This post is going to describe what client accounting services are and how to launch this offering in your own firm.

(Step-by-step)

In fact, I attribute being able to quickly scale my firm from scratch to sales in just 5 years mostly due to the client accounting services (CAS) offering in place.

So in today’s post, I’m going to show you exactly what CAS is and how exactly I’d recommend getting started:

- What is CAS?

- Benefits of CAS

- Step #1: Master the Core Technology

- Step #2: Adjust Your Sales Process

- Step #3: Bundle CAS into a Subscription Offer

- Step #4: Develop Standardized CAS Delivery Processes

- Step #5: Develop SOP’s for each Client

- Step #6: Plan Your Capacity

- Step #7: Invest in Reskilling

What are Client Accounting Services?

You’ll find a whole slew of definitions of CAS on the internet.

But let’s keep it simple.

CAS is simply where you act as an outsourced accounting services department for your client.

Think about what an internal accounting department handles:

- Bookkeeping

- Bill pay

- Collecting receivables

- Processing payroll

- Managing cash flow

- Preparing financial statements

The above work is usually performed by an accounting technician and controller on a weekly or monthly recurring basis (rather than annually).

Some would also say that CFO-level work should be included in a CAS offering, but I actually believe that it fits more within the advisory services offering. While that argument can be made, for the purposes of this article, I’m sticking more with technician and controller work.

Over the years, accounting firms have not wanted to offer this kind of service. It was viewed as low-margin, inefficient, and a distraction from the core audit, tax & advisory offerings.

But the tides are turning.

Based on a recent Accounting Today Top 100 Firms article, CAS was one of the fastest-growing accounting service niches:

Benefits of Cloud Accounting Services

Here are just a few:

Easy Upsell into Advisory

If you’re essentially your client’s virtual accounting department, you have a pretty good finger on the pulse of the business to be able to easily spot advisory upsell opportunities.

Demand is High

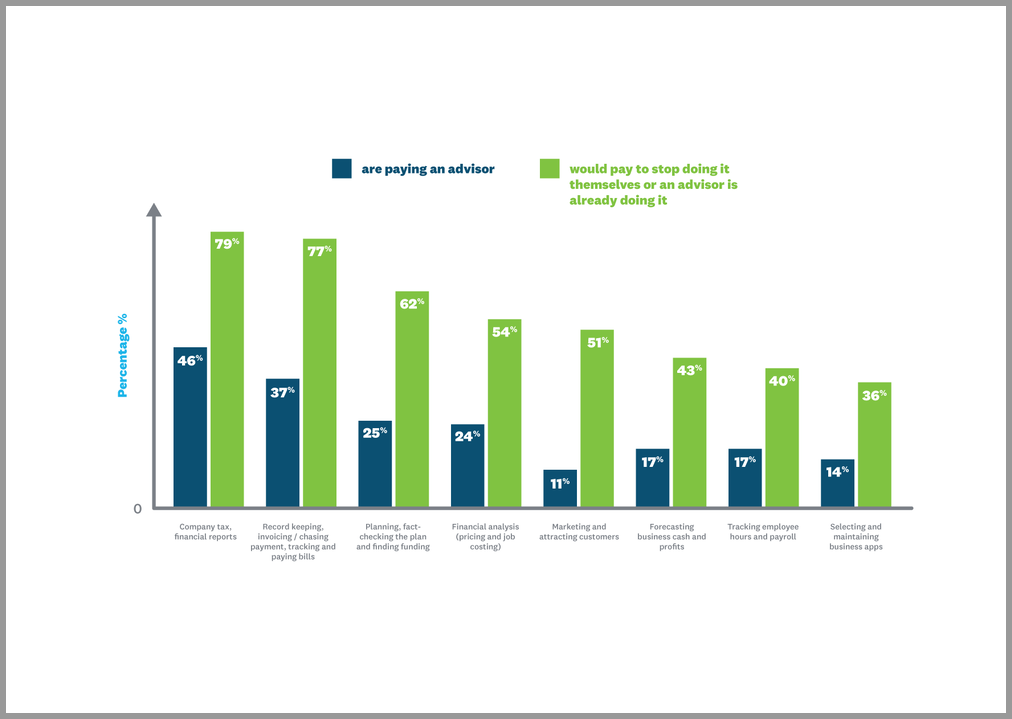

According to a recent Xero survey, 77% of business owners would pay someone to stop doing many CAS-related activities. This seems like an easy sell.

