QuickBooks Connect San Jose just wrapped up. And boy was it a good one.

Great people from all around the world. Awesome new product announcements. And insights into new trends.

I was invited down by Intuit as media this year and in this article, I share my highlights and takeaways.

Let’s go.

Overall Theme of QuickBooks Connect San Jose

Want more confirmation that the profession is undergoing massive changes? Look no further than the theme of this year’s QuickBooks Connect San Jose; “Own the Future.”

I’ve been to 3 major accounting conferences this year. At Xerocon San Diego, Xero’s CEO Steve Vamos’ opening keynote was dead focused on change in the profession (see the Xerocon San Diego wrap-up here). And at AICPA Engage, it was much of the same (see the AICPA Engage wrap-up here).

Ariege Mishergi Keynote

QuickBooks Connect San Jose further confirmed this when Intuit’s Global Accountant Segment Leader, Ariege Mishergi, took the stage for the opening keynote to discuss “Own the Future.”

She noted that the world is changing and accountants have to change too. She has witnessed a profession that has weathered change in the past and she believes it can be done again.

In the 90’s the profession digitized their work.

In 2005, the profession started moving to the cloud.

And today, advancements in artificial intelligence are once again taking things to a new level.

Intuit wants you to recognize this and to “Own the Future” in order to keep up with these changes.

Forecasting Trends

Trend forecaster, Michael McQueen, took to the stage immediately after to prep the audience for what needs to be on their radar.

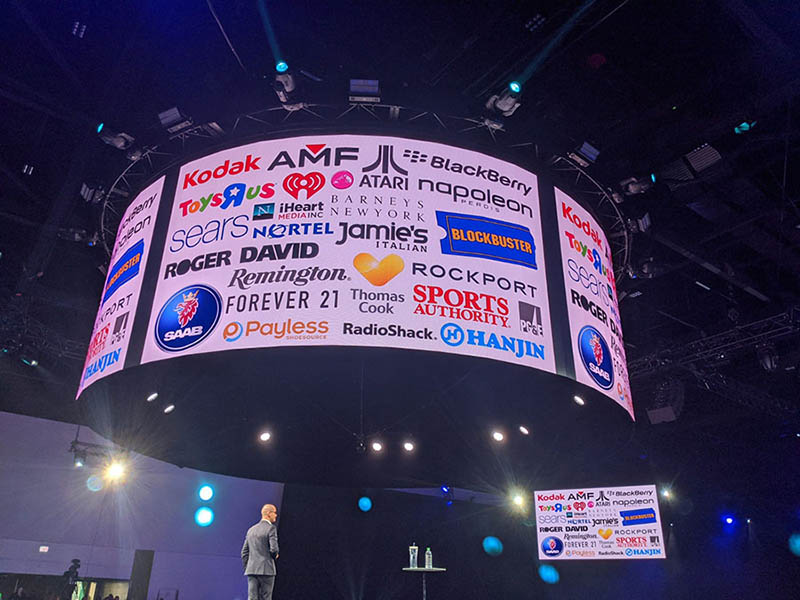

Early on, he posted this pic of familiar companies that didn’t see the trends.

Blackberry, for instance, went from 90% market share at its peak to just 3% now. Things can change quickly if you don’t adapt.

From his studies, successful companies that stay relevant have 3 things in common.

One, they think revolution, not evolution.

Two, they focus on friction. In other words, focus on areas of the business not working 100% seamlessly that cause friction for your clients. If you don’t, someone else will. Customer experience matters.

Third, they foster healthy paranoia. They have hunger and humility.

Big Product Updates

I was impressed by some of the new updates to their product. Not 1, not 2, but 3 pretty big releases were announced at QuickBooks Connect San Jose this year. These product updates will help firms and businesses be more efficient and to get deeper insights.

Want early access to some of the below features? Head over to www.intuit.me/qb-earlyaccess

