If you’re curious how much your firm is worth and how to increase your firm’s valuation, you’ll want to read this article on how to value a CPA firm.

I’ll also draw on my personal experience from selling my online accounting firm just a few years ago.

Let’s go!

Table of Contents

- How Do You Value an Accounting Practice?

- The 13 Factors Influencing the Value of a CPA Firm

- Marketing Strategy

- Growth Rate

- Size of the Firm

- Location

- Composition of Client Base

- The Quality of Your Team

- Recurring Revenue Model

- Use of Modern Technology

- How You Structure Your Deal

- Audit and Accounting Services

- CPA Firm Mergers and Acquisition Consultants

- Buyer Firms’ Service

- Level of Buyer’s Profitability

How Do You Value an Accounting Practice?

My firm Xen Accounting was acquired by a large European corporate services firm in 2018:

This process taught me a lot about firm valuations, and I want to share some of what I’ve learned in today’s article.

Before talking about the factors that increase/decrease a firm’s valuation, let’s take a look at a few valuable methods.

1) A Multiple of Gross Revenue

A multiple of gross revenue for the trailing 12 months is the most widely used valuation methodology in the profession.

Typically, one times revenue is the predominant multiple, but it’s possible to see higher or lower than this depending on the factors that we’ll be discussing below.

2) A Multiple of Net Cash Flow

Multiple net cash flow is a financial metric used to value a company by multiplying its net cash flow by a factor representing its market value.

The result of this calculation gives an estimate of the company’s worth. It is often used as a simple and quick way to compare the financial performance of different companies.

