One of my favorite kinds of services to offer small business clients are repeatable advisory services.

They match well with compliance services like tax and bookkeeping, they’re easy to offer and because clients wanted them, they’re also usually higher margin.

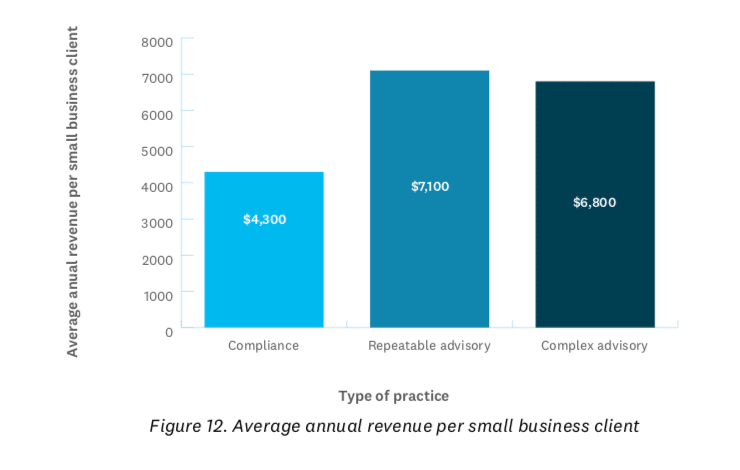

In fact, according to a recent 2020 report that I summarized, firms that offer repeatable advisory services charge 65% more per client than compliance-focused firms:

In this article, I’m going to discuss 4 simple tips for how you can boost your revenues by offering more repeatable advisory services in your firm.

Note: This post was sponsored by Receipt Bank. Everything discussed is my honest opinion based on personal experience.

What Is Repeatable Advisory?

Advisory work is loosely defined as charging for providing advice, which is typically analytical or forward-looking.

Repeatable advisory, therefore, is advisory work that you can perform on an on-going basis.

And I’m a big fan.

This is because you can have a standardized process to provide advisory service. The more standardized processes you have, the more smooth and scalable your operation will be.

By contrast, non-repeatable advisory work can be hard on your firm’s capacity since it’s usually a big project that must be delivered in one shot and there is no standardization involved, which means less efficiency.

The trick then is to find ways to deliver valuable advice on a regular basis and turn this into a service.

Below I’ll list 4 tips on how you can do so.

Tip 1: Make Bookkeeping a Staple

In a recent article, I stated that one of the keys to scaling your firm was to mandate bookkeeping across your client base.

But on top of that, the cornerstone of any valuable advisory service is having clean books that are up to date.

I argue:

The more bookkeeping you provide, the more advisory mandates you’ll find.

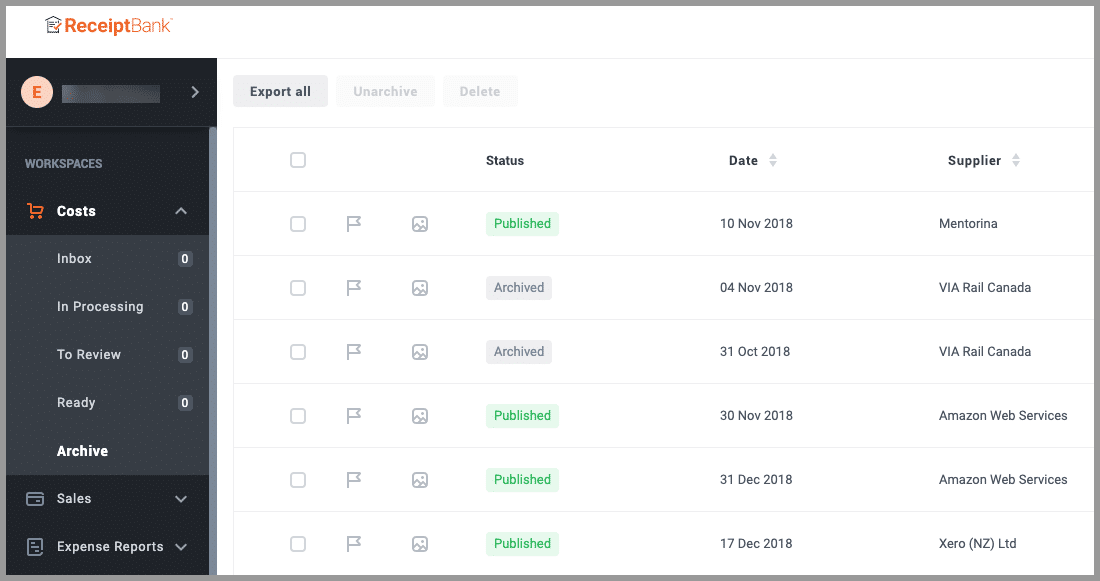

When I ran my firm, my favorite 1-2 punch to easily put together live accounting and expense data was Xero for cloud accounting + Receipt Bank for expense and bookkeeping automation.

