Enter the era of accounting tech startups.

Hot off the press, Pilot in the US just raised $40 million for their online and tax bookkeeping service bringing their total funding to $59 million.

Bench, an online bookkeeping service based out of Canada, raised $18 million in funding back in January 2018.

Visor, an online tax service, raised $9 million in November 2018.

Botkeeper raised $18 million in November 2018 for their online bookkeeping service.

These are just a few examples of accounting tech startups raising a ton of money to offer accounting, bookkeeping & tax services to small businesses. Clearly, they see the accounting, bookkeeping & tax space as a market ripe for disruption and they are throwing tons of money and shiny technology into it to help automate as much as humanly possible. And the market is big enough as apparently $60 billion is spent on bookkeeping and accounting in the US alone.

Couple that with software juggernauts like Intuit starting to offer add-on bookkeeping services to their QuickBooks Online product and we get a space that is getting insanely competitive and exceptionally crowded, fast.

Given this, can your firm compete in this day and age? And if so, how?

Accounting Tech Startups Overview

The tech startups I listed above all share similar attributes. And these attributes are very different from most traditional accounting, bookkeeping, and tax firms out there (though quite similar to cloud accounting firms in many respects).

The tech startups in the accounting space are:

- Hyper process-oriented

- Not timesheet based and implement fixed subscription pricing

- Heavily technology-based & paperless

- Have remote teams

- Focus on eliminating pain-points and are customer experience-oriented

- Acquire business online

- Have excellent marketing

- Have a scalable model

These characteristics are almost 100% opposite of most accounting & bookkeeping firms out there.

Yet, these are the characteristics that are likely required to stay competitive in the digital age. Many cloud accounting firms out there understand the shift taking place and have adopted many of these characteristics, though, they are lacking the large amounts of funding that players like Botkeeper, Pilot, Bench, and the likes have received.

The key here is that these new players recognize that bookkeeping, accounting, and tax are painful for small businesses. They realize that people hate it. And the tech space will move swiftly when they sniff out that there is an underserved market out there. This is exactly what is taking place now.

The problem that they are trying to solve is to make accounting easy and automated. And they are developing solutions and technology around solving that problem. The characteristics I listed above are what’s required today to solve the typical accounting pain points that many business owners face.

While most accounting firms are just thinking about producing a tax return or a financial statement, these tech startups are looking at solving customer pain points. This difference between the two explains why both have radically different characteristics. For example, producing a tax return doesn’t require you to be particularly technology-based, but offering a seamless, automated service experience does.

I like to give the example of Uber. Uber took a typically shitty customer experience (ie. taking a taxi) and turned it into something easy & automated. So much so, that the taxi industry is plummeting.

These tech startups understand pain points exceptionally well and go hard at solving this problem. The accounting industry isn’t following suit and as such, the same disruption is likely to hit the accounting, bookkeeping, and tax space for those that cannot adapt.

Another Similar Characteristic: Price

There is one more thing that ties these tech startups together. They are competing on price and are they are driving it down.