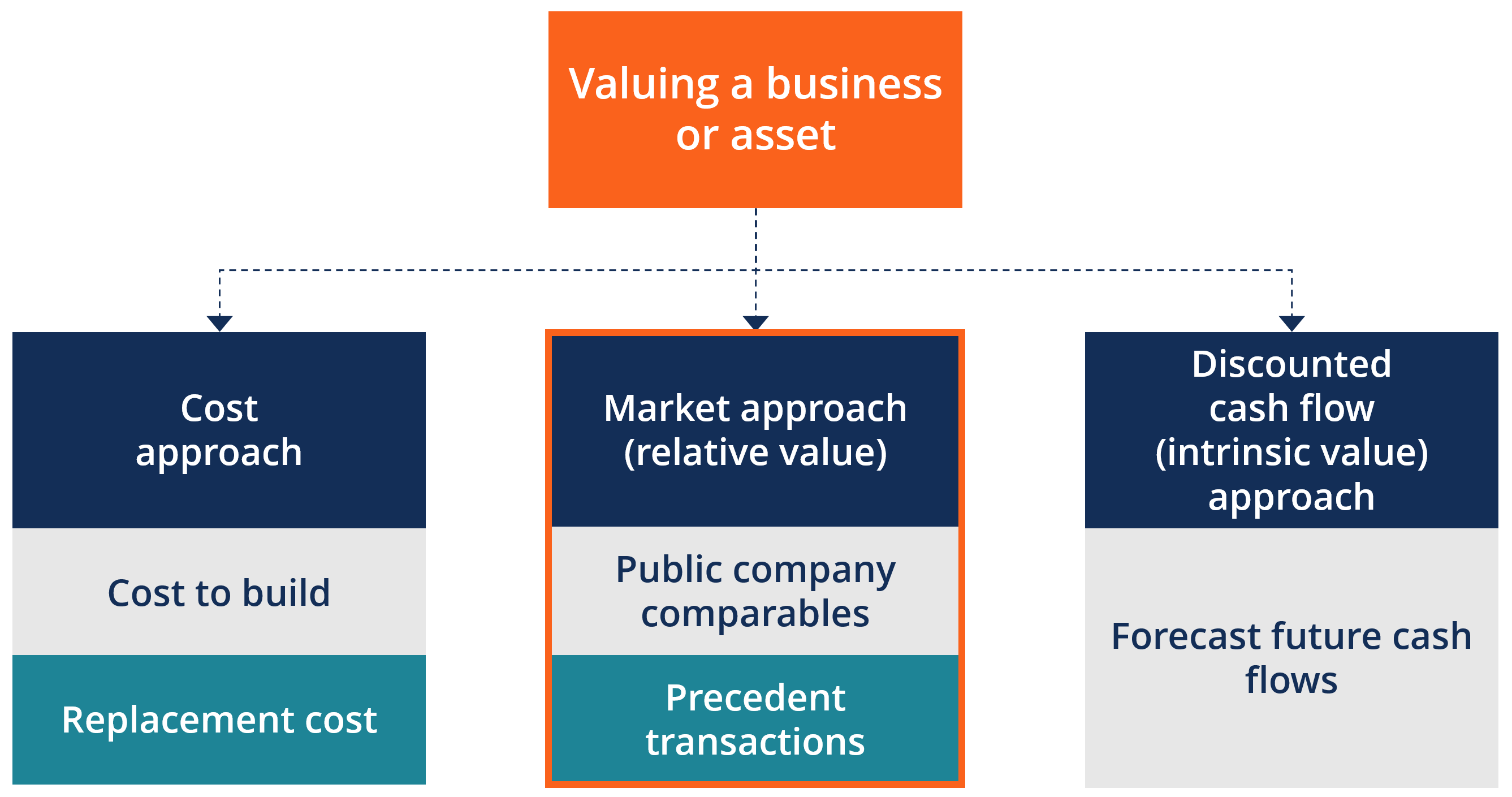

3) The Market Approach

One of the strengths of the market approach is that it is based on actual transactions that have occurred in the market, making it a reliable indicator of value.

The market approach values accounting firms by comparing them to similar firms that have sold in the past, using factors like size, location, services, financial performance, etc.

It’s considered reliable because it’s based on actual sales, but it may not work for all firms, and there should be enough comparable transactions.

4) Asset-Based Approach

The asset-based approach is a method of valuing an accounting firm based on its assets, including tangible and intangible assets and liabilities.

The valuator will estimate the value of the assets, such as property and equipment, and liabilities, such as loans or accounts payable.

This method is straightforward and objective, relying on quantifiable data, but may not accurately reflect the value of intangible assets or future economic benefits.

5) Cost Approach

The cost approach values an accounting firm by estimating the cost of reproducing its assets (tangible & intangible) and subtracting depreciation/obsolescence.

The valuation is based on factors such as acquisition cost, expected useful life, and improvements.

It provides a consistent and objective valuation but may not reflect the firm’s business operations or future benefits, especially for firms with significant intangible assets.

The 13 Factors Influencing the Value of a CPA Firm

Now that you understand how accounting firms are valued. Let’s take a look at some of the factors that might increase or decrease your valuation.

1) Marketing Strategy

Your firm’s marketing strategy will also play a role in its valuation.

Implementing marketing strategies that generate a steady flow of business is a good strategy not only for growth but also for a higher valuation.

2) Growth Rate

A CPA firm with a high growth rate of 30% per year is more likely to have a higher valuation compared to a stagnant firm with little growth.

This is because investors and buyers tend to look for firms with high growth potential, as they believe that these firms are likely to generate higher returns on their investments in the future.

3) Size of the Firm

The size of a firm is important because it impacts the number of potential buyers.

Smaller firms may generate more interest and, therefore, more potential buyers as the market for smaller firms tend to be larger.

The more potential buyers you have, the better price you will likely get for your business. On the other hand, a small CPA firm might lose value if the perception exists that it is not large enough to support the buyer.

4) Location

Urban areas often have a larger and more diverse client base, as well as a larger pool of potential employees, making them more attractive to potential buyers.

However, a CPA firm located in a rural area may be less expensive to operate and may have a more loyal client base, which can also increase its value.

When making business decisions, it is important to carefully analyze how the location of a CPA firm will ultimately affect its value and marketability.

5) Composition of Client Base

Other factors to consider are the kind of clients that the company attracts.

If you’re looking for CPA firms or CPA practices that have strong consulting specializations, it’s important to know who their clients are. If you have a specific niche market in mind, you should check to see if the firm has worked with companies like yours before.

6) The Quality of Your Team

Buyers will evaluate the strength of your team when purchasing a firm.

A firm with highly qualified individuals on the team who can deal with the clients themselves will fetch a higher valuation than those with more junior-level team members who might not have been there for a very long time.

7) Recurring Revenue Model

A recurring revenue model occurs when the firm charges its clients, ideally on a fixed monthly basis. This ensures that revenues are predictable and less risky for the buyer.

If there isn’t a steady stream of clients or if the clients don’t come back, the valuation of the practice will usually be less.

For example, tax and accounting practices that make a lot of money from one-time things like tax planning projects may not be worth as much as one that has discovered a method to turn their one-time revenue into a more recurring revenue model.

8) Use of Modern Technology

Technology counts. Premium buyers don’t want a manual, paper-based operation. They want a machine, which often requires the latest technology.

Cloud accounting software like QuickBooks Online, for example, can help automate your processes, which can boost your valuation.

9) How You Structure Your Deal

If you’ve negotiated an earn-out to earn a portion of the firm’s value based on the achievement of certain milestones, the buyer will be more willing to pay a premium.

