Watch out, because you definitely don’t want to piss off a bookkeeper. And that’s something that Intuit appears to have done recently. Xero, then put out an indirect response to Intuit on where they stand on the matter. With that, it’s clear there’s a Quickbooks vs Xero Bookkeeper battle that is now brewing, where each vendor are now positioning themselves for where they see the future of the role stand. Who would have thought the bookkeeper space would have been so interesting?

The Quickbooks vs Xero bookkeeper battle all started with this:

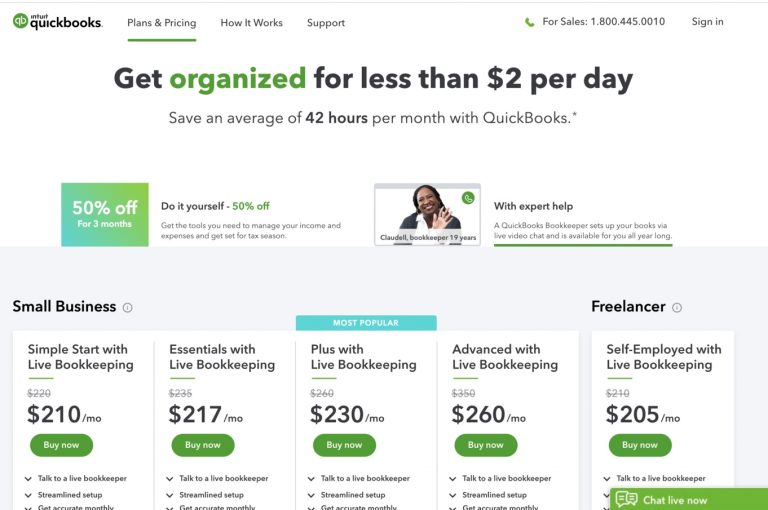

Bookkeepers and accountants alike picked up on this immediately. Intuit was no longer selling software, but they were now also selling bookkeeping services. The scope of this service was indeed murky, but their intention was clear.

Intuit’s response was that this move was only a test:

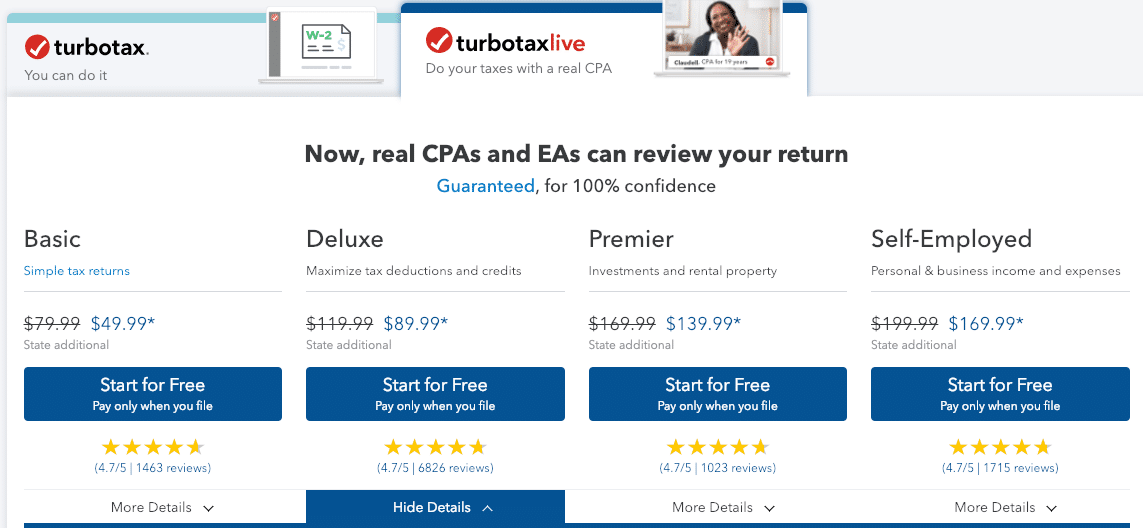

Still, loyal Quickbooks supporters felt betrayed. They saw it as a way of commoditizing what they were doing, undercut their pricing and essentially, replace them. And with Intuit’s recently similar play with their TurboTax product, it’s hard to argue that Intuit is not trying to take a cut of an accountant and/or bookkeeper’s top line.

What’s interesting is that if you navigate to the US Quickbooks pricing page, the “live bookkeeping” option no longer appears, this only after about 2 weeks time.

It took about a week, but fuelling this Quickbooks vs Xero bookkeeper showdown, Xero hit back, with Keri Gohman, President of Xero Americas, making a statement called, “Xero’s commitment to bookkeepers”, which read a bit like a manifesto of sorts. Xero’s position, essentially, is that they will treat bookkeepers as partners, they will not take a cut of what they earn, nor will they look for technology to replace them. They will use technology to augment the relationship between client and bookkeeper.