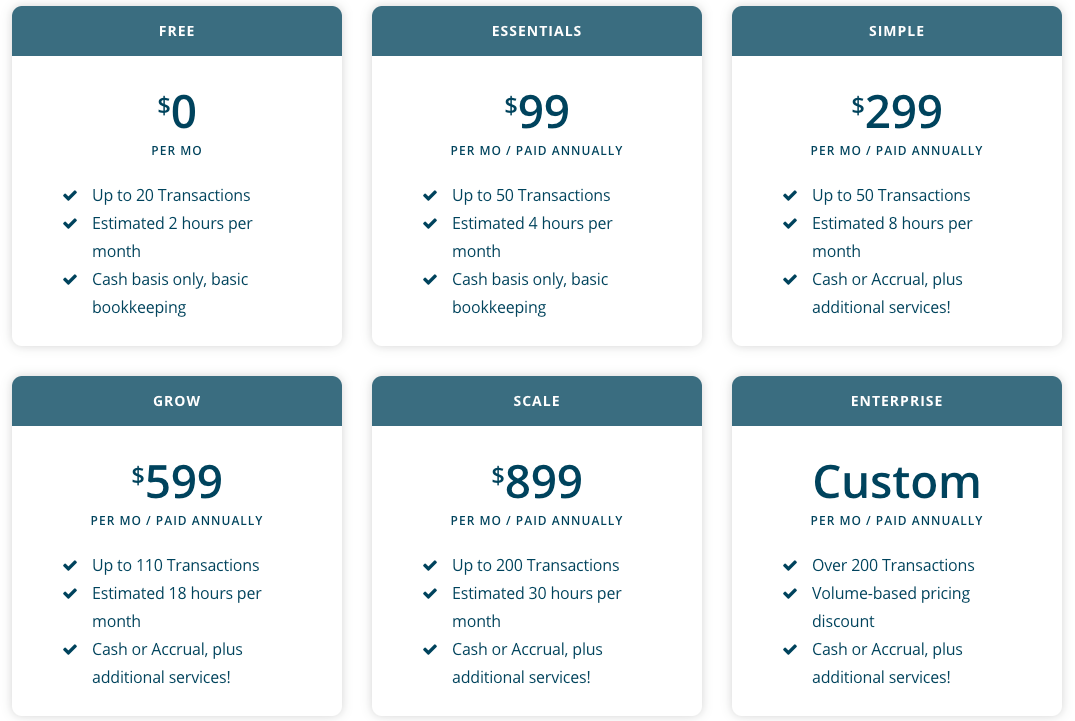

Let’s look at Botkeeper’s pricing:

There are many firms out there that perhaps offer the majority of their services to clients that fit into Botkeeper’s first 3 plans, which range from free to $299/month. Keep in mind that Botkeeper is including software in this price as well. Competing at this price point and making a reasonable profit for many firms would be very difficult. I mean, you certainly cannot compete with free or even the $99/month plan.

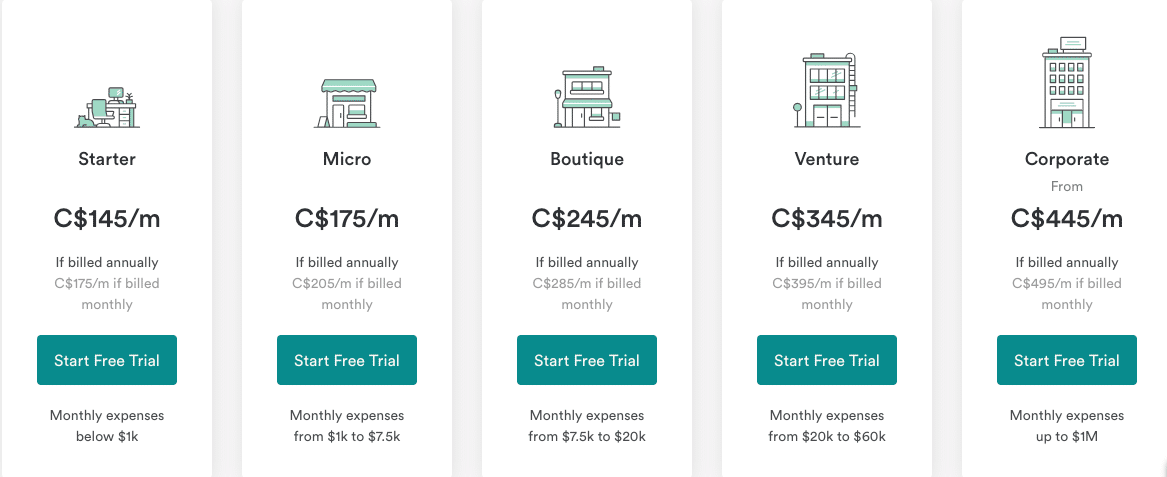

Here’s Bench’s pricing (shown in Canadian dollars with US pricing around 20% less than $CDN):

And Pilot’s advertised pricing is literally on par with this.

A typical firm is not going to be able to compete at these prices.

What it appears is happening is that these tech-startups are racing to create the most automated, but also, the most bare bones services available, at the absolute cheapest price possible. Get you in the door and onboarded quickly and standardize things to the absolute maximum in order to reduce price to the absolute minimum. It’s certainly a volume play.

Most firms are simply not modelled for this. They are not efficient nor do they have the right technology to automate and scale which presents a risk to many firms out there.

Purpose of the Funding

Let’s take a look at what this new breed of accounting tech startups are using the money for.

Bench

Per the 2018 press release, one of the investors, iNovia Capital, lists this as the reason for funding:

“This new capital will accelerate the development of Bench’s cognitive augmentation platform— a key element of the company’s ability to deliver incredibly high-quality yet cost-effective bookkeeping services.”