We had a set process for Receipt Bank to ingest the data and get it pushed right into our accounting system:

And because of this, we were able to achieve a timely monthly bookkeeping close for our clients.

This means that you, as the advisor, are able to spot-check the data (using tip #2 below), find upsell opportunities, and then deliver on those opportunities far more easily when you offer bookkeeping versus when you don’t.

Tip 2: Productize What You Already Do

I see a lot of accounting firms turning their offering into a subscription model, which is great.

The problem is that they’re not always capturing the value of what they’re providing.

For example, clients typically have a lot of questions for you during the year. Some of them involve analyzing & advising on financial data to help with their decision making (which can be extremely valuable).

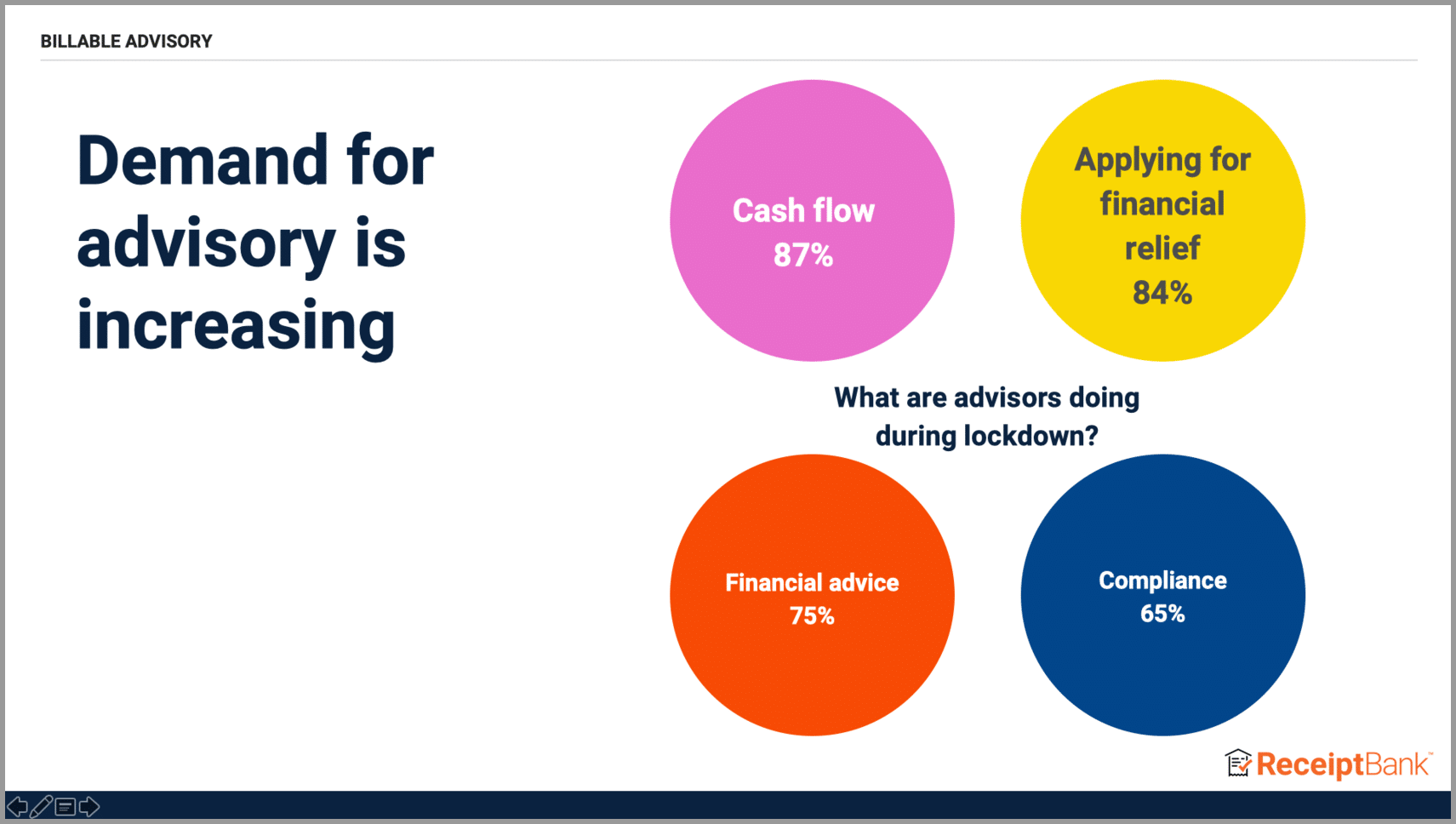

Receipt Bank ran a recent poll on 100 accountants to see what kind of advisory services they’ve been providing during COVID:

Three out of four are providing financial advice.

The question is, has this been included in your subscription plans?

