easier

- You can save time through robotic process automation in finance and accounting (given the cloud accounting tools you’re using)

- You can be closer to their business, thereby helping them grow in other areas

Not all of your clients will agree to a bookkeeping service, so you have a call to make. Either keep them onboard or cut them.

If selling doesn’t come naturally to you, Bill Kimball shared some tips on how you can elevate your elevator pitch on the Xero blog.

Step 3 – Present a Proposal

Once you have an interested party, then it’s time to price and present the offer.

We won’t go into great detail on pricing here, but if interested, you can check out my guide to pricing accounting services.

If you’re worried about bungling this step, I’ll make it very easy for you.

I’m a big proponent of the 3-tiered options approach, in that, you offer your clients 3 monthly options to choose from:

- Option 1 can be the VIP option with all the bells and whistles

- Option 2 can be the services they’re getting right now plus bookkeeping

- Option 3 can be taking the services you already offer them and just divide the annual price by 12

So if you’re not super confident in your upselling abilities, at the very least, you’ll keep them on Option 3. The only difference is that they’ll be paying you monthly instead of annually.

Step 4 – Structured Onboarding

Once you land the new mandate, make sure that you have a structured onboarding process. Again, we won’t be going through this in detail here, but it’s important to start on the right foot.

Write a checklist of all the things you need to be able to set up the client and start the work. This is your onboarding list. Don’t start performing any bookkeeping work until you’ve set up and gathered what you need first.

Step 5 – Mandate Bookkeeping for all New Clients

You may have decided to keep current clients on that didn’t opt for bookkeeping work.

That’s OK.

But if you want to scale your firm, my view is that offering a mandated bookkeeping service for all future clients and not letting your clients handle things themselves is the way to go.

It will take some discipline (I know it’s hard to turn down business), but being everything to everyone and scaling doesn’t go hand in hand.

Over to You

The gist of this article is that scaling comes with a certain level of standardization. Not only does it provide benefits to you, but your clients as well.

And it’s not just me that thinks this. Here’s an 80-person online firm that believes in mandated bookkeeping (jump to 35:00 of the podcast interview).

Now I’d love to hear from you.

What are your thoughts on this approach?

Agree? Disagree?

Is there a step that you’re hung up on?

Either way, let me know by commenting below.

I aim to start a Bookkeeping business in Hillcrest, Durban, South Africa.

Any advice, or can you point me in the right direction please?

Yes, maybe you want to take a look at this post of mine: https://futurefirm.co/how-to-start-a-bookkeeping-business/

Hi Ryan, I completely agree with the points you’ve discussed here. I want to add that good bookkeepers will keep track of your revenues and expenditures, as well as account payable and receivable and generate a balance sheet – both of which will help you prepare an effective tax strategy and ensure that your business management is focused on reliable financials.

Great advice; I never thought bookkeeping can be a value add service but reading this post I think it is a foundation and a requirement in order to be able to provide any value add service. Also, I like your thought about dividing the existing fees by 12 for a reluctant existing client. I don’t think they will say NO to an additional service for the same fee.

Enjoying all the coaching Ryan! We came to a lot of these conclusions about a year ago and now have 20 clients in fixed price bookkeeping packages and that is DEFINITELY the way to go! Funny enough I was talking to my staff about mandating bookkeeping for our corporate clients today! Will definitely be giving strong consideration to that approach. Now we just have to implement the 3 package approach. That will be happening next month! Thanks again!

Glad you’re enjoying the Future Firm Accelerate program and the content, Owen 🙂