Standardizing Your Accounting Firm is Far Easier

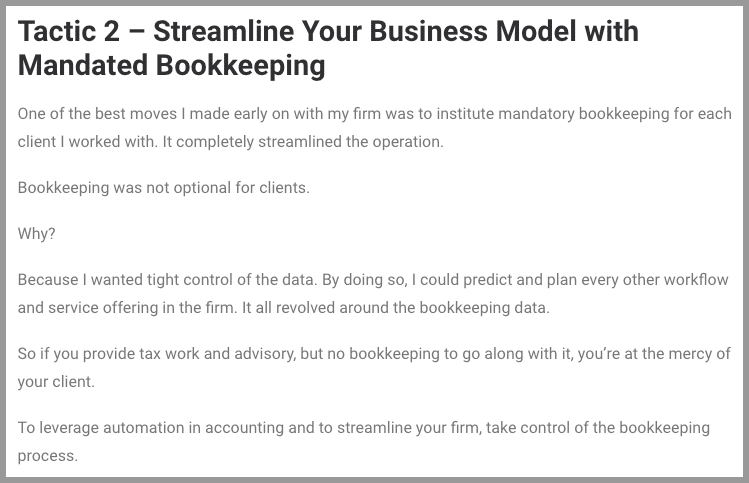

When you standardize, you can scale. One of the keys to standardization is eliminating as many variables as possible. When you provide client accounting services, you control the workflow and the data. The more you control internally, the more you can standardize.

Here’s what I had to say in my article on the 11 tactics to automate your firm:

Increased Client Stickiness

The more services you surround your client with, the harder it is for them to leave 🙂

Greater Efficiencies in Compliance Work

It’s a lot faster to complete your books and payroll compliance work when you’ve been the one handling them. These time savings translate to cost savings, boosting margins.

Improved Customer Experience

Client Accounting Services help foster a closer, deeper relationship with your clients as you are an integral part of the day-to-day business management.

How to Get Started with Client Accounting Services

Step #1 – Master the Core Technology

A solid CAS offering can only be successful when you’re automating as much as possible.

Punching numbers into a computer is dead.

One of the reasons why CAS is growing so fast is because technology can be leveraged to handle the heavy lifting of data entry. You then essentially become a manager of workflows.

And while there are tons of cloud accounting apps out there to help you automate these workflows, you’ll need to pick your core apps and become a power user of those apps.

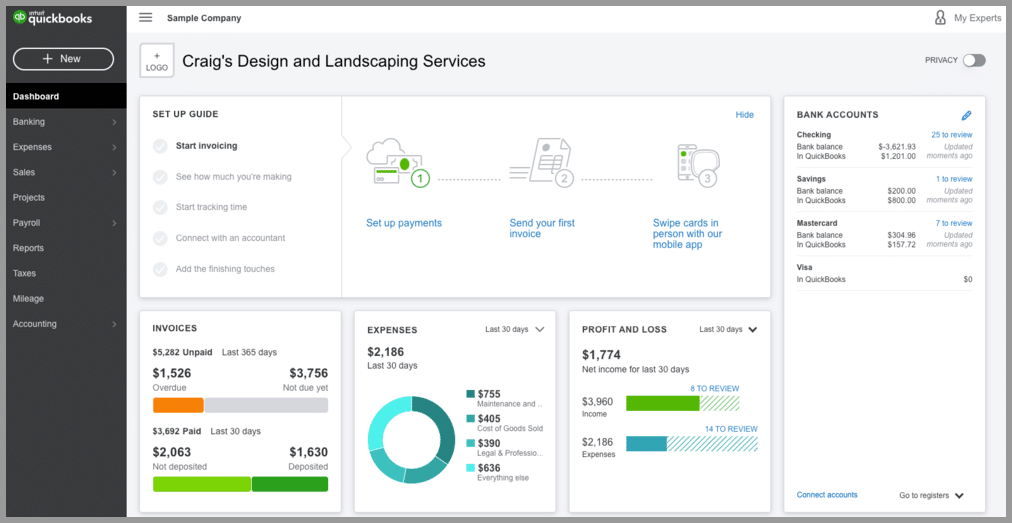

At a minimum, you’ll need to leverage cloud accounting software to automate the bookkeeping and to act as your automation hub for all other workflows that you’ll be taking over for your client.