Pilot

Per a 2019 article on Index Ventures website:

“This Series B investment of $40 million will accelerate adoption of Pilot’s best-in-class bookkeeping service and fuel product development.”

Botkeeper

Per the 2018 press release:

“The Boston-based company currently supports nearly 1000 companies, and plans to use the funds to grow across engineering, sales, and marketing.”

There’s a common theme here. The money is being used for development of technology as well as for marketing. In other words, your marketing budget is not going to make a dent against these players and they are heavily investing in innovate technology to give themselves a competitive advantage that many smaller firms won’t be able to compete with.

Because of their deep pockets, going head to head with them is going to be exceptionally difficult if their model pans out.

Where Can the Smaller Players Compete?

Personalized service.

Sure, that concept may seem old school, but at the moment, these tech startups are geared for one thing. Volume.

They want to automate the whole experience and standardize things to the max. With that comes a dilution of the personal relationship that most expect to have with their accountant, bookkeeper and tax advisor.

There are still things that cannot be automated. High quality personalized advice can only come from knowing your client, their habits, their risk tolerance and their goals. You cannot automate this aspect of things. At least not yet.

Above I listed several attributes for what many of these accounting tech startups have in common. Do not get me wrong and let me be exceptionally clear; I believe these are very important and all firms today should be moving in that direction. My belief is that you will not be competitive in the years to come without these characteristics. But not all of you are going to raise millions of dollars to devote towards sales, marketing and technology. Winning the battle with these tech giants won’t be possible if you try to face them head on.

But, if you personalize your service more than these tech startups, you can win the battle on that front. That’s something the bigger players just won’t do well. Again, they are there for volume, scale and pumping business through their machine. By offering a hyper personalized service, you will be offering something that these tech startups won’t be able to feasibly offer. And with the right tools & technology in place, you can still offer your customers the modern service experience that they seek.

For years now, the industry has been saying to focus on advisory services rather than compliance services. While there is a lot of hype around this kind of statement for several years now, I do believe that offering very personalized services are a form of advisory as you get to know your client very well and can therefore offer them intricate services that some of these volume players may not dive deep enough into.

The benefit of a super personalized service is that you can usually charge higher prices (and therefore go upstream, which is not the market that these tech startups are targeting) and retain loyal clients over long periods of time, so you don’t have to battle with these tech companies when it comes to price (and judging by the pricing shown above, that’s a great thing).

At the end of the day, you are dealing with people’s money. People still want that personal connection and to feel that trust with their advisor. They don’t want to always talk to a robot and they want advice at certain times during the year. I am not saying that players like Pivot don’t have the abilities to offer a really personalized service. They do. But that’s not their focus.

We have yet to see the feasibility of these new models long term, but from the looks of it, they are here to stay and only intensify. If that’s the case, action is required to stay relevant long term.

Is offering a personalized service the only way to counteract these new accounting tech startups? No. There are other ways to set yourself apart and to not compete head on with these new offerings. The point of this article is to demonstrate that the current landscape is changing massively. You are no longer going against the Big 4 and other firms in your area but tech startups with tons of funding who are set out to offer a superior customer experience, with more technology and more marketing budget than you.

Even though new threats are presenting themselves, with the right strategy you can keep yourself relevant for years to come.

With QuickBooks offering a bookkeeper and CPA on demand, I wonder if these providers will also end up offering the personalised service for a premium.

Hey, it was very informative … thanks for sharing.

Amazing content.

Thank you for sharing us.

You’re very welcome 🙂

A helpful guide and amazing details, thanks for all this valuable information.

Brilliant article Ryan,

We are an M&A company and one of the assets we are selling is related to Accountants and Real Time Data Capture.

Have a look at:

http://Www.captova.com

http://www.scanov.com

We are looking for buyers like Bench, Pilot, Botkeeper and larger start up companies to acquire these assets

I have 2 questions for you though:

First are there many accountants using Real Time Data Capture? And if so what do they use the RTDC for?

Second question is where would we find start up companies that specialize with Accountants only in mind?

Best regards and stay safe..

Karim

http://Www.iveycorp.com

Hi Karim, thanks for reading. I’m not totally familiar with RTDC (or perhaps that exact terminology), so, unfortunately, I can’t provide much insight here. Best of luck.

Very impressive and informative article. Thanks for sharing

You’re very welcome!

Very good insights Ryan. Like you said, the ‘volume game’ comes at the expense of human touch. Now that ScaleFactor has flopped, I am curious to see how this whole idea is going to pan out.