Busy season accounting can in many ways seem unavoidable, but it can be manageable with the right approach.

In this post, I’ll lay out 10 simple tips your firm can implement to keep yourself sane and to avoid you from working long hours during the busiest time of the year.

Table of Contents

- Why Does Busy Season Accounting Happen?

- 10 Tips to Master the Busy Season

- 1. Make sure your clients have clear deadlines

- 2. Implement capacity planning (at least) several months in advance

- 3. Fire unprofitable clients

- 4. Use 3-Tiered Pricing to Control Capacity

- 5. Increase your pricing across the board

- 6. Review your core processes in advance

- 7. Optimize your work habits

- 8. Automate as much as possible

- 9. Use Loom to replace meetings

- 10. Prioritize your self-care

Why Does Busy Season Accounting Happen?

During the audit busy season, it’s almost a given that most public accounting firms have their hands full. The increased workload and tight deadlines can put immense pressure on professionals to deliver accurate and timely financial services.

A dreadful busy season full of long hours, working at night, and time away from family and young children starts with one big mistake: poor planning.

The reason is that everyone, including your clients, knows the critical tax days in advance for tax returns and other deliverables, which should give time to make a plan. The tax and audit busy season dates are typically from January to April for accounting professionals.

With a proactive plan in place, you should identify:

- The resources you need to allocate

- The amount and types of projects you’re willing to take on

- How much growth you’re ready for

Without a plan in place, you’re likely to get bombarded with tasks with no way to filter them out. This is a recipe for disaster, as you’ll accept any type of client with no focus, leading to a big mess.

It is for this reason that during tax season, being intentional with your actions makes the difference in how you survive the period. In fact, improving and avoiding the tax season mindset better prepares your firm for the future. This means setting clear expectations with your clients so you can say “No” to unscheduled requests and follow your plan.

10 Tips to Master the Busy Season

As mentioned, many potential actions exist for avoiding a busy and overwhelming season for domestic and international certified professional accountants.

Here are ten proactive action items for your next tax season.

1. Make sure your clients have clear deadlines

If you’ve ever experienced a problematic tax season, tracking client information has likely been a root cause. Solve the problem by implementing a simple 3 step communication process that helps your clients understand what their deadlines and responsibilities are to help you manage your workload.

While tax time is at the top of mind for your clients at a specific time of year, there is nothing stopping you from making your firm’s work a year-round process. That means training your clients to provide documentation, stay up-to-date, and be ready ahead of time for the documents you’ll need. Time management is crucial, so let go of things that waste your time.

2. Implement capacity planning (at least) several months in advance

Capacity planning is the practice of having a clear way to measure how much work you have and how much you actually get done (with the current team). If you are constantly flooded with work and your team is overworked, it’s probably due to poor capacity planning.

You can’t do this just hours, or days or even a week before the busy season because the reason why it is critical to plan your capacity several months in advance is that it will give you a realistic view of how much work you’ll be able to complete during tax season. Based on this, you’ll ensure you don’t overcommit to work where you’re unable to complete it all. Or use this data to staff accordingly for the additional influx of work.

3. Fire unprofitable clients

The reality is that not all clients in accounting firms are good clients. Some just end up being a complete pain to deal with and end up taking up a disproportionate amount of your time.

The takeaway: Make sure every client you have is profitable before the busy season hits. If this isn’t the case, you need to let them go or manage their service expectations.

4. Use 3-Tiered Pricing to Control Capacity

Three-tiered pricing is a strategy that simultaneously helps you improve your margins and free up your capacity.

With three-tiered pricing, you can get creative by delivering work in different ways so that not every single client gets the “premium” offering (which drains your capacity) at suboptimal prices.