Optimization Center

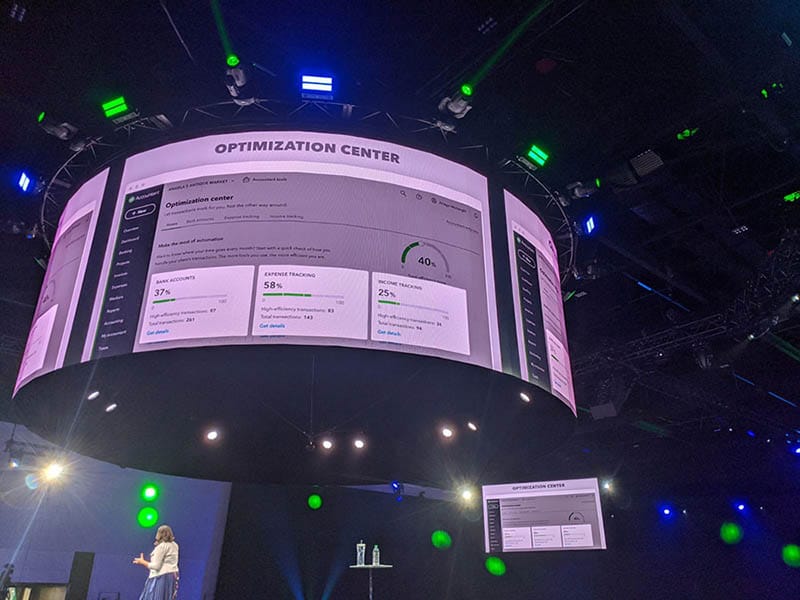

Firms will love this one. Want to know how much you’re automating for each QuickBooks Online client? Intuit will now show you.

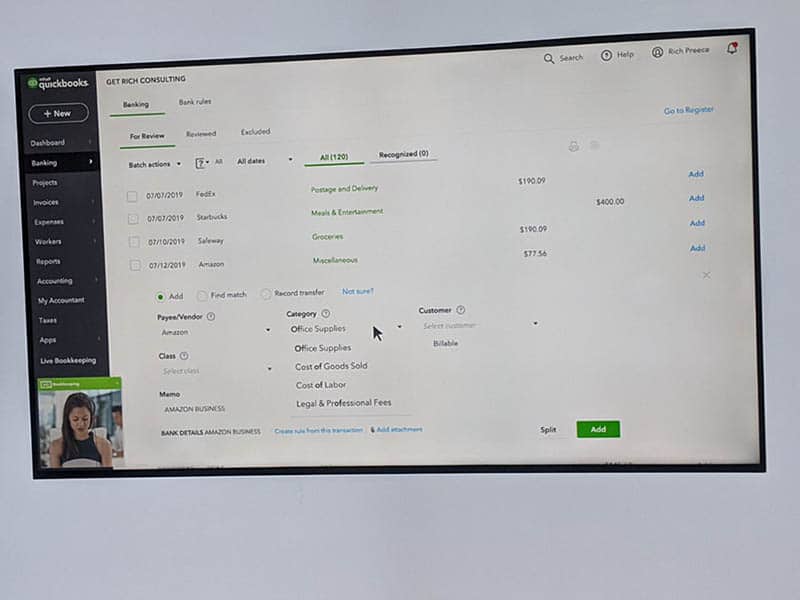

Optimization Center will show you a list of your clients in QBO. Next to each one is a percentage number indicating how efficient you are on that client in 3 main areas: banking, expenses and income. If you’re at 40%, then that means you’re missing out on 60% of the efficiency gains possible in the app.

You can further drill down into the number to see where you’re inefficient in those 3 main categories. It will show you things like whether you’re setting enough bank rules, whether you’re syncing documents properly, etc.

This is a great way to tweak your QBO files and reach 100% efficiency on each one.

Bookkeeping Review

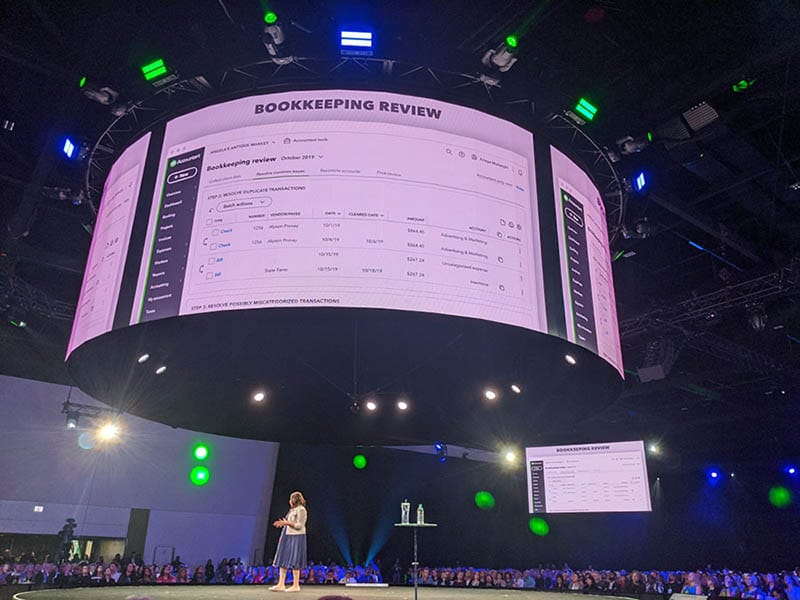

This feature helps you spot bookkeeping errors automatically. It analyzes your QBO file in several key areas.