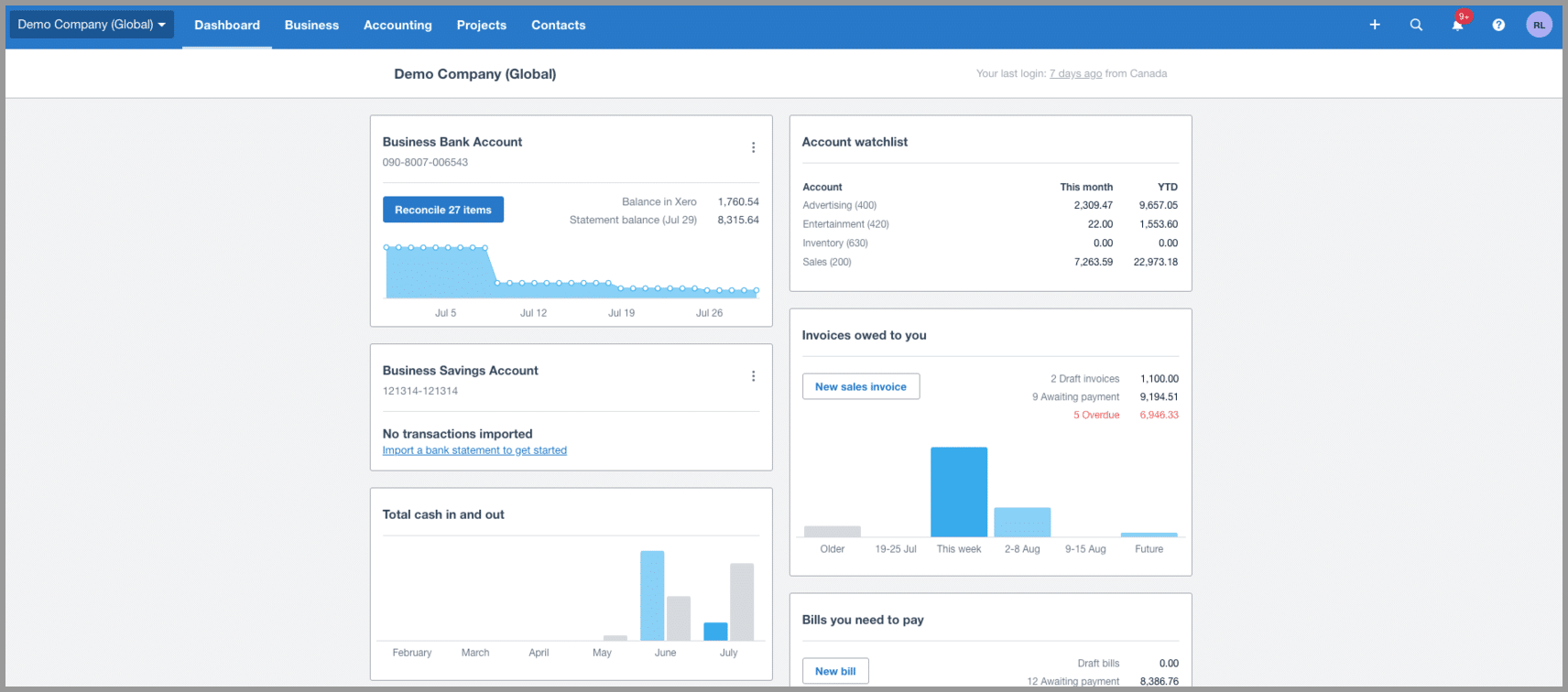

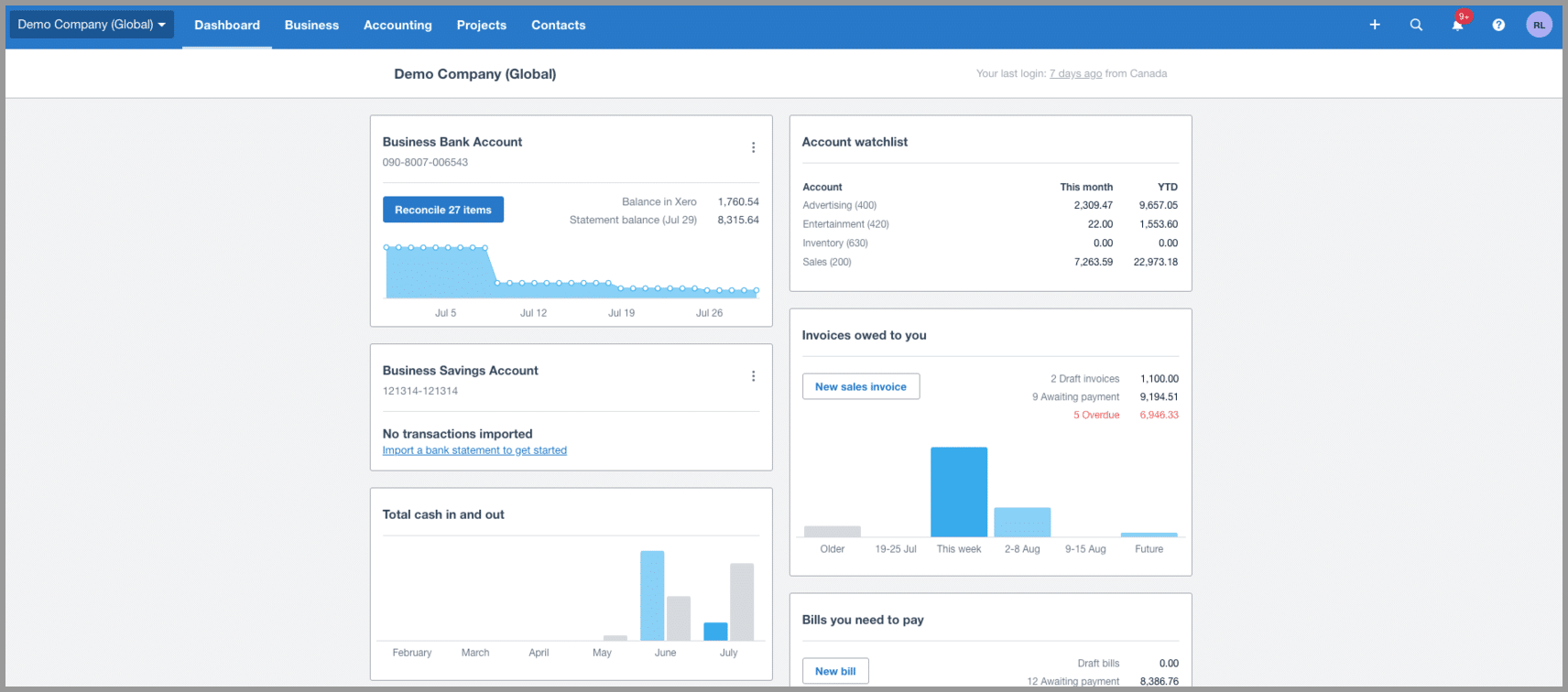

When it comes to cloud accounting software, consider Xero:

Past that, my suggestion is to ease into the technology by mastering 2-3 move apps that integrate with Xero/QBO, depending on the workflows you’re taking over as part of your CAS offering.

