If you’re looking for information about accounts receivable automation, you’ve come to the right place.

In this article, you’ll learn:

- What accounts receivable automation is

- The top 5 benefits of automating this process

- The best tools to automate A/R

- How to specifically automate A/R

Let’s dive in!

What is Accounts Receivable Automation?

Automating accounts receivable is the process of sending invoices, following up on customer payments, and ensuring you collect payments owed to you via an application (hence “automation”).

Some AR automation tools do more, like reconcile the transaction with your accounting ledger tool along with a variety of other things to eliminate manual processes and better help accept payments.

Collecting cash is the lifeblood of any business, and as an accounting firm, we need to know how to help our clients collect cash in the easiest way possible so that their businesses can grow.

Before automation, the only possibility for credit management in a business was to create a collections role in their company or outsource the service, both of which have often been seen as a cumbersome process to manage before automation was possible.

5 Benefits of Accounts Receivable Automation

Technology makes accounts receivable management far more efficient.

Here are five benefits of using this tech to show its effectiveness. Use them to communicate with your clients and/or convince yourself of the usefulness of A/R automation.

1. Get Paid Faster with an Automated Accounts Receivable Process

In an advisory accounting firm, you are helping your clients take control of their cash flow and get their precious cash in the bank faster.

Your business owner clients are probably slow to remind clients of outstanding receivables in a timely manner, and their accounts receivable will pile up.

The key benefit here is in the automated reminders part of the accounts receivable process. When your client sends an invoice to their customer, an automated email sequence goes out reminding them that the invoice is past due.

This process massively speeds up the payment schedule and takes up less mental space than having to remember who owes.

2. Accounts Receivable Automation Saves Time

Speaking of rolling up your sleeves and sending emails or making collections calls, AR automation improve work life balance and saves a ton of time in one of the most critical business processes. Once you set up the technology, connect it to everything, figure out your communication cadence (how much you’ll email unpaid accounts) and you’re off.

3. Better, Stickier Customer Relationships

Helping your clients collect their cash faster will deepen your relationship with them.

Not to mention, when you surround your client with more services like AR automation, it becomes harder to leave you as well.

4. An Additional Recurring Service Offering

Below you’ll see that offering an automated receivables service can actually be quite simple to not only invoice customers but manage cash flow. And because it’s something you’ll need to do on an ongoing basis, it’s a great way to increase your monthly recurring revenues.

If you do offer this service, it’s a good idea to build out your service terms and include them in your engagement letter.

Accounts Receivable Automation Software

There are hundreds of accounting and finance applications in the world, and more than a dozen tools either specifically automate the customer invoice process along with a variety of receivables collections features. You don’t need an accounts receivable team, just a proper workflow and the right practice management software.

Ten apps are listed below, most do very similar things so there is only a short unique tidbit of each:

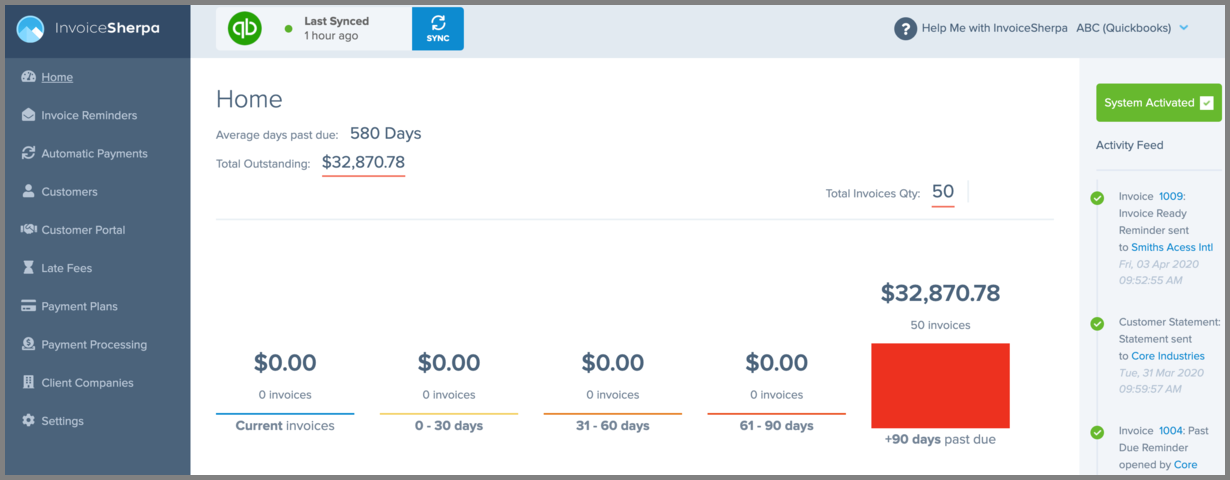

InvoiceSherpa: This is one of my preferred tools for managing accounts receivable processes and I go into great detail on how to use it in this article. It can help manage late payments and also accept credit card payments.

Chaser: Chaser is a very-well integrated and reviewed “end-to-end” AR automation platform for bad debt.