But it also puts you at a higher risk.

This is how you structure your deal to raise your firm’s valuation:

a) Upfront Cash Investment

The down payment for a straight sale is between zero and twenty percent of the anticipated selling price.

Several operational factors can significantly impact the amount of a buyer’s down payment.

For instance, closing on a tax-focused practice just before tax season is more likely to necessitate a down payment than closing on the same practice before tax season.

Accounts receivable: Most sellers expect to keep the money they are owed for work they have already done and work that is still in progress.

It makes sense. But think about how the buyer will have to replace those funds, leading to a negative cash flow from operations.

If bought clients are slow payers, the situation worsens. This means the buyer could wait months before getting paid.

Buyers are willing to make larger down payments for the practice if the seller is willing to loan the accounts receivable to the buyer for a while after the sale.

Once there is a positive cash flow, the buyer pays the seller for the accounts receivable.

Financing from the bank: Banks have made it harder to get credit, which makes it harder to finance purchases. As a result, there has been a trend toward smaller payments upfront.

If the buyer wants to avoid paying a lot up front, they may not want to buy the practice if it needs a lot of money to be spent on it, like upgrading technology.

b) Client Retention Periods

Some buyers may require a clause that part of the selling price is withheld and only paid out based on the retention of the purchased client base after a certain period of time.

These types of retention clauses may actually help improve the firm’s valuation since the buyer is able to hedge their risk, though this does place additional risk on the seller.

c) Duration of the Payout Period

The length of the payout period is how long it will take for the seller to get all of the sale money from the buyer.

For small firms, payment terms can be as long as five to seven years, while other firms may have payment terms as short as upfront.

Larger firms tend to have longer payment terms which have a higher valuation.

Why? Because buyers tend to evaluate the profitability of a purchase of a practice based on the cash flow that will be generated.

The longer the payout period, the smaller the purchase payments and, consequently, the greater the annual cash flow generated by the transaction.

A deal that will take three years to generate positive cash flow is difficult to sell to the partners of acquiring firms, especially considering the upfront integration costs the firm will incur, which will affect the multiple.

d) Buyer’s Expected Profits

The profitability variable is based on the anticipated profits of the buyer, not the seller’s historical values.

Profitability for the buyer and multiple for the seller could increase if the buyer anticipates:

- To acquire a company with minimal or no incremental overhead expense increases

- Capitalizing on cost synergies, such as rent reduction or renegotiating an existing office lease

When combined, the four variables listed above – initial cash investment, retention period, payout period duration, and profitability – produce the multiple used to value a practice.

For instance, a for-sale company with less initial capital, a longer retention period, and a longer payout period should have higher profitability for the buyer and a higher multiple for the seller.

10) The Synergies Between Buyer & Seller

Buyers may benefit from synergies.

If you offer cloud accounting services and the buyer concentrates on advisory services, your product may be a fantastic fit because your clients may naturally transition into their offering, giving the buyer many opportunities to upsell and cross-sell.

If you want to boost your company’s worth, target organizations where your model fits nicely.

11) CPA Firm Mergers and Acquisition Consultants

Consultants specializing in mergers and acquisitions are frequently qualified accountants who can advise you on the timing and pricing of your transaction.

They may also act as a broker, help you attract buyers, and also help play a role in your firm’s valuation.

12) Buyer Firms’ Service

Many firms can provide a wide range of services.

Among the main services are:

- Bookkeeping

- Tax and Accounting Services

- Auditing

- Other services like payroll and human resource management

Some businesses mainly serve consumers and small business owners, while others serve medium-to-large-sized businesses.

If you think your CPA practice is similar to the clients that your buyers offer, your valuation will be higher.

13) Level of Buyer’s Profitability

Buyers want a profitable company. Profitability increases valuation. If your margins are low, focus on boosting margins before selling your firm.

Remember that If your company is more profitable and has a higher margin percentage, it will fetch a higher valuation.

What is Your Firm Worth?

Hopefully, the article above provides some guidance on the factors that sellers are taking into account when it comes to valuing your firm.

Have any questions?

Pop them into the comments section below!

Hi Ryan, well done for providing these insights.

I own a firm and have already gone through 3 acquisitions, and we are working on the 4th, which is a firm that is our size, that is 80 headcount.

The guy does not have a succession plan in place, is 58 years old and is fed up with running the business. In this regard, we offered him approx 0.75 of one year’s revenue with the pretext that we would run the business for him and that the transaction needed to leave enough cash runway as a stand-alone.

Taking a very high-level perspective, what do you think?