It looks at whether there are any unreconciled transactions, whether some banking transactions are missing key data, identifies duplicate transactions, identifies transactions that might have been miscoded and other areas of the file to help streamline the review process.

Additionally, it was announced that in this section, there is a statement export feature. Bank & credit card statements are now downloaded directly into the app to help finalize month-ends. It’s working right now in Canada with 70% of banks supported. US support coming soon.

Another winner from what I can see so far.

Business Performance Overview

Live for everyone right now, this new feature provides users with a rich data experience with key metrics on their clients.

While I have not been able to play with it, it seems to provide good dashboarding functionality for key KPI’s.

But what I’m very excited about is that you can toggle the “industry comparison” feature. Switch this on to benchmark your clients against millions of other businesses in Intuit’s database.

New Features & Updates for Small Businesses

A few more features were announced for small businesses using QBO that firms should be aware of. Here are some notable ones.

1) There’s a cash flow management and prediction feature that will allow businesses to predict their cash flow over the next 90 days. The cash flow planner will show what your shortfall using AI and will then provide some recommendations to address the shortfall. One of the options, of course, will be to leverage QuickBooks Capital to secure financing.

2) Receipt Capture: Think of a lite version of Hubdoc or Receipt Bank, integrated directly within QBO.

3) Mileage Tracking: A new feature will allow users to track their mileage automatically, similar to MileIQ. The mobile app will detect when you’re traveling and prompt you to log it as a business or personal trip to generate mileage deductions for you.

4) QuickBooks Online Advanced: Intuit is going upstream with a mid-market offering. For those outgrowing QBO and need something before selecting a larger ERP, this may be an option.

All-In on QuickBooks Live

I’m very interested in QuickBooks Live. To me, this represents the first large scale attempt to Uberize parts of the profession.

Controversial?

Yup.

A smart business move by Intuit?

Most likely.

Competition for your firm?

Intuit isn’t saying so, but I certainly think it will be, which may impact marketing for your firm.

If successful, it will force firms to think about their services differently.

QuickBooks Live is a matchmaking service to match bookkeepers with small businesses needing bookkeeping help. I wrote more about this months ago when it was first discovered.

Make no mistake about it. Intuit is now offering bookkeeping services. While obviously not marketed as a competitor to your firm, in my view it is.

Intuit is currently hiring bookkeepers, training them & sending them the equipment required.

On the business side of things, it makes sense for those that want to tap into the on-demand economy. If you need bookkeeping help, tap a button, and your bookkeeper will appear to walk you through whatever issues you may have.

The Process for the Business

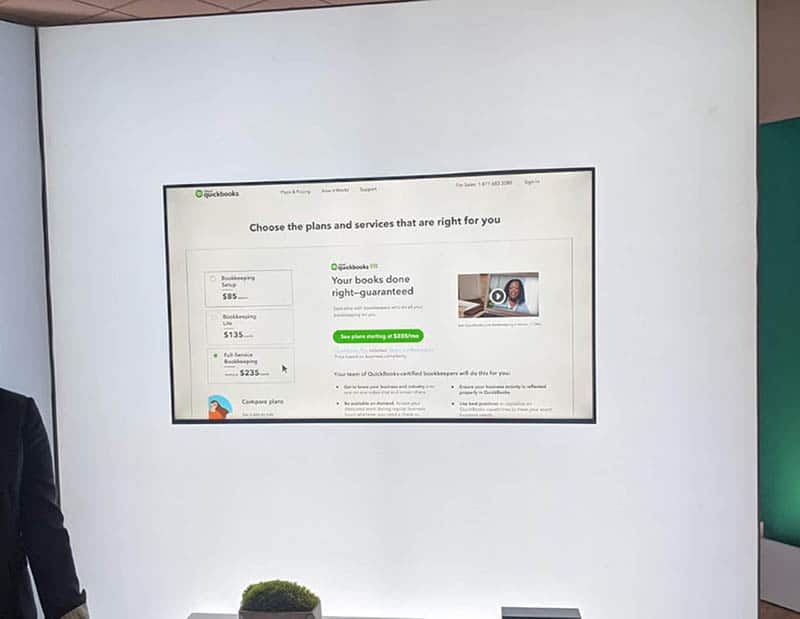

It starts with the business selecting the plan they want. Here’s a few sample plans (which are still evolving):

There’s a plan to set up the QBO file, a lite plan for bookkeeping support and then a plan for full-service bookkeeping. Some of the things that can be included in the plan would be setting up QBO, categorizing and reconciling transactions, on-demand bookkeeping assistance, teaching how to use QBO and best practices around workflows and personalizing monthly reports.