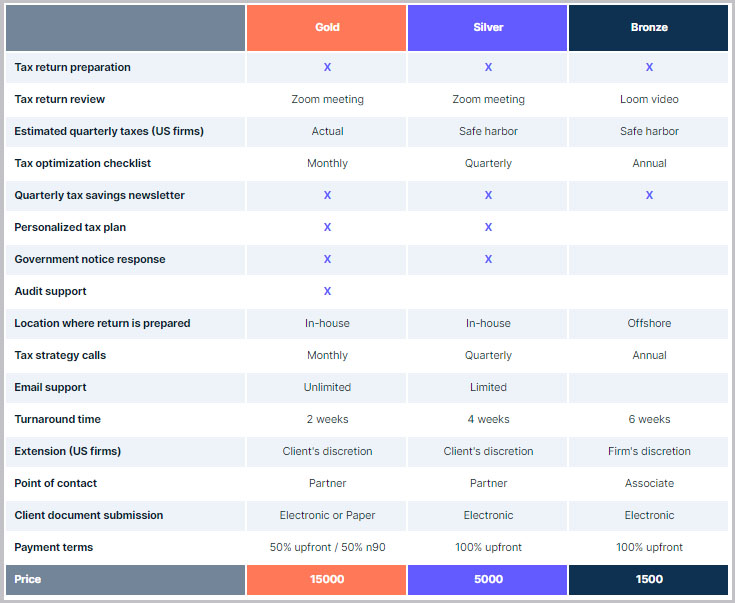

As an example, your Gold plan might include meetings to review the client’s tax return before filing it whereas your Bronze plan might only include support for email questions.

When done right, three-tiered pricing will not only boost your prices but protect your precious capacity.

For an in-depth look at three-tiered pricing in your public accounting firm, check out this guide.

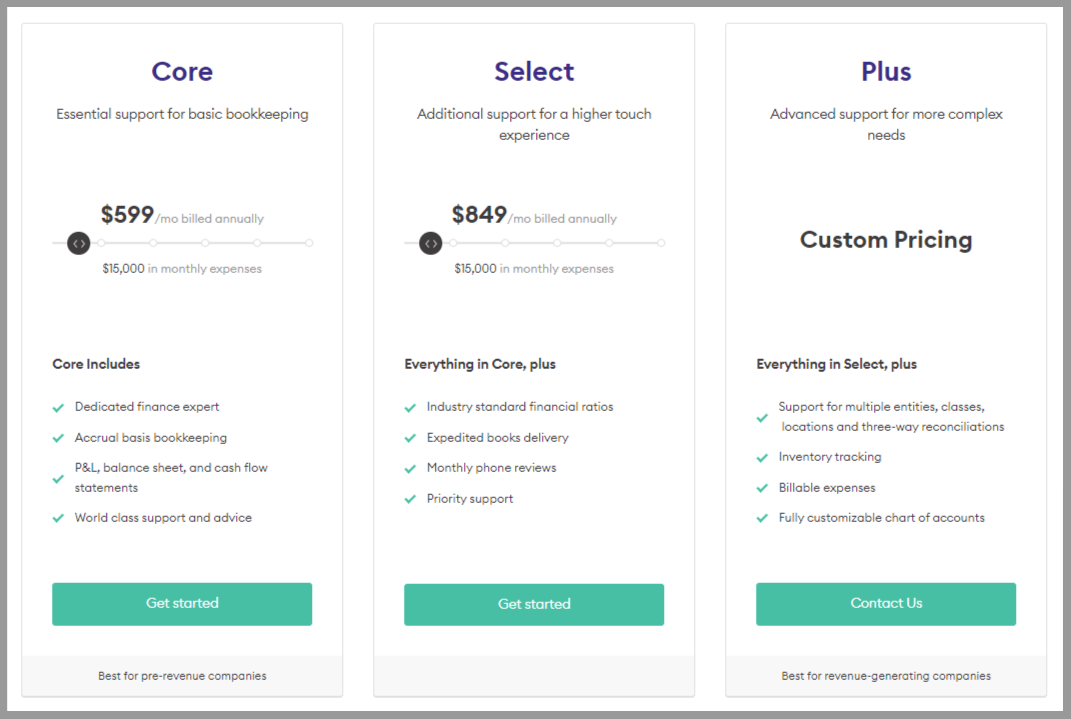

Also, here’s an example of 3-tiered pricing from Pilot:

5. Increase your pricing across the board

I’m not done with pricing yet! One of the best ways to help with accounting busy season is simple: charge more!