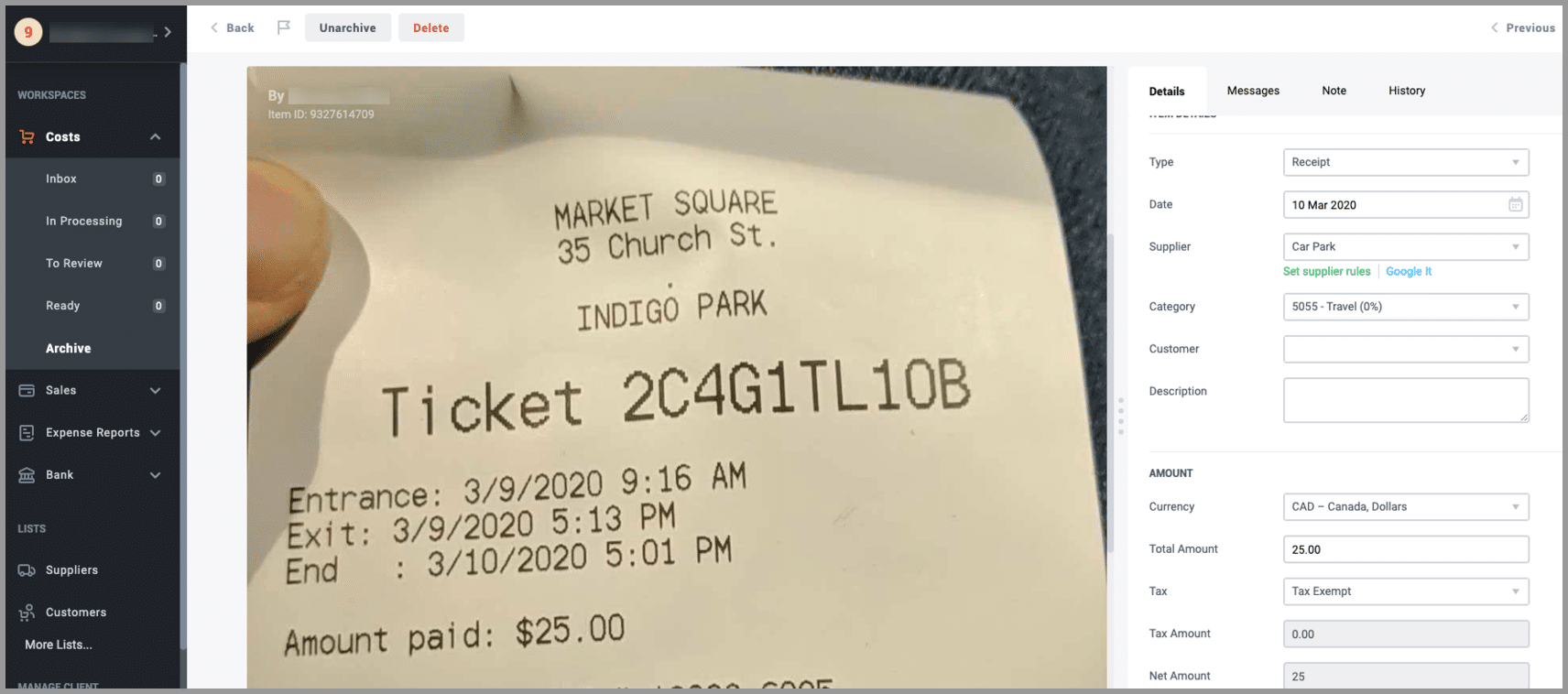

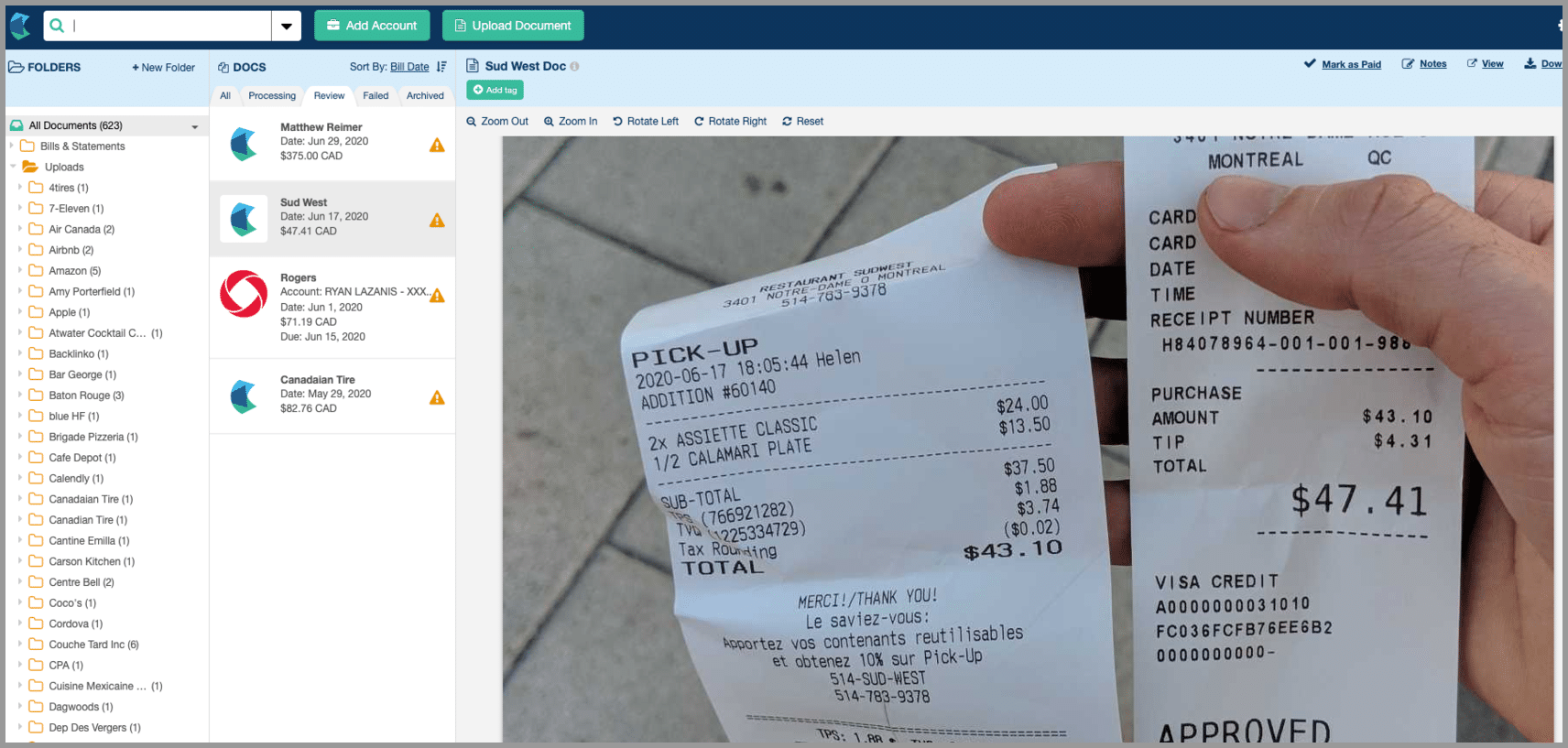

If you’re looking to automate expense management, consider Receipt Bank:

Or Hubdoc:

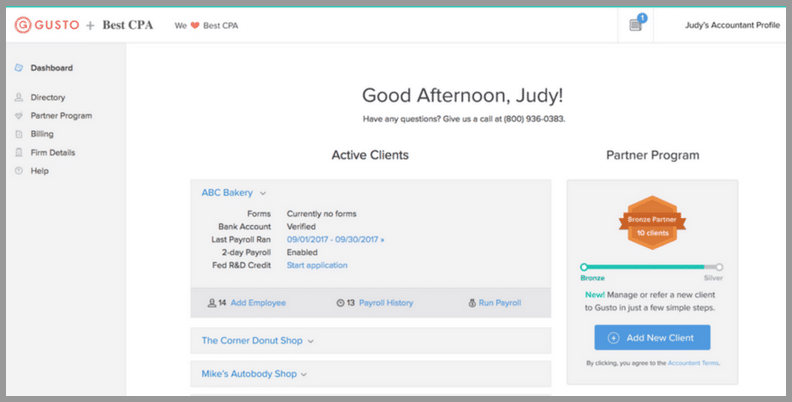

For payroll, check out Gusto in the US:

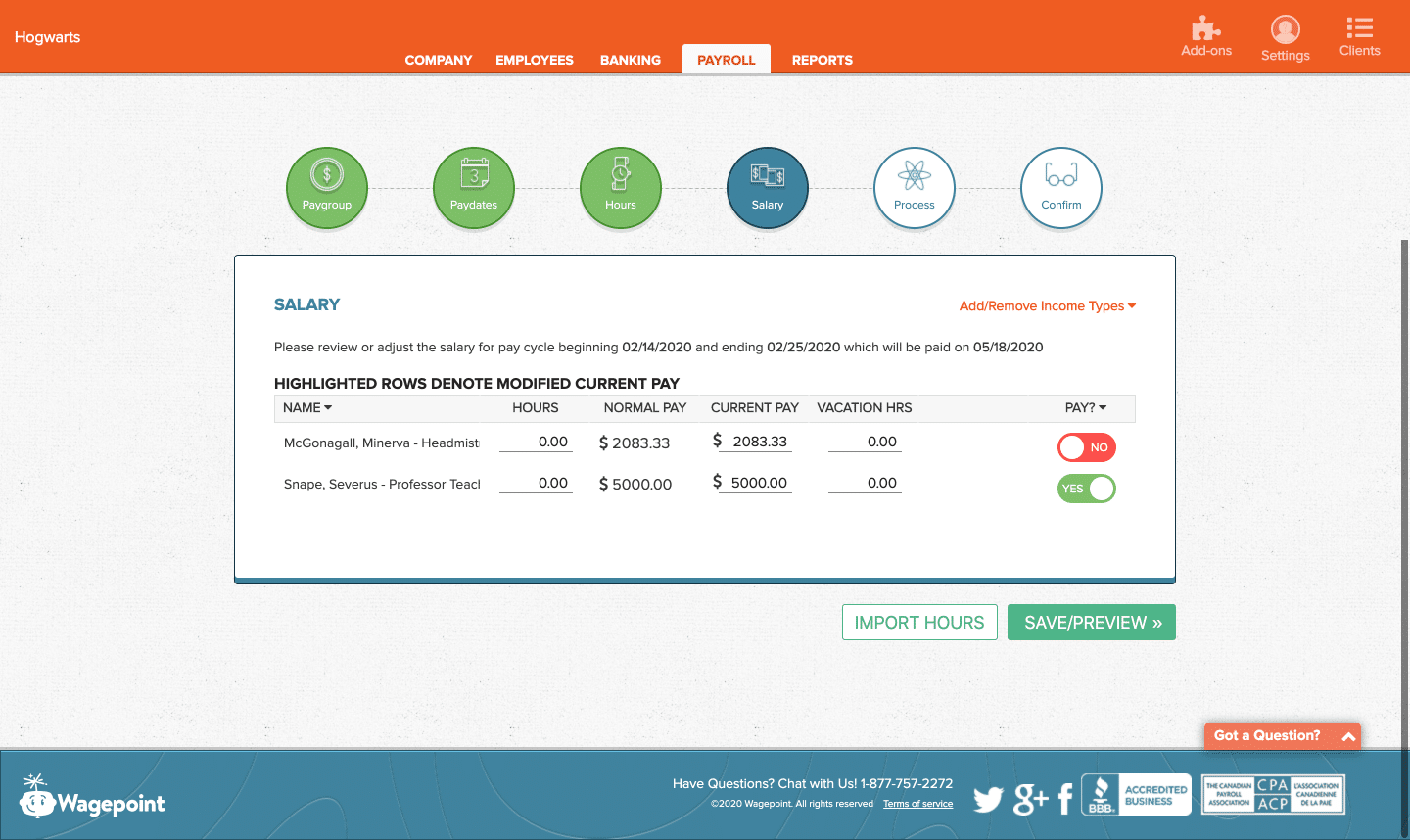

Or Wagepoint in Canada:

And these apps are really just the tip of the iceberg…

The point is to identify your core technology at the beginning and master them in order to be able to leverage the automation benefits necessary for CAS.

Step #2 – Adjust Your Sales Process

The needs analysis that you’ll perform when offering a CAS service will greatly differ from a needs analysis that you perform when you’re selling a tax plan or a once-a-year financial statement.

That’s because, at the core of it, client accounting services centers around taking over workflows. And a successful CAS offering should make those workflows as smooth and as efficient as possible.

So the sales process has to assess their current workflows and be able to visualize what the ideal workflows will look like, all supported by the right technology identified in Step #1 above.

Here are examples of processes that you’ll need to understand depending on the CAS offering:

- The revenue streams, how invoices are created and how money is collected

- Types of expenses and how bills are paid

- How many employees the company has, how often payroll is run, how the payroll file is assembled and how payroll is paid out

- Etc.

In this step, you really need to visualize how you’ll take over those workflows and how you’ll improve your client’s current situation. This is basically what they’re paying you for.

Step #3 – Bundle Client Accounting Services into a Subscription Offer

Because you’re now delivering value and services on a recurring basis, you’re in a great position to start charging your clients a monthly subscription.

And to do that, you’ll need to productize your services.

A good way to think of it is to define, upfront, the services, apps, and support that you’ll perform on a regular basis and then determine a monthly price for your services.