If you want a very easy way to add a repeatable advisory service, the simple way is to take what you already do and include it as a line item in your plans. Then communicate the value of this service and provide different levels to the service.

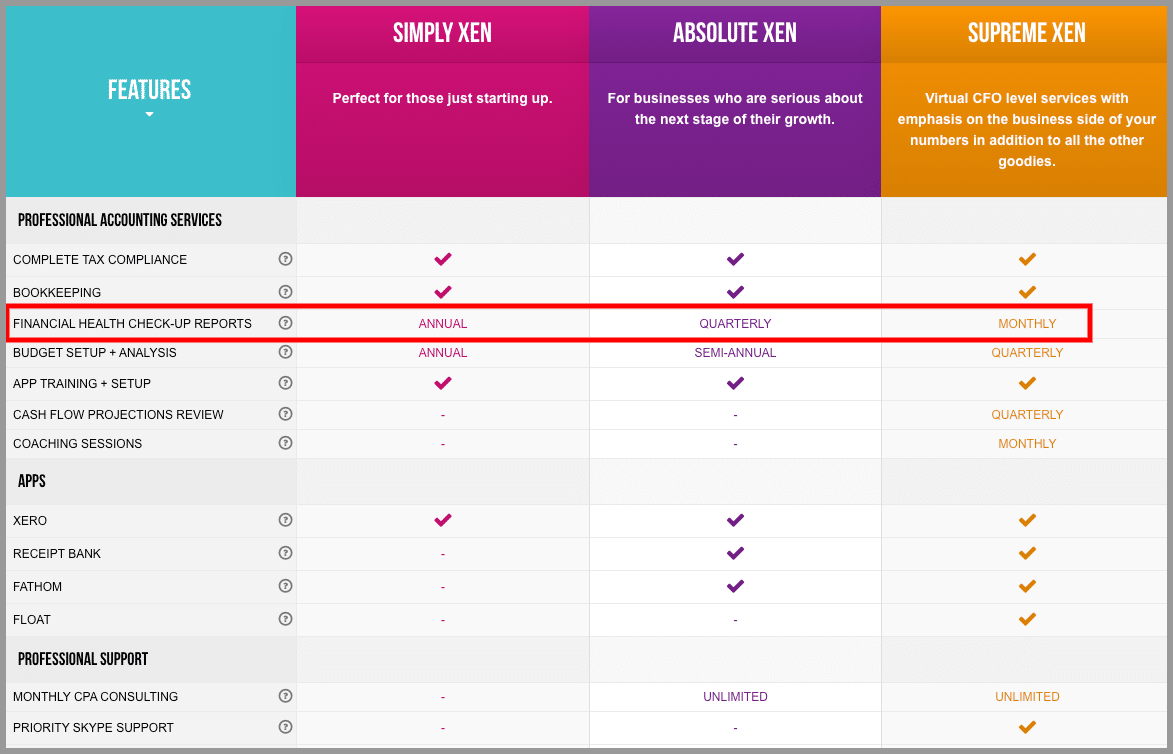

For instance, here was how I handled this in my last firm:

Basically, providing advice was formalized into a meeting with the client. Since the books were up to date (see tip #1 above), we were able to sit down formally to analyze their numbers, listen to where the business was going and support the business with advice to help them along the way.

You’re already doing this. You just need to formalize & structure what you’re already doing and build it into your plans. If you do it right, you can now start charging for this advice.

Tip 3: Turn Once-Off Engagements Into Repeatable

One of the reasons why my firm was acquired only 5 years after starting it was because I had a business model in place that ran like clockwork. To achieve this, I needed everything as standardized as possible and to balance the inbound clients we were receiving with our team’s capacity. To best manage our team’s capacity, we only focused on predictable, repeatable work (which in turn directly reflected our MRR – monthly recurring revenue).