Increasing your pricing will have two outcomes.

The first is that you’ll automatically increase the amount of revenue per client. The second is that the price-sensitive (and usually capacity-heavy) clients will probably leave.

This is a win-win scenario for your public accounting firm since, as discussed above, unprofitable clients are one of the main culprits of an exhausting accounting busy season.

To be fair to your clients, make sure you communicate your price increase in advance. This way, you give them enough time to consider their options and find another firm that might be a better fit for them.

Hear my full thoughts on how to increase your pricing in this podcast episode.

6. Review your core processes in advance

Whether this is your first busy season or not, having a series of processes that helps you get consistent results is one of the keys to running an efficient firm. Put differently, if any of your core processes have a gap, then this process will bog you down when you are at your maximum capacity.

It’s for this reason that taking the time to analyze and measure how efficiently your core processes are running, in advance of a busy season, makes a significant impact on how you tackle the tax season.

7. Optimize your work habits

Hopefully, you’re doing this year-round, but the busiest time of the year gives you the opportunity to evaluate how you work.

In general, we are all becoming more distracted, and it’s hard to stay focused on tasks. This affects us at work and especially has an effect on productivity.

Take some time to evaluate how your personal work habits are serving you.

Do you try to multi-task too much?

Do you feel the need to immediately respond to e-mail or Slack?

Do you start the day without a clear list of priorities?

Work on eliminating waste, and being present as much as possible when you get into your workday. Then, hopefully, you can relay this expectation to your team and create an organizational sense of calm and focus.

By consciously working on improving your time management skills and implementing strategies to stay focused and organized, you can maximize your productivity and efficiency not only during the busiest time of the year but year-round, ultimately achieving a better work-life balance and professional success.

8. Automate as much as possible

Technology and automation are playing huge roles in making our lives easier. The key is to use it to your advantage without getting overwhelmed (I mean, there are 147 apps you could be implementing!)

So where to start?

First:

You need to document your processes. By getting granular about the specific tasks you and your team are doing on a day-to-day basis, you can identify the most repetitive tasks.

Second:

Try to subtract rather than add. If the goal is to simplify the busy season, look for areas to apply automation (ex: using robotic process automation in public accounting) that free up time. This sounds obvious, but sometimes there’s a temptation to add a new tool or any accounting software that is purely an additional “nice-to-have.”

Many compliance and data entry tasks can be automated, allowing your people to free up time to focus on communication and other accounting services. Start there.