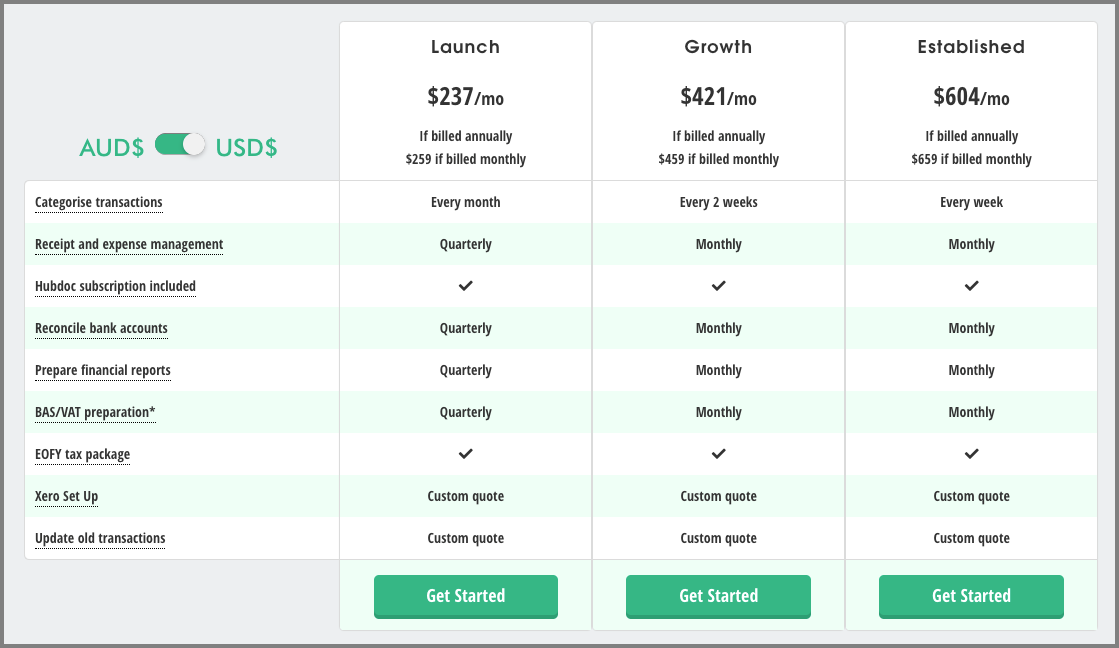

Here’s an example of how Bean Ninjas in Australia productized their bookkeeping offer:

Step #4 – Develop Standardized Client Accounting Services Delivery Processes

CAS can be a very repetitive kind of service offer. So the key to success, your margins, and your client’s satisfaction is to ensure that each repetitive process is delivered in the same way, each and every time.

This is actually easier than it sounds. The problem is that most firms don’t take the time to process map upfront.

It’s simple.

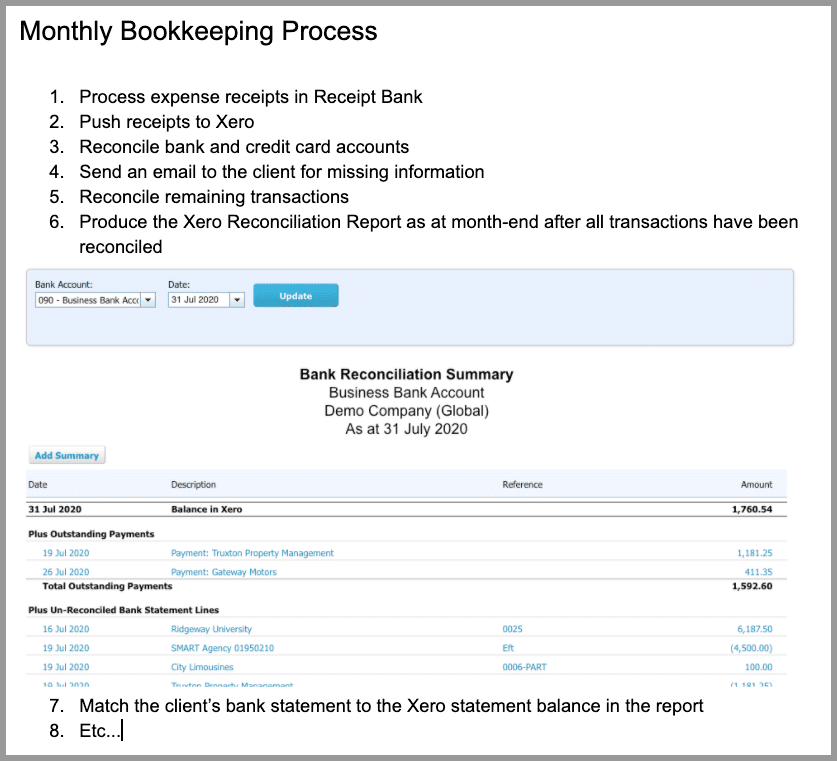

a) Take someone experienced on the team that has performed that task countless times

b) Ask them to write out the detailed steps (with screenshots) to perform that task the next time it needs to be completed

Example:

c) Review the steps to see if anything can be optimized and adjust the process as necessary

d) Store these processes in a central location (ie. a knowledge base) for everyone to refer to

e) Train the team

f) Review the process quarterly to make sure it’s being tweaked for further optimizations

If the service is totally new and item a) can’t be done, then handle the service yourself in that first one or two periods, work out the kinks, and document things yourself.

That’s it.

Step #5 – Develop a Standard Operating Procedure for Each Client

In Step #4, you’ll have developed a firm-wide standard operating procedure (SOP).

But we all know that each client is unique.

The trick in this step is to document each client’s uniqueness in how their processes might be handled.

For instance:

If payroll needs to be approved by your client’s CFO and you keep sending it to their COO, your client will become frustrated.

Likewise:

If your client wants their rent expense to be split between 2 different GL accounts and your team keeps putting it to just 1, again, your client will not be happy.

So it’s up to you to (reasonably) document the uniqueness of each client to ensure consistency of the delivery of CAS for each client across your firm.