Plooto: It’s a tool offering automated accounts payable (in addition to accounts receivable), they serve a ton of clients and have a lot of resources for accounting firms who want to offer payable/receivable services.

Collbox: A basic (but not in a bad way) AR automation tool that focuses on debt collection for past due invoices on customer accounts.

Bill.com: This well-known product also offers accounts payable features as well as expense management tools in addition to AR automation.

Debtor Daddy: Debtor Daddy allows users to create a very intricate invoice workflow, including SMS reminders (in addition to email) and custom reporting to see where your A/R process stands.

BillerGenie: This tool offers invoice collection and reconciliation, with a focus on making A/R processes easy.

Routable: A tool that provides both payable/receivable functionality and a very active roadmap to improve the app over time.

Satago: Satago handles A/R collection and reporting while also giving users a look at customers credit profile reducing the chance of bad debt and improve days sales outstanding.

Satago: Satago handles A/R collection and reporting while also giving users a look at customers credit profile reducing the chance of bad debt and improve days sales outstanding.

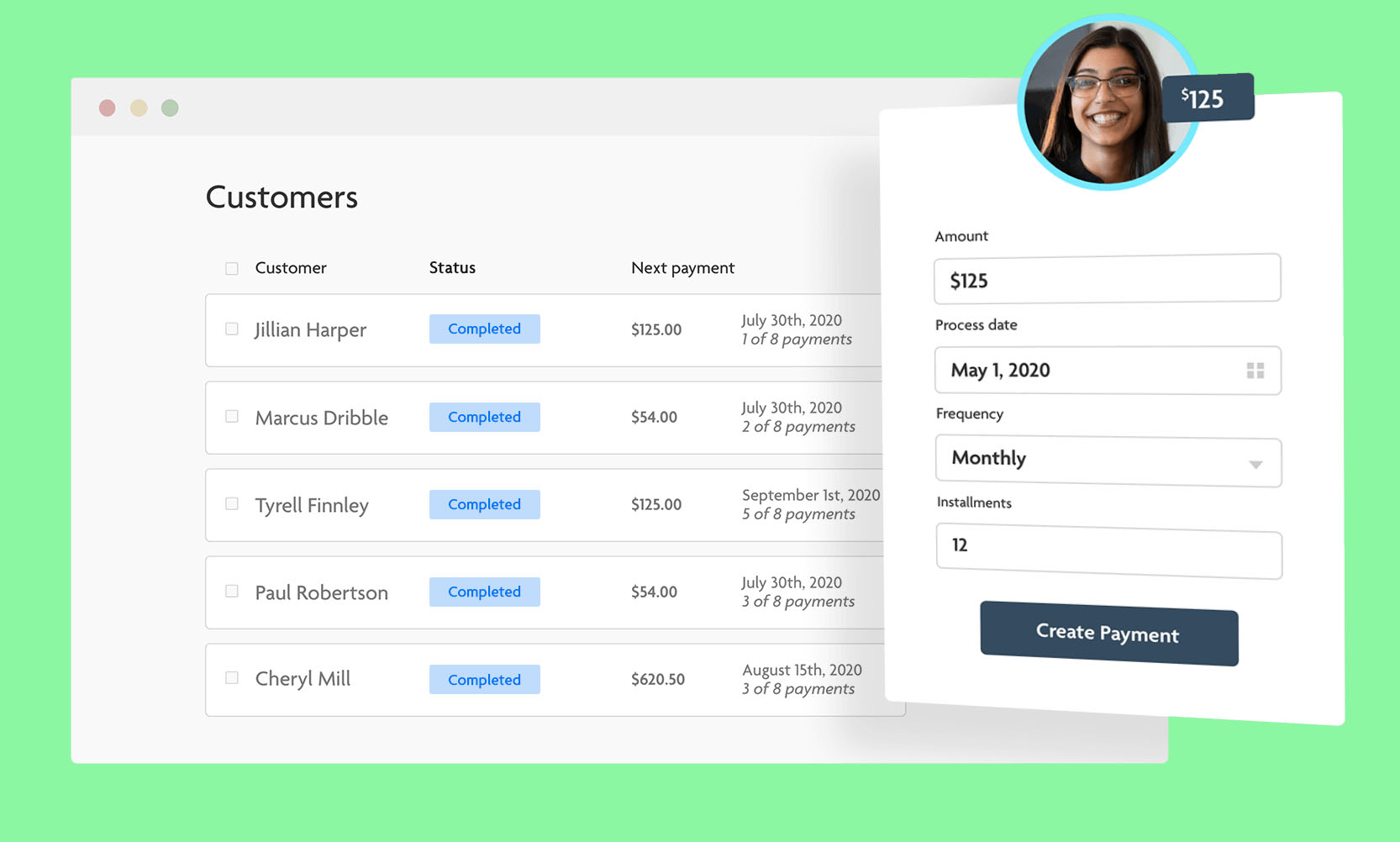

Rotessa (Canada): Rotessa is a unique spin on the A/R game and allows users to set up automatic payment processing with their customers. I personally have used it across 2 businesses.