So if a client came to me for help with a cash flow forecast, I wouldn’t just provide a once-off service here. I would turn that into a repeatable engagement.

How?

The once-off service would be to implement the cash flow forecast model. We’d gather the data and assumptions and then build out the initial forecast.

Then, I’d bolt on a recurring update to that forecast to take into account any changes happening in the business and their assumptions. That would either be an annual, semi-annual, quarterly, or monthly update.

Building out the forecast took time and was an initial hit to our capacity. But updating the model regularly allowed us to charge a monthly price and was actually quite easy to do since all the legwork was done.

Consider how you can turn once-off engagements into repeatable ones.

Tip 4: Implement an Annual Re-Engagement Process

Most accounting firms meet with their client once a year after year-end is over. By that time, spotting any upsell opportunities (and opportunities that help the client) is over.

By contrast, I advocate for a re-engagement meeting with each client before the year comes to an end.

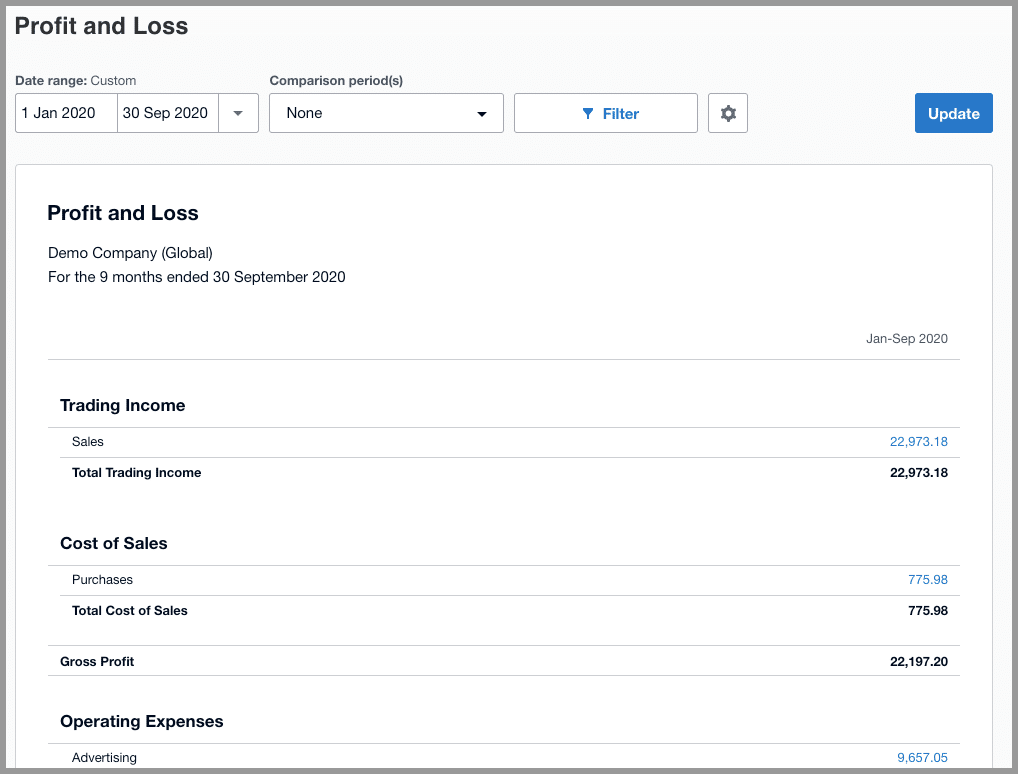

If you’ve followed my advice in tip #1 above, then you’ll already have a pretty good idea of what the YTD figures will look like just by glancing at the books:

You’ll then be able to engage in a conversation about where the business is heading in the upcoming year.

From there, you’ll be able to spot areas where you can further help (ex: help with their cash flow, provide more structured advice, help with financing, etc) and then upsell the client into a repeatable advisory arrangement.

Based on their needs, you can then construct a new monthly plan (including a new repeatable advisory service of course) to go live on the first day of their fiscal year.

Repeating Services for the Win

Because my interest was in building an accounting firm model that was smooth and scalable, I always focused on recurring, repeatable services. I avoided once-off mandates as much as humanly possible unless the team had excess capacity in a given period.

Hopefully the above tips help you achieve that same goal.