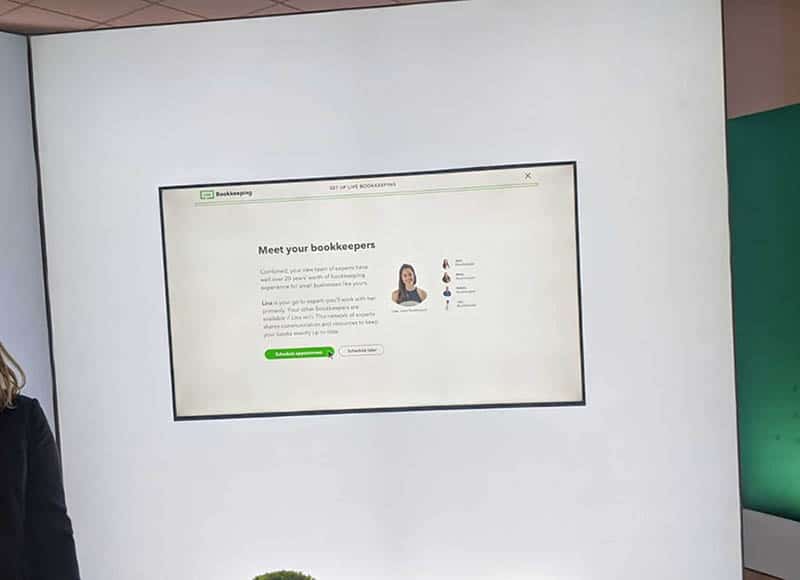

Once the business picks the plan and provides a bit of background information, Intuit will match the business up to a team of their bookkeepers.

Following that, you’ll be prompted to schedule a meeting with your lead bookkeeper. The meetings will look like this to the business (with a live video of the Intuit bookkeeper at the bottom left of the screen):

Essentially, Intuit is packaging its software with human expertise.

For the Bookkeepers

When the world first found out about QuickBooks Live months ago, there were some ProAdvisors upset as they saw this offering competing with their own. In my conversations with Ariege Mishergi, Intuit’s Global Accountant Segment Leader, there was some admission that the mistake early on was with regards to perhaps not properly communicating this offering to their accountants and bookkeepers.

She also mentioned to me that there are firms that love it, some that are indifferent to it, while others are afraid of what this may mean to them. They are trying to assure the ones in the latter category not to worry too much.

It seems that Intuit is listening though. They spent a chunk of time at QuickBooks Connect San Jose explaining why this offering exists and how it might not threaten anyone else’s work.

Still, I see this as the natural evolution of where the profession is heading. Marketplace businesses connecting buyers to sellers (like Uber) are incredibly popular, so it was only a matter of time before this was going to hit accounting & bookkeeping.

There were special sessions to help explain the offering and the benefits to bookkeepers that join. They would become an employee of Intuit, would have to dedicate a minimum of 20 hours a week, be able to work remotely and create their own schedule and participate in a benefits plan. This, as well as some other perks, exist as well.

Firms should know this offering exists and prepare accordingly in my opinion. I also think QuickBooks Live can make a lot of sense for those smaller firms or bookkeepers with excess capacity and who want to easily fill that capacity.

I believe this will be a successful initiative by Intuit. Keep this on your radar.

Dude, Where’s My Car?

I don’t have much else to say other than, Ashton Kutcher was at QuickBooks Connect San Jose. Pretty cool! He’s a smart dude and had some good tips for entrepreneurs.

That’s a Wrap on QuickBooks Connect San Jose

Intuit knows how to produce a world-class event. QuickBooks Connect San Jose a good vibe with interesting product announcements that will actually help your firm and insight into new trends happening, notably with QuickBooks Live.

And of course, meeting up with your peers is always a highlight.

Thank you so much for sharing this data with us.

You’re welcome!

Such a nice blog on quick books connect san José highlights and I hope you keep update us with such great tips and information in future too. This is a great post; I will share as much as I can.