How to Automate Accounts Receivable Processes

Here’s a simple 6-step process that you can use in your firm to deliver a secured automated accounts receivable service.

Step 1: Pick Your Tool

The first thing you’ll want to do is pick the A/R automation tool that you’ll be using. You can choose from the list above.

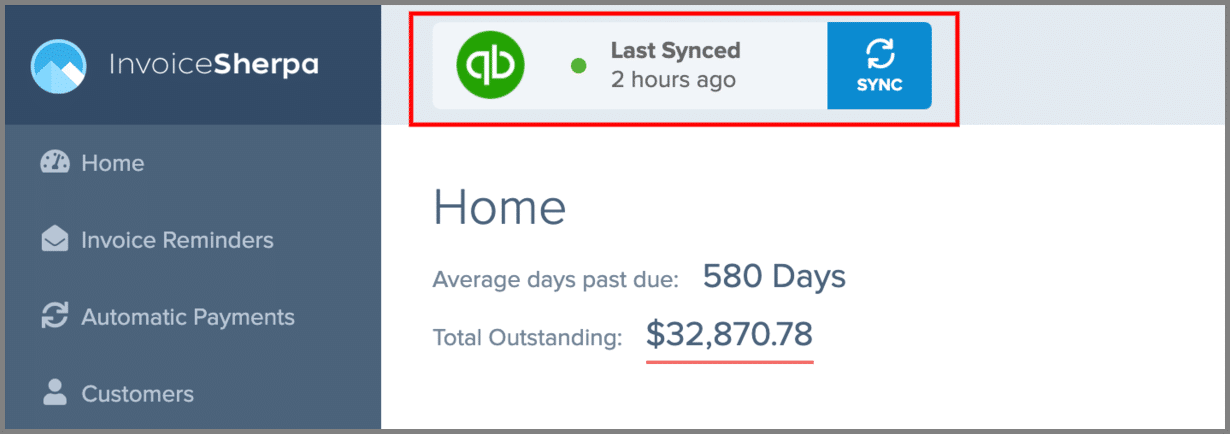

Step 2: Connect to Your Cloud Accounting Software

You’ll then want to integrate your cloud accounting software to your A/R automation tool so that overdue invoices and customers are synced across.

Here’s what it looks like in InvoiceSherpa:

Step 3: Setup the Automated Payment Reminder Cadence

The big thing we’re trying to automate is collection of payments. This happens through automated reminders sent to debtors.

So you’ll need to configure the part of the app that controls the templates for reminders and determine just how often you want payment reminders to be sent out.

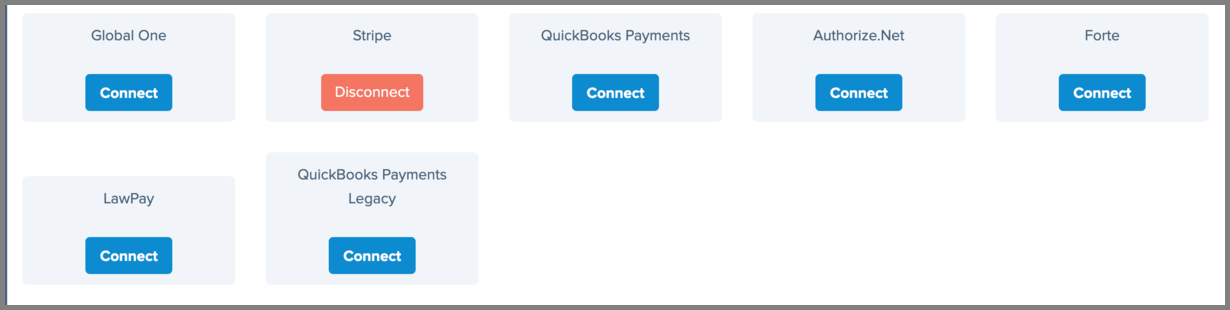

Step 4: Connect Payment Gateways

Different apps have different ways to collect money.

For instance, InvoiceSherpa offers you several possibilities to collect payment:

Whereas in Rotessa, you’ll collect payment via bank account.

Whatever it is, you’ll want to make sure that there’s a way for payments to get collected through the app thanks to your efforts in Step 3 above.

Step 5: Clean the Books Before Automations Run

The way these apps work is that they send automated reminders based on outstanding invoices.

If your books haven’t been updated in a while, payment reminders might be sent out on payments that have been received, but not reconciled.

So make sure the books are up to date before the payment reminders go out

Step 6: Assess Collection Efforts

Once the automation of accounting process has run, you’ll want to assess just how successful your collection efforts were. Depending on the result, you may consider tweaking reminder templates and their messages to see if your collection efforts improve in future periods.

Accounts Receivable Automation is a Powerful Tool (and Service)

AR automation is a fantastic way to improve the financial performance and cash position of a business. And using a tool to automatically follow-up, collect, and reconcile invoices makes it easy to do.

Hopefully, this guide serves useful to help you improve this critical part of you and your clients’ businesses.

very informative, keep up the good work