9. Use Loom to replace meetings

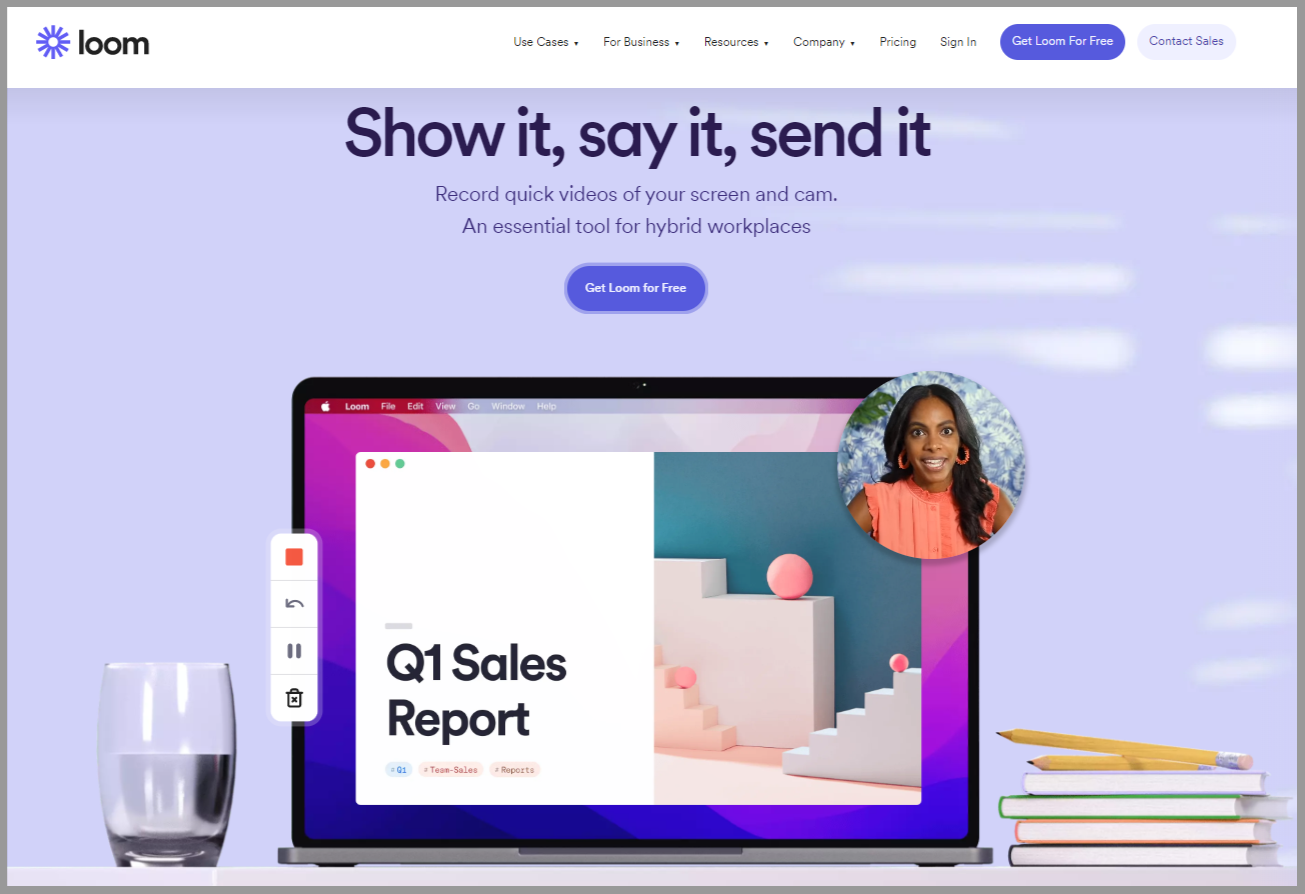

During busy seasons you should avoid meetings like the plague. They are time-consuming and get it the way of you and your team getting work done. The problem is that sometimes you may need to convey an amount of information that isn’t practical via email. This is where Loom comes in.

Loom is a screen and video recording software that makes it easy to record quick explanation videos. This way, you make sure everyone knows precisely what you are talking about, and avoid a meeting. Also, Loom has a free version to start.

10. Prioritize your self-care

As tax accountants, recognizing the significance of self-care becomes even more crucial due to the demanding nature of the industry, regardless of the season.

You are the most valuable asset your firm has. This means that running yourself to the ground grinding day in and day out is not a sustainable move. Even though most accountants justify going through an unsustainable work pace, it’s essential to understand that doing this will have negative repercussions in the future.

Prioritizing your self-care is the best thing you can do for your wellbeing and the long-term growth of your firm. You should always feel free to do this. So make sure that whatever healthy habit you have implemented in your life, you keep on doing it during the busy season.

So, make sure that whatever healthy habits you have established in your life, you continue to practice them, even when things get hectic during the tax filing season.

Final Thoughts on Making Yourself Less Busy

It shouldn’t come as breaking news from a freelance writer or news outlet that busy seasons are tough on you and your team. It’s a time of year where the workload is higher than normal, but that doesn’t mean that you or your team have to dread it.

The reality is that if you are proactive about how you tackle the challenge, you’ll find that there is plenty you can do to make the busy season much more manageable.