In the ongoing QuickBooks vs. Xero bookkeeper battle, both popular accounting software solutions offer a compelling array of features. QuickBooks boasts the advantage of accommodating unlimited users, a key selling point for businesses with multiple team members needing access to financial data. Meanwhile, Xero stands out with its exceptional sales tax tracking capabilities, simplifying the often complex task of managing taxes for businesses of all sizes. As bookkeepers weigh the pros and cons of these two accounting giants, the choice ultimately hinges on the specific needs of the business and whether unlimited user access or robust sales tax tracking takes precedence in their financial management strategy.

So in this Quickbooks vs Xero bookkeeper battle, who is right and who is wrong? And should Quickbooks users even be so upset? Let’s take a look.

The Quickbooks Side of Things

Let me just be clear on one thing. I like Intuit’s play here. Was it rolled out properly? Maybe not. People are sensitive what you encroach on their livelihood. It’s only natural for bookkeepers to be upset. Especially when they act as a valuable channel for business that you have relied on for so many years. They are the ones helping you get more subscribers and then when they see Intuit offering bookkeeping services on top of their software all of a sudden with basically no mention of anything, it’s easy to see that a loyal supporter would be upset.

But, ignoring the messaging part of things, I think exploring the marketplace side of things is a smart move in the accounting space. Uber has connected drivers with passengers, Airbnb has connected renters with those looking for short term stays, and so on. The marketplace space is super hot. So why not foray into this space when it comes to accountants, bookkeepers and tax professionals?

The hardest part of a marketplace business is actually getting users on to your platform. Without users, the platform is virtually useless. You need the buy side (the small business in this case) and you need the sell side (the accountant/bookkeeper). Intuit has that already, and millions of them. Now, on top of selling their software, they can make a cut from connecting these users together.

Keeping in mind that Intuit is now a SaaS (Software as a Service) company and one of their biggest KPI’s is their MRR (Monthly Recurring Revenue), what better way to increase their subscription revenue than by bundling in their software with services and then sourcing those services, on-demand via their vast network of professionals.

What Intuit is likely testing at the moment is if the market actually has interest in shopping for your bookkeeper à la Uber model, essentially, something that’s more on-demand. It’s an interesting move, but one that no doubt kicked off a Quickbooks vs Xero bookkeeper showdown.

Another interesting part of this test is that it seemed like Intuit was not actually offering bookkeeping services, but bookkeeping support, for those businesses that handle their bookkeeping in-house and want the assistance of a bookkeeper for questions from time to time. This is interesting because it seems to assume that bookkeeping is getting easier and more automated, where the average person can handle this on their own without the need for a bookkeeper (an assumption that Xero seems to have made as well as this point is addressed in their response on the matter).

This is interesting because it seems to assume that bookkeeping is getting easier and more automated, where the average person can handle this on their own without the need for a bookkeeper (an assumption that Xero seems to have made as well as this point is addressed in their response on the matter).

When assessing Quickbooks Online plans for review, it’s crucial to examine how they address key financial aspects such as accounts receivable and bank reconciliation. It simplifies accounts receivable management with its robust invoicing system, ideal for businesses aiming to streamline payment tracking and maintain healthy cash flows. Moreover, the platform’s bank reconciliation capabilities automate the process by allowing direct bank account connections, reducing errors, and saving valuable time. These features, available across various QuickBooks Online plans, make it an invaluable tool for businesses of all sizes, ensuring efficient financial management and accuracy in their financial transactions.

Last observation. I think what we are beginning to see here is something I wrote about as a top trend trend over the next few years for accounting firms (trend #3 in the article) discussing how the gig economy is going to greatly impact firms down the road. Trends were pulled from a recent World Economic Forum report which specifically talks about how traditional job roles are being deconstructed into tasks and are being re-bundled into new talent platforms. This will create opportunities for workers (much more flexibility for when/where/how to work), but will cause create strain on firms (less and less interest in a steady full time job means recruitment/retention becomes even more difficult). I think we are very much at the beginning of this starting to happen.

The Xero Side of Things

Xero played things pretty smartly the other day and likely won over a few supporters in doing so. Seeing the backlash, the President of Xero Americas released a statement of where they stand with regards to their bookkeeper partners, thus fuelling the Quickbooks vs Xero bookkeeper battle. In it, Keri says:

“We must avoid the temptation to believe the hype that the future will soon be dominated solely by technology. This is a future, already alive in the imaginations of many, where the work traditionally done by bookkeepers is eliminated and replaced by AI and on-demand, Uber-like services.

At Xero, we are proud to deliver some of the most innovative technology that the bookkeeping industry has ever seen. But we are also determined to forge a future where the distinctly human contributions of bookkeepers continue to shine through. We want to use technology not to replace the work of bookkeepers, but to enhance the positive impact bookkeepers have always delivered.

Our industry is at a crossroads. We are facing a clear choice. Do we believe that the role of a bookkeeper is simply to collect and process data? Or, do we believe that the role of a bookkeeper is to engage deeply and understand what makes each and every small business unique?”

This seems to be a direct shot at Intuit. She also seems to be saying that Xero would not look to Uberize the bookkeeping profession and instead they will create software that will enhance how bookkeepers work with clients.