Step #6 – Plan Your Capacity

This step is near and dear to my heart, though 99% of accounting firms out there have little to no capacity planning processes in place to ensure that:

- The work promised is delivered on time

- Their team is not overworked

This is especially important when it comes to CAS services because, week in, week out, CAS services need to routinely go out like clockwork. Missing a week of payroll for your client because your team is overworked would be unacceptable and would be grounds for the client to seek help elsewhere.

The basic thing you want to model out is your team’s available capacity, in hours, compared to the forecasted capacity requirements promised to your clients.

A good accounting practice management system, like Teamwork, should be able to help in this area:

Step #7 – Invest in Reskilling

If your firm is looking to move more heavily into CAS, it will be worth reskilling your team.

As Client Accounting Services are offered weekly or monthly, compared to many other compliance services that are performed annually, there’s an entirely new dynamic that your firm must get used to.

I believe upskilling/reskilling in the following areas could be useful:

- Time management & prioritization of tasks (arguably, there will be tighter deadlines and more to juggle at once)

- Technology skills (see Step #1)

- Customer service skills, since a closer relationship is being built with the client. You will be an extension of their team.

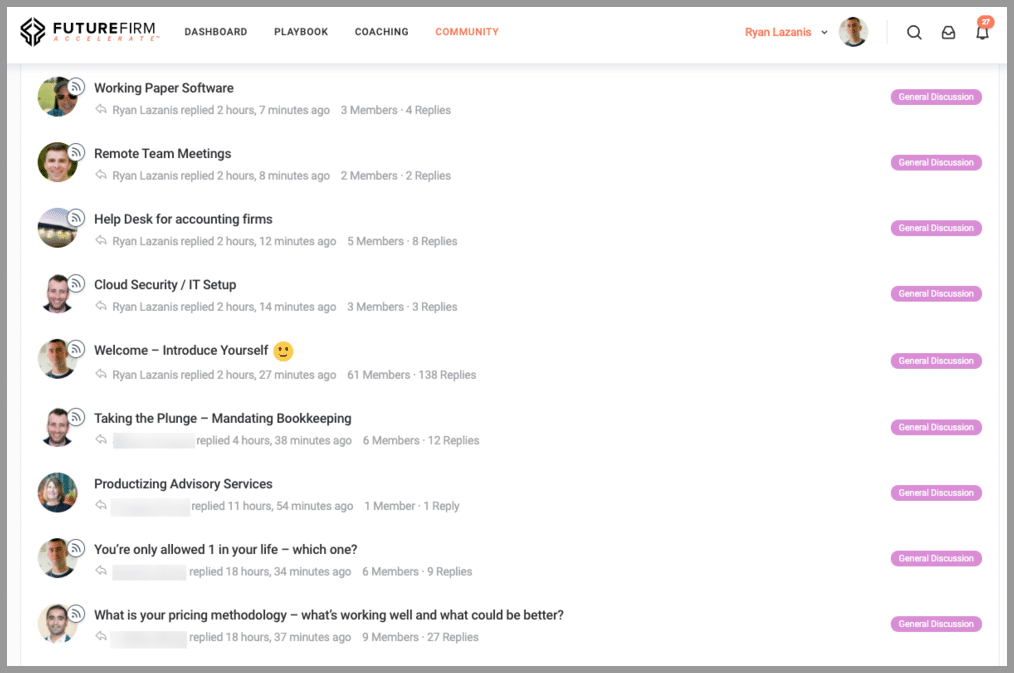

There are a variety of resources online to help you level up in CAS, but I’m partial to my own online coaching program, Future Firm Accelerate®, which helps accountants fast-track the growth of a modern scalable firm through online courses, online coaching, and an awesome community which looks like this:

Now I’d Like to Hear From You

So there you have it.

A background on what CAS is, why it’s interesting for your firm, and my 7-step process for growing a client accounting services offering in your firm.

Now I’d love to hear your thoughts:

What’s your experience been with CAS services?

Are there any you like more than others?

Would you like to see more information relating to this subject?

Let me know by leaving a comment below!

Excellent article Ryan!

Thank you sir!

Thanks Ryan this is great. I’m glad to see that we followed most of the steps when developing our CAS practice. Step #4 and #5 both need some work on our end.

You’re very welcome.

When you use a payroll service like Gusto, is that built into your pricing or does the client pay for that themselves?

Personally, any time there’s a variable cost, I let the client pay for it (too hard to manage)

Thanks for the clear and complete article. I agree completely with your thoughts. We have built our business around delivering high quality CAS to clients at a higher value and better service level than others in the space and clients have responded well.

What are your through around scaling this model and the structure of the team for this.

Secondly any ideas on metrics for determining capacity should you want to avoid the timesheet mgmt approach.

Thanks

You’re welcome Simon.

1) I think it’s a very scalable model. Hard to comment on the structure of the team in a brief answer unfortunately though 🙂

2) It comes down to forecasting time (hours) on tasks and then assigning those to individuals to compare available capacity to assigned capacity

Very good article. Thank you. Please send me your articles to my email id. Thanks.

Thank you!

Spot on Ryan. Every word counts in your article. Thank you so much.

🙂

Thanks for pulling this this together. A very clear overview of CAS with some useful tips to get started. Appreciate your work.