At the same time, there is an admission that the way that many bookkeepers work today will likely disappear. Technology will replace large chunks of what bookkeepers do and what Keri is getting at is that bookkeepers will need to retool and be able to advise clients on their business rather than just process data.

Small business owners searching for a comprehensive accounting solution should consider Xero accounting software. Xero offers a robust suite of accounting features tailored to meet the unique needs of small businesses. With user-friendly tools for invoicing, expense tracking, and financial reporting, Xero simplifies the often complex world of accounting, enabling small business owners to maintain a clear and accurate financial overview.

Whether it’s managing expenses, tracking cash flow, or preparing tax documents, Xero’s accounting features provide a seamless and efficient solution, making it an excellent choice for entrepreneurs looking to streamline their financial operations and focus more on growing their businesses.

Pricing Plans

QuickBooks is an incredible accounting program. It assists small companies in monitoring the finances and budget and monitoring income and costs. This software is useful for tracking transactions in the finance business, handling invoices and payments, creating reports, filing taxes and others. This tool helps in managing customer information, vendors, clients, inventories and finances. Use the report center to view Sales, Income, Cost and Total Revenues. Sales tax calculations product tracking e.g. sales taxes and sales tax information, can be automated in all QuickBooks users’ accounts and customers.

Xero’s pricing plans cater to businesses of various sizes and needs, offering flexibility and scalability in their accounting solutions. Xero’s Starter plan is ideal for small businesses, providing essential features like invoicing and bank reconciliation at an affordable monthly cost. The Standard plan builds upon this foundation by adding features such as multi-currency support and expense claims. For larger businesses or those requiring more advanced functionality, Xero’s Premium plan offers advanced financial reporting and project tracking tools. Furthermore, Xero’s pricing model allows users to choose add-ons for payroll and expenses, tailoring their subscriptions to match their specific requirements. With transparent pricing and a range of options, Xero ensures that businesses can find a plan that fits their financial management needs without breaking the bank.

Adding New Accounts

Xero and QuickBooks Online are different in establishing new accounts. For example, if this is the first time you have spent money on something. In QuickBooks Online, it is easy to create an account by choosing the Accounts drop-down menu. Xero doesn’t have this feature. If a new transaction is added to an existing Online Banking account, then the transaction is re-entry.

This distinction means that in Xero, there may be a bit more manual work involved when establishing new accounts, while QuickBooks Online streamlines the process with its dedicated account creation option. Understanding these nuances can help users choose the accounting software that aligns best with their specific needs and preferences.

Who Wins, Who Loses?

So who is winning the Quickbooks vs Xero bookkeeper battle at the moment?

Xero and QuickBooks are two prominent accounting software solutions that cater to the needs of businesses, whether small or large. When it comes to the Xero vs. QuickBooks debate, both have their unique strengths.

From a PR perspective, Xero just took the prize.

But as I mentioned above, I do like what Intuit has attempted. Ultimately, I think a marketplace approach may be the future for some, but certainly not all, bookkeeping, accounting and tax tasks. I am thinking about this from a business standpoint for the software vendor but also from a customer experience perspective. If parts of the Uber model can be successfully applied to the bookkeeping/accounting/tax space for some aspects of the process, I think it will greatly enhance the way accounting gets done from a customer perspective.

At the end of the day, Intuit are both basically saying the same thing, just in different words. The role of the bookkeeper is changing, bookkeepers need to adapt. Technology is automating more and more of what bookkeepers have based their livelihoods on. Intuit has said this through release of a test business model to Uberize parts of what bookkeepers do and Xero more explicitly stated this when they indicate that technology will enhance the way that they will need to work with clients (but also replace what they were doing previously).

If the marketplace approach does succeed, I think the big losers in this will likely be firm owners. This will almost certainly increase commoditization of services and squeeze profits for those that don’t adapt and will perhaps make recruitment/retention of employees that much harder (already one of the top issues facing firms today) since employees now have the option of the ultimate flex-schedule.

One thing is for certain, the Quickbooks vs Xero bookkeeper battle has just begun. Who would have thought that bookkeeping would have been one of the most exciting things to hit the profession as of late?

Nice article Ryan, you raise some good points. I agree both software venders are acknowledging their softwares will reshape the role of the bookkeeper but have always accepted there will be a human element to any engagement. Now Intuit wants to provide that human element too, they want it all & rightly deserve any backlash they receive from the bookkeeper community.

Thanks for checking it out David. I’m not so sure that Intuit wants to provide the human element as well in this instance, though I do believe that they want to facilitate the human element (and take a cut along the way). Just speculating here…

Very interesting article. Thank you for your time in providing great information. Learning more about Xero vs QBO on this side of things was more than I had thought about before. I think bookkeepers are always going to be needed even on a smaller scale. It’s nice for business owner to not have to think about if their accounts have been reconciled or not. I just recently started a bookkeeping business and some of our clients are Amazon FBA sellers and it’s fairly split between them wanting to use Xero or Quickbooks. Your blog post helped me realized just how competitive they are with each other. I don’t think either of them are going anywhere any time soon.

Glad you found it helpful Rebecca!